Mooners and Shakers: Blockstream raises US$125m for BTC mining operations; Bitcoin and crypto market dips a tad

Coinhead

Coinhead

It’s hump day and Bitcoin and the crypto market have run out of some puff. That’s okay, but which way is it heading next? That’s the question, and analysts are split, as per. Meanwhile, in a positive industry sign, Blockstream has raised US$125m to further its Bitcoin mining operations.

Canadian-headquartered firm Blockstream is one of the world’s biggest Bitcoin mining operations and this raise, led by Kingsway Capital, is notable because it’s another potential sign that the narrative is improving for an important part of the crypto ecosystem.

Bitcoin miners have come under a heavy weight of pressure during this bear market, causing many into a situation of forced selling to cover their infrastructure costs. But increasing BTC mining health, via various metrics including improved hashrate, has given at least some cause for renewed optimism that the worst of the bear market might be over.

NEW: Selling pressure from #Bitcoin miners hit multi-year low. Bullish 🤑 pic.twitter.com/2H7lLaRhqP

— Bitcoin Archive (@BTC_Archive) January 24, 2023

That said, it’s widely understood that most small-mid Bitcoin miners’ break-even level for sustainable profitability is a level above US$25k. Not out of the woods yet, then.

But, as CoinDesk and others report, the Blockstream raise will focus on expanding mining capacity for “institutional-hosting customers”, which the company says is a BTC mining segment that has been “resilient” amid Bitcoin price volatility compared with smaller miners.

green shoots 🍃 for #bitcoin spring 2023. #bitcoin +39% since 1st Jan.@blockstream +$125m growth raise.

good start to the year of the #bitcoin 🐇 rabbit— Adam Back (@adam3us) January 24, 2023

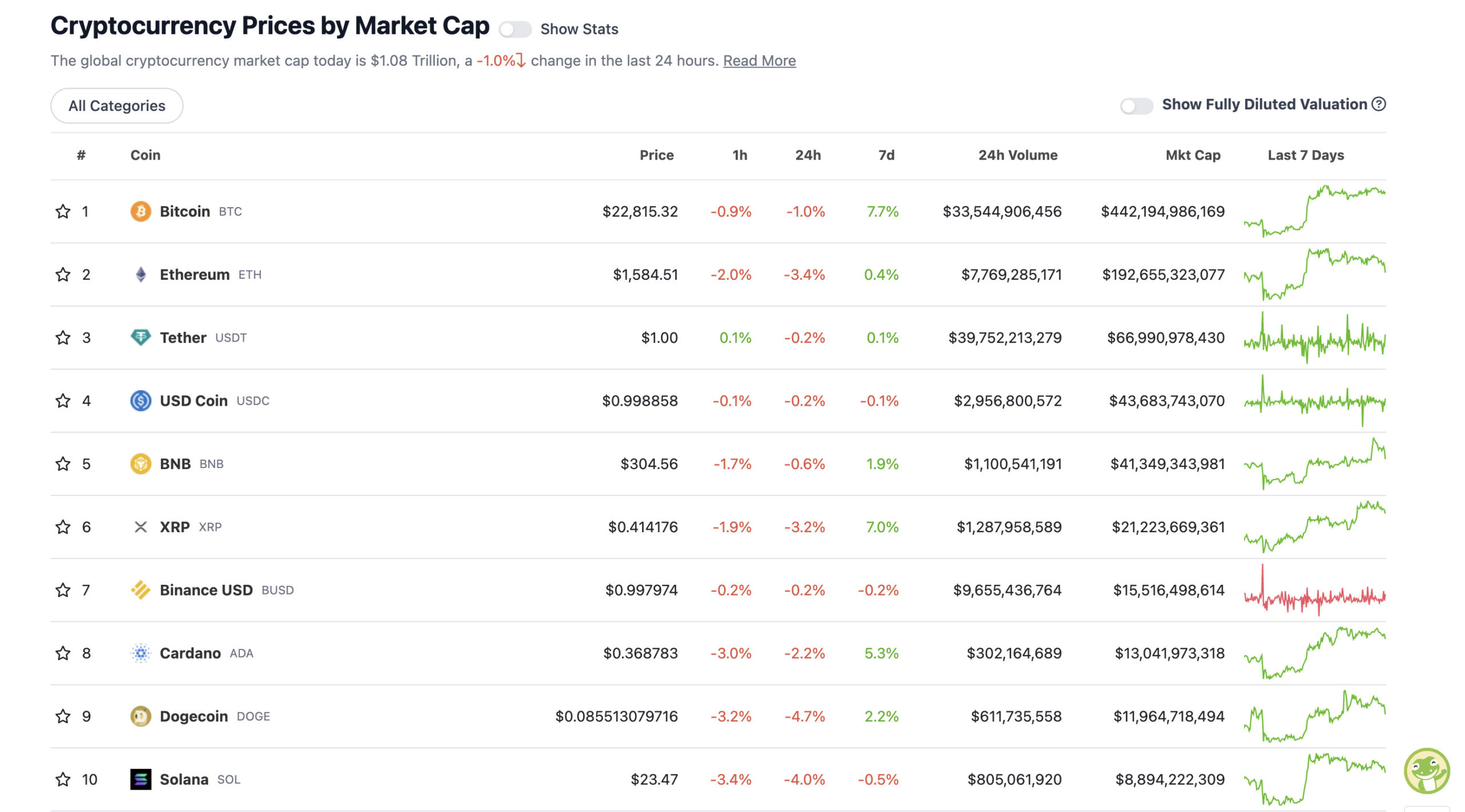

With the overall crypto market cap at US$1.08 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s a sea of 24-hour red in the crypto majors today. Bitcoin and pals had to take a breather at some point. Up Only might be the name of a good crypto podcast, but it isn’t a thing otherwise.

The biggest daily pullbacks in the top 10 are Dogecoin and Solana. Can’t tell you with too much certainty why, although Cointelegraph‘s Nivesh Rustgi is pointing at a bearish divergence for the SOL token and apparent oversold conditions according to the market’s Relative Strength Index (RSI).

Meanwhile, regarding the market-moving crypto in chief (that’d be Bitcoin), let’s quickly tap into some various Twitter-based analysis from those who rarely take their eyes from the charts.

We can’t tell you who’s right with any certainty, but we’ll just leave these mixed thoughts here for now…

I believe $SPX breaks it’s year long downtrend and we see a decent move up for #crypto.

Far too many people calling for a crash. They don’t happen when everyone is bearish.

The herd is often wrong. All I see is cope for a crash bc they missed the $BTC long from 16.5k.

— Roman (@Roman_Trading) January 24, 2023

sitting mostly in stables again now, alot of ltf setups i liked yesterday failed overnight

— Bluntz (@SmartContracter) January 24, 2023

#Bitcoin couldn't break through a crucial resistance at $23.1K.

If we continue to make LHs, we'll probably test and sweep around $22.3K before continuation.

Grants some serious buying opportunities. pic.twitter.com/P8YPYAaHvU

— Michaël van de Poppe (@CryptoMichNL) January 24, 2023

Sweeping a market-cap range of about US$8.6 billion to about US$408 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Kava (KAVA), (market cap: US$422 billion) +9%

• BTSE Token (BTSE), (mc: US$459 million) +8%

• Quant (QNT), (mc: US$2.18 billion) +4%

• Rocket Pool (RPL), (mc: US$730 million) +4%

• BitDAO (BIT), (mc: US$672 million) +3%

Rocket Pool catches our eye today, mainly because of our most recent chat regarding the LSD sector (er, that’s Liquid Staking Derivatives) with the blokes over at Apollo Crypto – a leading Australian-based crypto-industry fund.

RPL is doing well overnight again, although the market leader in this segment is still Lido Finance (LDO).

Relative to consensus, I think @LidoFinance will lose less market share than expected (if I'm reading expectations correctly).

Weekly growth rate is pretty strong. pic.twitter.com/uGx228EVMc

— mhonkasalo.lens (@mhonkasalo) January 24, 2023

DAILY SLUMPERS

• Axie Infinity (AXS), (market cap: US$1.27 billion) -10%

• GMX (GMX), (market cap: US$417 million) -9%

• Optimism (OP), (mc: US$429 million) -9%

• Flow (FLOW), (mc: US$1.12 billion) -9%

• Decentraland (MANA), (mc: US$1.2 billion) -9%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

El Salvador’s Bitcoin-loving president Nayib Bukele has fired up against mainstream media outlets, after his country managed to prove doubters wrong and pay off US$800 million in debt…

In the past year, almost every legacy international news outlet said that because of our “#Bitcoin bet”, El Salvador was going to default on its debt by January 2023 (since we had an 800 million dollar bond maturing today).

Literally, hundreds of articles https://t.co/rEiK7K13U4

— Nayib Bukele (@nayibbukele) January 24, 2023

🇸🇻 El Salvador just paid off $800 million in debt despite mainstream media saying they would default because of #Bitcoin

"When their lies are exposed, they go on silence mode." – President Bukele pic.twitter.com/WlSZ9Y2Q9V

— Bitcoin Magazine (@BitcoinMagazine) January 24, 2023

Ark Invest CEO, Cathie Woods sees potential crypto rebound amid whiffs of a Fed pivot.

— Crypto Crib (@Crypto_Crib_) January 24, 2023

This Web3 game @NeonBlockchain has been building in stealth 🤯

Gameplay is looking 🔥 pic.twitter.com/E7s842F4Ic

— Brycent 🚀 (@brycent_) January 24, 2023

Frederick Hayek predicts #Bitcoin in 1984

If there's one video you watch today, let it be this one. pic.twitter.com/KFYSIl8gRZ

— Baggins (@satoshibaggins) January 23, 2023