Mooners and Shakers: Bitcoin roller coasters below $40k… and back up again

Coinhead

Bitcoin dipped sharply below US$40k earlier today for the first time since August 2021, before staging a bit of a recovery. The crypto market is on quite a ride so far this year – perhaps not the one most wanted, but it’s not boring.

If you’ve nothing better to do, grab the popcorn and take in the extremes between bulls and bears right now on Crypto Twitter. (Or see below for a quick taster.)

Wall Street investment giant Goldman Sachs meanwhile has predicted four US Federal Reserve interest-rate hikes in 2022… which, if it plays out, might well equate to at least four more fearful corrections in the crypto market this year, if recent correlated reactions keeps going accordingly.

With more institutional money in the crypto space than ever, perhaps it shouldn’t be surprising that this risk-on, volatile market is moving back and forth with more traditional financial tides.

That said, for the first time in quite a while, crypto didn’t actually follow the S&P 500’s latest pump last week. Maybe there’s hope yet, then, that it can decouple, move out and find its own two-bedroom apartment this year.

BTFD

— Cameron Winklevoss (@cameron) January 10, 2022

A couple of months of pain are about to turn into a couple of months of euphoria

— Tyler Strejilevich (@TylerSCrypto) January 10, 2022

I'd rather long than short here for #Bitcoin. pic.twitter.com/QUc8n58b8K

— Michaël van de Poppe (@CryptoMichNL) January 10, 2022

Trying to wrap my head around the fact that Bill Miller has a half-Bitcoin and half-Amazon portfolio. pic.twitter.com/Wzn33DBZAX

— Lyn Alden (@LynAldenContact) January 10, 2022

#bitcoin ain’t going to $20,000 or $25,000 you silly bears.

Hope y’all get rekt.

— David Gokhshtein (@davidgokhshtein) January 10, 2022

It’s time to pay attention as this is playing out live https://t.co/0tOFlceJx2

— Pentoshi 🐧 (@Pentosh1) January 10, 2022

Just want to reiterate this. New analysts calling bottoms as $BTC is waterfalling downwards.

Not a good sign if you’re long.

I expect lower 30s soon.#bitcoin #cryptocurrency #cryptotrading #cryptonews https://t.co/XhdeFS1mZM

— Roman (@Roman_Trading) January 10, 2022

You know what real carnage is? $GOLD still being at the same price area that it was in 2011 😂

Absolutely Rekt sir

— Kevin Svenson (@KevinSvenson_) January 10, 2022

With the overall crypto market cap losing the magical US$2 trillion mark earlier today for the first time in about three months (it’s now back up a fraction over two trill), here’s the state of play in the top 10 by market cap at the time of writing, according to CoinGecko data.

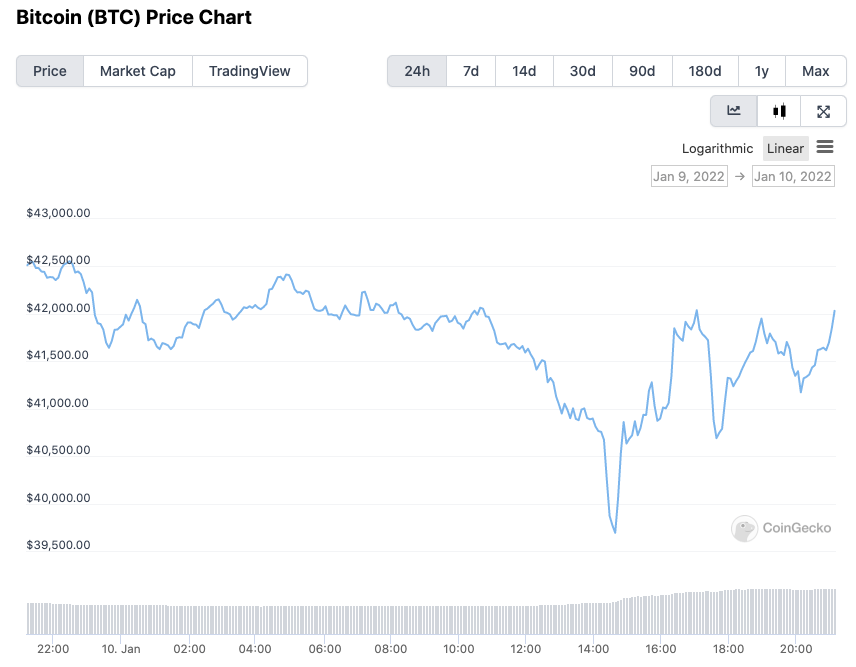

The orange-coloured, OG crypto, overall health barometer and market pace setter (that’d be Bitcoin, BTC) has a 24-hour chart that resembles a Luna Park roller coaster.

Having hit a daily low of US$39,692, BTC has since bounced back nicely and is currently stabilising again around US$41,800. Although what happens next is anyone’s guess. And guess, a lot of them will.

Elsewhere in the top 10, layer 1 protocols Ethereum (ETH), Solana (SOL), Cardano (ADA), Polkadot (DOT) and Terra (LUNA) are all down about 3-6% over the past 24 hours, as are BNB and XRP. All were in double-digit loss territory earlier, when Bitcoin was big dipping.

Sweeping a market-cap range of about US$20.7 billion to about US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Near (NEAR), (mc: US$9.2b) +10%

• Oasis Network (ROSE), (mc: US$1.26b) +6%

• Cosmos (ATOM), (mc: US$10.75b) +3%

• Huobi (HT), (mc: US$1.4b) +1%

• FTX Token (FTT), (mc: US$5.2b) +0.5%

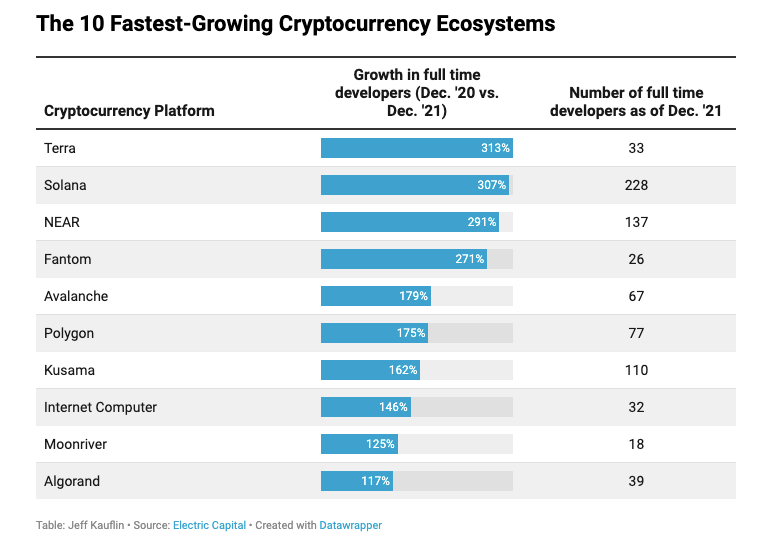

Layer 1 contender NEAR has a been a solid performer lately, even during recent market uncertainty, largely maintaining its general uptrend over the past several months. And, as Forbes points out, the protocol was the third-fastest growing crypto ecosystem for developers over the past year…

DAILY SLUMPERS

• Olympus (OHM), (mc: US$1.6b) -23%

• THORChain (RUNE), (mc: US$1.7b) -10.5%

• Curve DAO Token (CRV), (market cap: US$1.68b) -10%

• Arweave (AR), (mc: US$2.10b) -9%

• Gala Games (GALA), (mc: US$2.3b) -9.8%

Special mention, also goes to recent top 10 coin and highly popular layer 1 smart-contract protocol Avalanche (AVAX), which is currently about -7% on the daily timeframe and -25% on the weekly. Changing hands currently for US$84.7, it’s also about 41% below its all-time high of about US$145, achieved just two months ago.

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• YfDAI.finance (YF-DAI), (market cap: US$1.56m) +70%

• Epik Prime (EPIK), (mc: US$51.6m) +25%

DAILY SLUMPERS

• LooksRare (LOOKS), (market cap: US$40.6m) -61%

• Oddz (ODDZ), (mc: US$10.6m) -22%

• Redacted Cartel (BTRFLY), (mc: US$480m) -20%

hey #Bitcoin is at the same price it was yesterday. Glad I didn't spend all day watching the charts 😅

— Benjamin Cowen (@intocryptoverse) January 10, 2022