Mooners and Shakers: Crypto market surges as Meta plans NFT integration

Coinhead

After comparatively flat price action in the market yesterday, the past several hours have seen crypto prices spike as institutional adoption continues apace and Meta reportedly makes a surprise NFT-related move.

According to a Financial Times report today citing unnamed sources, Mark Zuckerberg’s ubiquitous social-media company looks to be preparing to barge on into the buzzy non-fungible token sector of crypto.

Facebook and Instagram enabling NFTs.

“Teams at Facebook and Instagram are readying a feature that will allow users to display their NFTs on their social media profiles, as well as working on a prototype to help users create — or mint” https://t.co/e5ivuMESED

— Matty (@DCLBlogger) January 20, 2022

There is still a fair bit of conjecture and rumour about the details surrounding this story, including which blockchain these features might be built on or integrate with, but one thing’s for sure, the market is reacting favourably at the time of writing (see further below).

It might pay to also keep an eye on another big development occurring today, and that’s the “Cleaning Up Cryptocurrency: Energy Impacts of Blockchains” hearing occurring in the US Congress.

The scrutiny on this side of the industry, which is an essential component of “proof of work” cryptos including Bitcoin and (for now) Ethereum, is largely coming from the Democratic side of the US political landscape.

The likes of fierce crypto critic Senator Elizabeth Warren and leaders from the House Energy and Commerce Committee are turning up the heat, so to speak, on crypto-mining companies to prove or explain what value they provide in the face of high energy consumption.

Brian Brooks, CEO of crypto-mining company Bitfury, who is speaking at the hearing, published some notes ahead of the meeting.

Thoughts for @EnergyCommerce @HouseCommerce in advance of tomorrow’s important hearing on #Bitcoin and US energy policy, and how @BitfuryGroup is working to help. https://t.co/mnS2PKFPWO

— Brian Brooks (@BrianBrooksUS) January 19, 2022

“It’s not up to the government to decide if Bitcoin is important to the country’s future — that’s the market,” said Brooks, who also served as the Comptroller of the Currency in the Trump administration. “The market has spoken.”

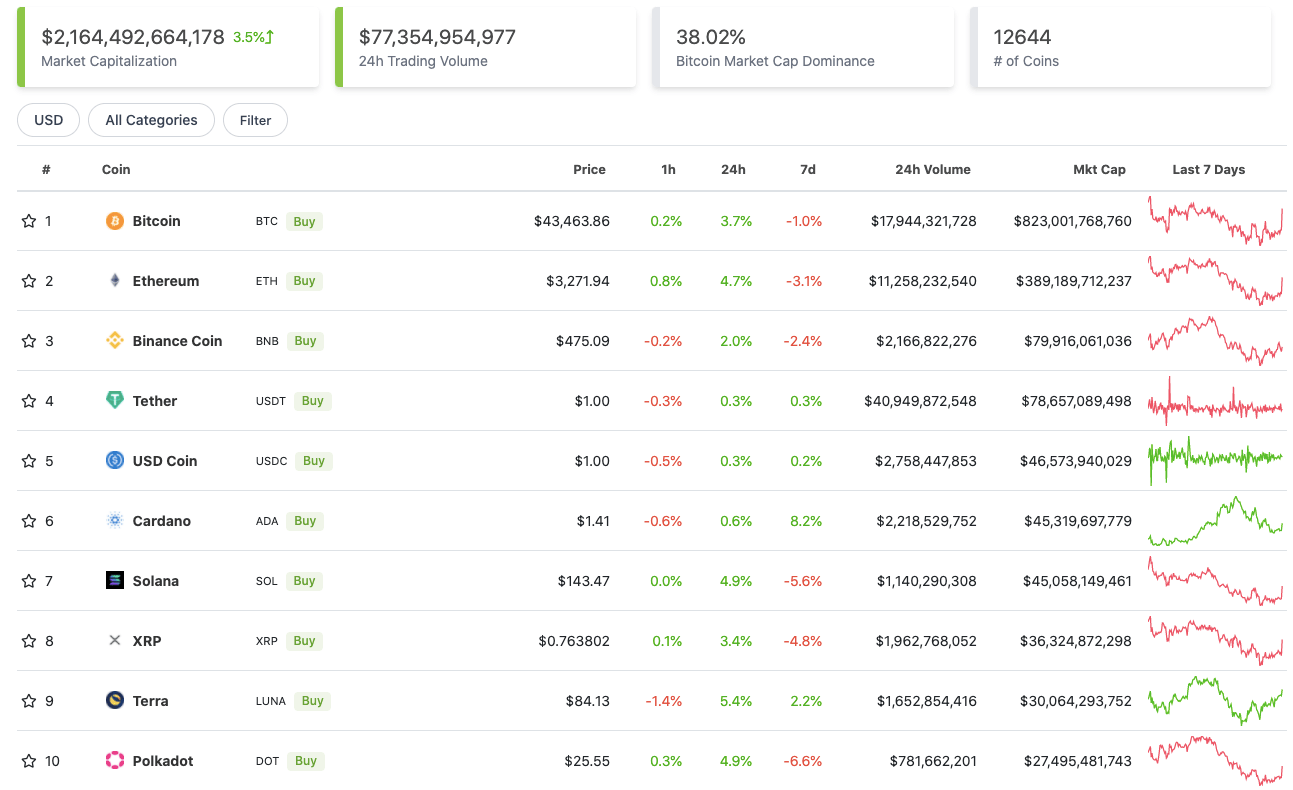

With the overall crypto market cap up about 3.5% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

As you can see from the chart, Bitcoin (BTC) and the rest of the tokens in the layer 1 blockchain-populated top 10 are all faring pretty well on a daily timeframe right now with no particular surging standouts.

Cardano (ADA), however, has moved the least, although it had been doing its own thing earlier in the week, pumping on the promise of its DeFi ecosystem enablement and expansion through the decentralised platform known as SundaeSwap.

🎊 Creating pools and depositing liquidity is now live!

Swapping will be enabled at 21:45 UTC today! 🍨https://t.co/453DZLLUdD

— SundaeSwap Labs 🍨 (@SundaeSwap) January 20, 2022

Sweeping a market-cap range of about US$22.1 billion to about US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Cosmos (ATOM), (mc: US$11.8b) +12%

• Kadena (KDA), (mc: US$1.34b) +12%

• Osmosis (OSMO), (mc: US$2.87b) +9%

• Crypto.com (CRO), (mc: US$11.9b) +8.7%

• Sushi (SUSHI), (mc: US$1.26b) +8.6%

DAILY SLUMPERS

• Secret (SCRT), (mc: US$1.42b) -5%

• Pocket Network (POKT), (mc: US$1.3b) -4.6%

• Stacks (STX), (mc: US$3.76b) -4%

• Monero (XMR), (market cap: US$1.2b) -1%

• Huobi Token (HT), (mc: US$1.55b) -0.5%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• DEAPcoin (DEP), (market cap: US$242m) +70%

• Router Protocol (ROUTE), (mc: US$78.5m) +38%

• Universe.xyz (XYZ), (mc: US$70m) +37%

• Paint Swap (BRUSH), (mc: US$33m) +30%

• Maple Finance (MPL), (mc: US$45m) +18%

DAILY SLUMPERS

• Aquarius (AQUA), (market cap: US$27m) -25%

• Cardstarter (CARDS), (market cap: US$48m) -16%

• Cream (CREAM), (mc: US$40m) -14%

• Scream (SCREAM), (mc: US$19.5m) -13.8%

• Propy (PRO), (mc: US$186m) -13.5%

A couple of things to end on. Let’s go with the bad news first…

Russia’s central bank is looking to pull a China and propose a “blanket ban” on cryptocurrency circulation and usage, including crypto mining.

Can’t believe Russia is banning blankets, everyone is going to be so cold at night. https://t.co/z0R8KTx55R

— The Wolf Of All Streets (@scottmelker) January 20, 2022

But let’s end with something more positive. During an interview yesterday, Walt Bettinger, CEO of Texas-based financial services giant Charles Schwab, said that “crypto is hard to ignore” and his firm would “welcome the chance” to offer the trading of the asset class in a regulatory favourable environment.

$8.1 trillion Charles Schwab CEO: We would "welcome the chance" to offer direct trading of #bitcoin and crypto 🙌 pic.twitter.com/kzomJoWqv5

— Bitcoin Magazine (@BitcoinMagazine) January 20, 2022