Mooners and Shakers: Ethereum and Bitcoin resisted at key levels; dog coins take a nap

Coinhead

Coinhead

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

There’s a lot going on in crypto news as always, but the price action in the majors, led by Bitcoin and Ethereum, has stagnated to start the week.

That’s not to say things are dumping… just yet. “Consolidating in a range” and “heading for a retest” might be the more optimistic words to use here. And as far as Ethereum is concerned, although it’s just been rejected at US$2,000, it’s been in a pretty significant, choppy uptrend ever since about July 19, when it was languishing around US$897.

It is techincally in a month-long rising wedge formation, however, which is apparently a bearish pattern and, according to NewsBTC.com, the token’s trade volume on major exchange Binance has been dropping concurrently. But that’s a slightly contradictory stat compared with frothiness we’re hearing on social media regarding accumulation and whales pulling several shedloads of ETH from exchanges.

Another fact is, though, for now the leading smart contract platform has held on to more than 52 per cent in gains since that July 19 dip. The ETH rally may be taking a breather right now, but perhaps it has a ways to go yet leading into the Merge… not to mention the potential mayhem of an upcoming ETH PoW miners’ fork as well. More on that from Apollo Capital’s David Angliss, here.

Anyhoo, onto some price action…

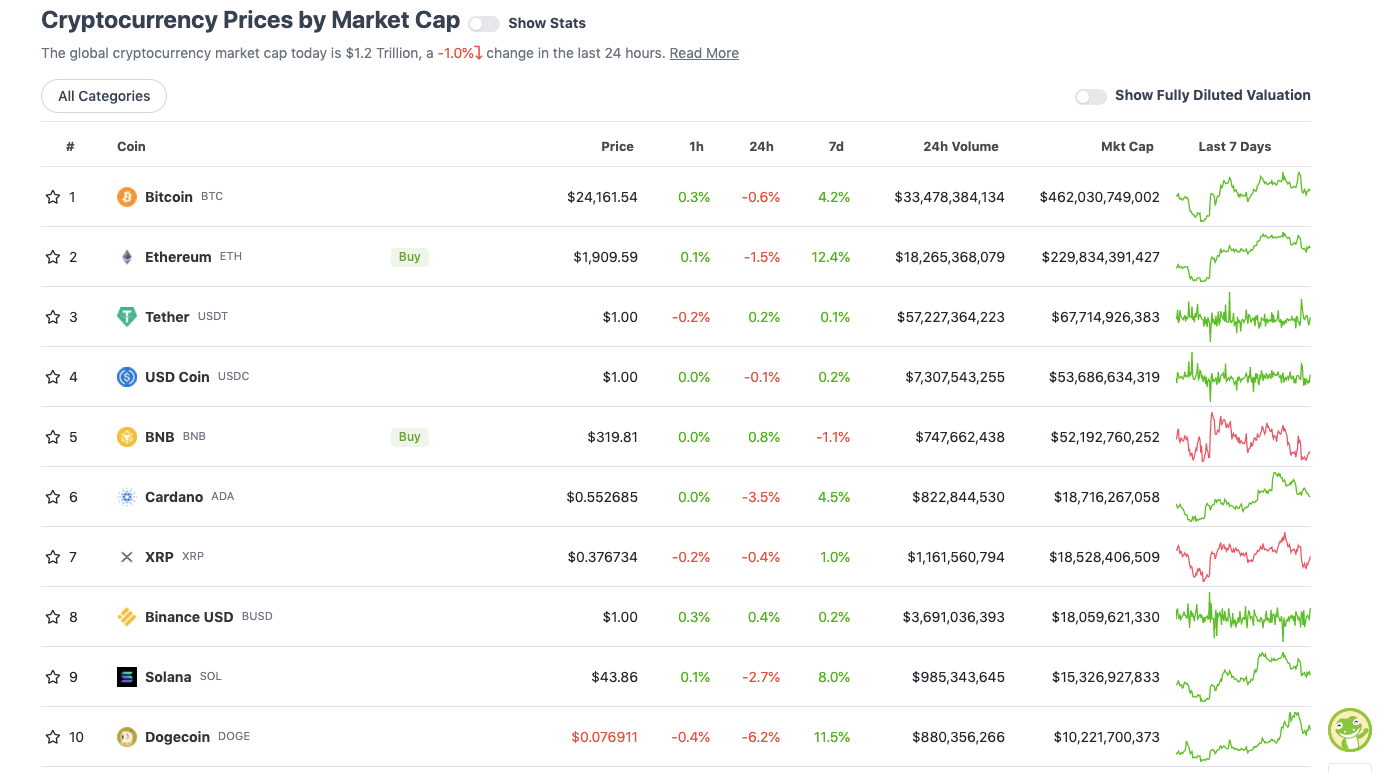

With the overall crypto market cap at US$1.2 trillion and down a fraction since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Since Bitcoin’s weekend high of US$25k, it’s experiencing a bit of a comedown, which is “very normal”, according to Dutch trader/analyst Michaël van de Poppe. We’ll run with that idea, then. He’s looking for support a little lower, actually – somewhere between US$23k and $23.8k.

#Bitcoin consolidating a little, as we've had a pretty decent run upwards in the past week.

▫️ Very normal; nothing goes up in a straight line.

▫️ Profit taking, as bear mindset is still key.

▫️ Giving people on HL's opportunities to jump in.Watching $23.8K and $23K for longs pic.twitter.com/lfqPqMmKft

— Michaël van de Poppe (@CryptoMichNL) August 15, 2022

A quick swipe up to fellow crypto analytical brain @JustinBennettFX, though, and he’s spotting a potential sign of strength returning to the US dollar once again. Never a particularly good thing for your crypto portfolio. Let’s hope it rejects…

The $DXY is trying to reclaim the channel it lost on the 10th.

Not a good sign for #crypto. pic.twitter.com/kxVmS6NhPY

— Justin Bennett (@JustinBennettFX) August 15, 2022

As for the dog-meme coins that were excitedly leg-humping their way into Monday, led by recent top-10 entrant Dogecoin, and Shiba Inu, the fun’s over for now. Annoying squeaky chew toys are stashed away and it’s time for a nap, with DOGE down about 3% and SHIB pulling back by 11%.

Perhaps layer 1 chain Polkadot (DOT) can squeeze its way back into the 10. That said, some negative press is swirling around one of its major protocols, Acala (ACA), which suffered a major exploit on August 14.

Acala was hit by a hack that reportedly minted 1.2 billion of the DeFi protocol’s aUSD stablecoin, without collateral. This resulted in aUSD, for a time, depegging from the US dollar by more than 99%.

Acala Dollar (aUSD) is still depegged at the time of writing, although it has recovered significantly from the crash and is now sitting at US$0.9349.

Sweeping a market-cap range of about US$10 billion to about US$508 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Chiliz (CHZ), (mc: US$1 billion) +7%

• STEPN (GMT), (mc: US$625 million) +6%

• LEO Token (LEO), (mc: US$5 billion) +5%

• Lido DAO (LDO), (mc: US$1.53 billion) +4%

• Filecoin (FIL), (mc: US$2.1 billion) +2%

DAILY SLUMPERS

• Celsius (CEL), (mc: US$1.18 billion) -26%

• BitDAO (BIT), (mc: US$596 million) -14%

• Aerarium Fi (AERA), (market cap: US$2.48 billion) -13%

• Shiba Inu (SHIB), (market cap: US$9 billion) -9%

• Gala (GALA), (market cap: US$509 million) -7%

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

The best explanation of Bitcoin👏

— Tansu YEĞEN (@TansuYegen) August 15, 2022

Do Kwon: Free

Sifu: Free

Alex Mashinsky: Free

Su Zhu: FreeTornado Cash developer: Arrested

Crypto: The land where it’s okay to rug/swindle billions of $ from retail investors, but writing code to provide basic privacy is a jailable offence.

— Miles Deutscher (@milesdeutscher) August 15, 2022

Yikes, what’s Michael “Big Short” Burry up to? Liquidating his ENTIRE portfolio, aside from one stock – Geo Group (NYSE:GEO), which apparently operates as a real estate investment trust specialising in prison properties. Things that make you go… hmmm… WTF?! Maybe he’s changed his tune again in Q3…

The "Big Short" Michael Burry Liquidates Entire Portfolio, Holds Just One Stock At End Of Q2 https://t.co/Cdj4D7PWAu

— zerohedge (@zerohedge) August 15, 2022

Web3 companies: it’s time for our meeting

The meeting: pic.twitter.com/dJ108QewWk

— drewso22.eth (@Drewso22) August 15, 2022