Mooners and Shakers: Bitcoin surges past $24k as USDC stablecoin recovers and market hopium rises

Coinhead

Coinhead

While the US deals with SVB and the biggest American banking collapse since the GFC, Bitcoin and the crypto market continue to rocket this morning.

Why? This is a good question, because it’s not as if traders were high-fiving each other until their hands were raw over on Wall Street overnight. And crypto has been heavily correlated to the movements of US stocks for, like, seemingly forever now.

Yeah, the Nasdaq closed in the green by 0.45% – but talk to the hand, says Bitcoin, currently up about 10% over the past 24 hours.

So, why is this happening in the immediate aftermath of the Silicon Valley Bank (SVB) collapse – the worst banking implosion in America since the 2008 Global Financial Crisis?

Not to mention the contagion effect that is having on other, smaller US banks, including the FDIC shuttering of another crypto-friendly on-off ramp – Signature Bank (which really is pretty concerning news for the industry). And Silvergate? Yeah, that’s last week’s news.

Risky assets such as Bitcoin and pals have been surging on the back of US regulators, including the US Treasury and Federal Deposit Insurance Corporation, creating a “Deposit Insurance National Bank” to make sure depositors of SVB have their funds protected.

And look, Joe Biden’s giving it the thumb up, so everything’s absolutely gonna be alllllright and what’s more, US taxpayers won’t be out of pocket for any of this.

Joe Biden: US banks are reliable, we will work to make sure this doesn't happen again.

And that taxpayers will not bear any losses from Silicon Valley bank collapse.

We believe you Joe 🤨 pic.twitter.com/9o6ESlZ9mq

— Crypto Crib (@Crypto_Crib_) March 13, 2023

So, if taxpayers aren’t going to have to fork out… then where’s the money coming from? Oh yeah, that’s right – time for a money printer goes “brrrrr” meme…

📰 "$25,000,000,000 will be made available by the Treasury to fully protect all depositors" #FederalReserve #SVB #SBNY pic.twitter.com/JCUs24MrXt

— Kevin Svenson (@KevinSvenson_) March 12, 2023

Robert “Rich Dad, Poor Dad” Kiyosaki certainly thinks more “fake money” is about to flood in…

BAIL OUTS begin. More fake money to invade sick economy. Still recommend same response. Buy more G, S, BC. Take care. Crash landing ahead.

— Robert Kiyosaki (@theRealKiyosaki) March 13, 2023

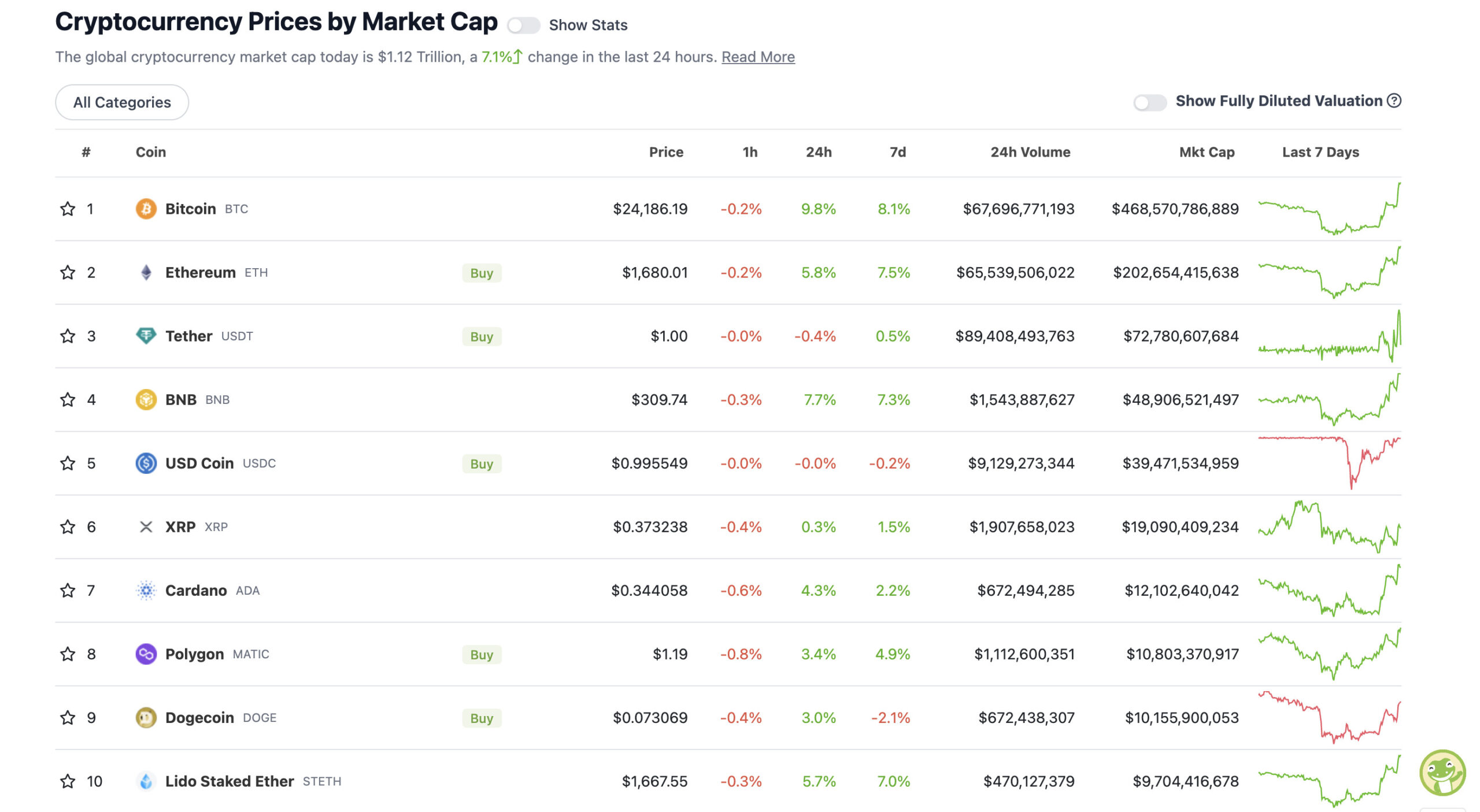

With the overall crypto market cap at US$1.12 trillion, up a stonking further 7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s a green scene across the majors. And it’s particularly good to see USDC pretty much regain its 1:1 pegging with the US dollar. Hope you didn’t panic sell for a loss if you’ve been holding the stablecoin as dry powder.

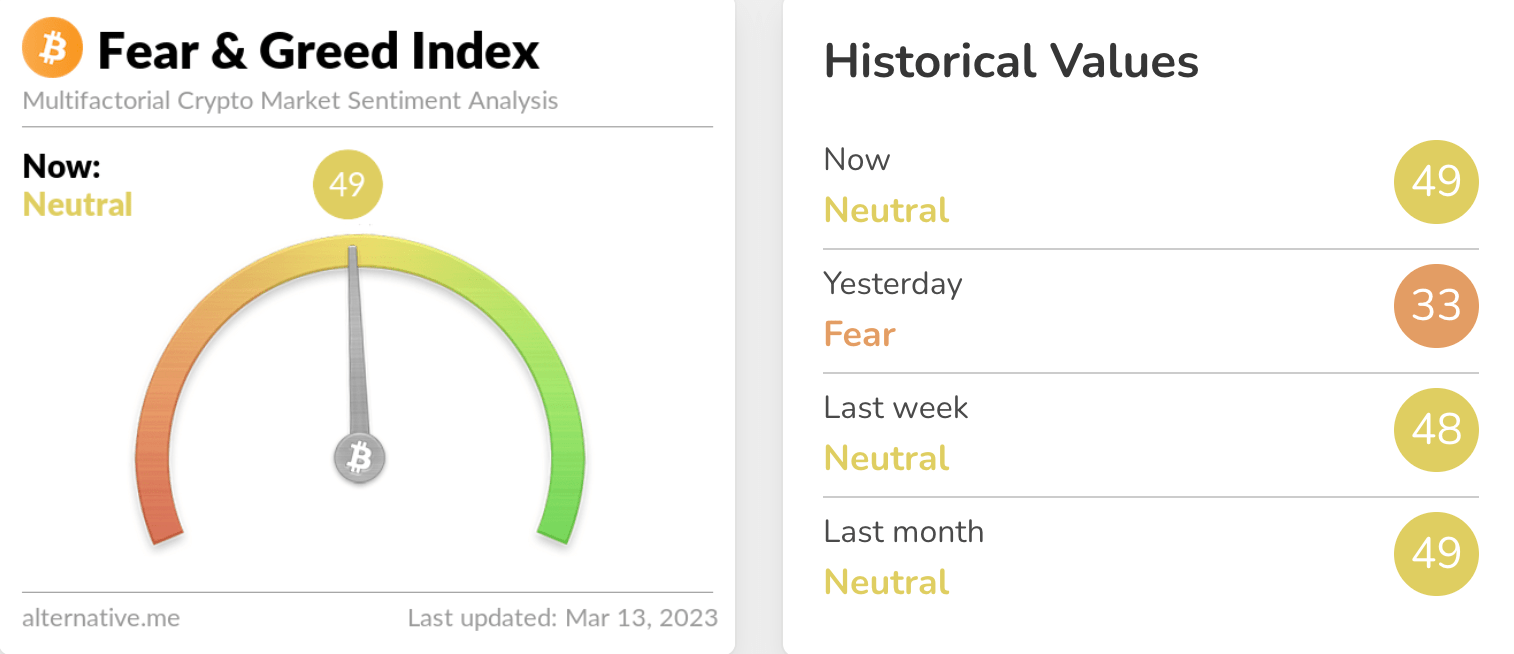

Let’s check in on some market sentiment…

Yup, that tells the story pretty well. The Silvergate, SVB and Signature bank fear has shifted to hopium for a Fed pivot and money-printing narrative.

Hmm, we’ll see. The CPI US inflation data report tomorrow will be something to keep an eye on.

Meanwhile, some/most Crypto Twitter analysts are definitely encouraged with Bitcoin’s performance so far this week:

That was a very strong #BTC Weekly Close$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) March 13, 2023

In the past 96 hours, three banks collapsed, few more on the edge.

The FED bailed out the depositors and slowly started QE. #Bitcoin bounced up massively, as it should. Now is the time.

— Michaël van de Poppe (@CryptoMichNL) March 13, 2023

“Markets don’t bottom off Bullish news”.

This is a newspaper I had 3 years ago after the Covid-19 Crash.

When these articles came out it ended up being the bottom of the crash & markets went on an upward roar.

I’m seeing similar “panic” today.#bitcoin #cryptocurrency #stocks pic.twitter.com/mbnr1gKuDX

— Roman (@Roman_Trading) March 13, 2023

Sweeping a market-cap range of about US$8.3 billion to about US$416 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Conflux (CFX), (market cap: US$554 million) +50%

• WhiteBIT Token (WBT), (mc: US$665 million) +19%

• Synthetix Network (SNX), (mc: US$993 million) +16%

• Rocket Pool (RPL), (mc: US$819 million) +16%

• Filecoin (FIL), (mc: US$2.56 billion) +16%

• Stacks (STX), (mc: US$1.1 billion) +13%

• Optimism (OP), (mc: US$821 million) +112%

• The Graph (GRT), (mc: US$1.28 billion) +10%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Fed bailing out banks that are failing while we're 12 months out from the next halving with the potential for a Grayscale spot ETF approval surprise in between.

Couldn't have written a better script for Bitcoin

— Will Clemente (@WClementeIII) March 13, 2023

JUST IN: 🇺🇸 FED swaps now show that the most likely scenario is no more interest rate hikes.

— Watcher.Guru (@WatcherGuru) March 13, 2023

She unironically just started the greatest bull market of your life today pic.twitter.com/4g68BtSXGV

— LilMoonLambo (@LilMoonLambo) March 12, 2023

SVB was Not a crypto bank, signature was roughly 15% crypto, only Silvergate was really a crypto bank.

— Mike Novogratz (@novogratz) March 13, 2023

#Bitcoin pic.twitter.com/O4bZ1dGcfQ

— naiive (@naiivememe) March 13, 2023