Mooners and Shakers: Bulls expect as Bitcoin simmers; ApeCoin surges on Otherside auction rumour

Coinhead

Coinhead

Is Bitcoin loading up to do something special? If the US dollar index (DXY) cops a rejection at its current level and sinks, then odds would be in favour of a BTC surge.

As pointed out by various Twitter-lurking crypto analysts yesterday, the DXY is showing possible signs of weakness on the charts right now.

Bearish divergence on the Dollar $DXY, which is a great sign for further upwards momentum for #Bitcoin. pic.twitter.com/4BGSatk6f4

— Michaël van de Poppe (@CryptoMichNL) April 20, 2022

That said, Bitcoin has just hit a pump-blocking wall of resistance of its own at the US$42.2k level…

#Bitcoin getting rejected by the $42,2k barrier! pic.twitter.com/1AYPbYtcRn

— Crypto Rover (@rovercrc) April 20, 2022

But Bitcoiners and crypto investors at large will be hoping for the following scenario in the coming days/weeks…

The next #Bitcoin bull run is loading 👀 pic.twitter.com/Ma3sJfSBWp

— Josh (@CryptoWorldJosh) April 20, 2022

It’d be a welcome set-up before the US Fed’s next Federal Open Market Committee (FOMC) meeting in the first week of May.

That could bring back further downwards pressure on the market if Jerome Powell and mates go hard on their next interest-rate hiking. Anything “dovish” or expected from them, though, and a market-boosting effect might even be possible.

Whether #BTC needs to pullback a little more or consolidate a little more…

Overall, $BTC is currently building its next macro uptrend#Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 20, 2022

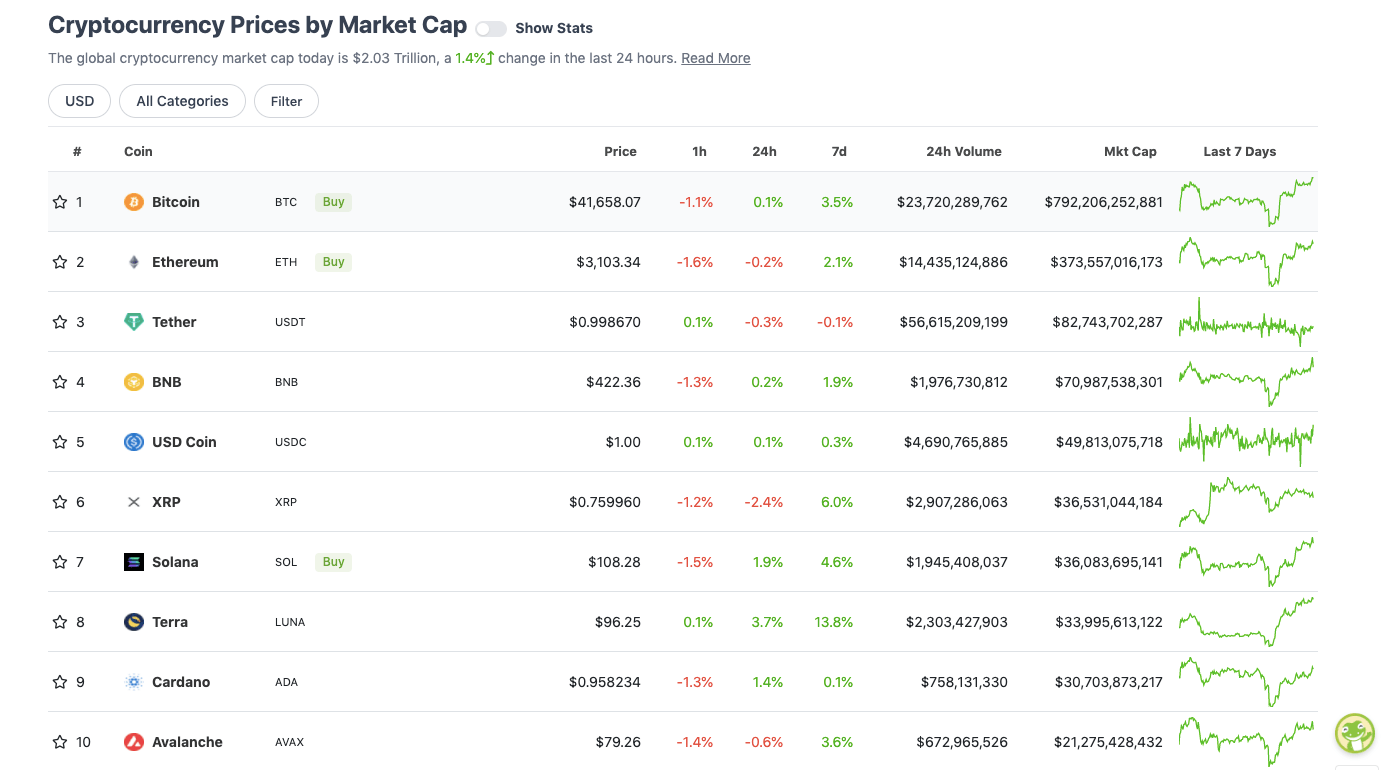

With the overall crypto market cap a bit over US$2 trillion, up about 1.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

That’s pretty flat movement in the majors there at the time of writing. Apart from Terra’s LUNA token, that is, which has now flipped Cardano (ADA) and has Solana (SOL) in its sites.

LUNA’s price is tied to the growing success of Terra’s “algorithmic” UST stablecoin, which is also moving up the charts and is now the third-most widely circulated stablecoin behind USDT and USDC.

Whenever UST is minted, LUNA is burned, reducing the supply. This maintains the stable price of UST and helps gives LUNA its value.

Sweeping a market-cap range of about US$21.3 billion to about US$992 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• ApeCoin (APE), (mc: US$4.6 billion) +26%

• Synthetix (SNX), (market cap: US$1.49 billion) 26%

• STEPN (GMT), (mc: US$2.2 billion) +11%

• Aave (AAVE), (mc: US$2.66 billion) +11%

• Zilliqa (ZIL), (mc: US$1.7 billion) +8%

ApeCoin (APE), the recently airdropped governance and utility token for the Bored Ape Yacht Club ecosystem, has risen by more than 35 per cent over the past week.

Just a word of warning, though, this could end up being a buy-the-rumour, sell-the-news scenario, as speculation surrounding BAYC’s “Otherside” metaverse project mounts.

According to Twitter account “renegademaster”, Otherside will be selling plots of digital land in a Dutch auction, opening at 600 APE bidding. The Dutch auction format should mean the price will decrease until an accepted market value is found.

Was just sent some huge alpha re @yugalabs land drop. The sale will be a Dutch auction of some sort starting at 600 $APE.

BAYC / MAYC (Airdrop)

Punks, Meebits, Cool Cats, Nounz, WoW, Toadz (Auto WL)Get your $APE ready. Looks like we’re gonna need it. #BAYC #OTHERSIDE

— renegademaster / guccibayc.eth (@renegademasterr) April 20, 2022

DAILY SLUMPERS

• Chain (XCN), (mc: US$1.78 billion) -9%

• Radix (XRD), (mc: US$1.34 billion) -4%

• NEXO (NEXO), (mc: US$1.3 billion) -3%

• OKB (OKB), (mc: US$5 billion) -3%

• NEAR Protocol (NEAR), (mc: US$11.5 billion) -2%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Lyra Finance (LYRA), (market cap: US$35 million) +59%

• Bezoge Earth (BEZOGE), (mc: US$182m) +45%

• Shiba Predator (QOM), (mc: US$183m) +38%

• Dogelon Mars (ELON), (mc: US$594m) +35%

• Synapse (SYN), (mc: US$659m) +33%

DAILY SLUMPERS

• Pool.lotto Finance (PLT), (mc: US$118m) -15%

• ICHI (ICHI), (mc: US$36.5m) -12%

• Nym (NYM), (mc: US$98m) -11%

• Ref Finance (REF), (mc: US$41m) -9%

• Tenset (10SET), (mc: US$302m) -9%

JUST IN: Russia's Federal Tax Service proposes legal entities use #Bitcoin and crypto in foreign trade 🇷🇺

— Bitcoin Magazine (@BitcoinMagazine) April 20, 2022

Again, great insights from @KingJulianIAm – follow him https://t.co/9ogkWEQ2bc

— CRYPTO₿IRB (@crypto_birb) April 20, 2022

The Ethlizards NFT project is proving it’s up on meme culture today, giving a nod to April 20’s cannabis-themed numerals. Maybe it’s hoping NFT fan Snoop will take notice…

Happy 4/20 LizFam! Celebrate responsibly <3 🦎 pic.twitter.com/MpD1nE78wq

— Ethlizards 🦎 (@ethlizards) April 20, 2022