Mooners and Shakers: Bitcoin recovery stalls; Solana shines; Near climbs

Coinhead

Bitcoin’s move back up from its big dip earlier in the week has come to a bit of a halt today, but several altcoins are still making strong, positive moves.

While a Bitcoin bounce from just below the $40k level has been encouraging, along with strong bottoming signals, some traders have been emphasising that a small rally on low-ish volume and low liquidity is something to remain cautious about for the time being.

As Rekt Capital points out, for instance, a determined BTC move in either direction is something that’s still well in the balance right now and what we’re seeing could still be considered consolidation ranging.

Despite the recent recovery, #BTC hasn't yet reclaimed the blue 50-week EMA as support

That said, it also hasn't confirmed this EMA as new resistance

The EMA's role in this recent recovery still lies in the balance$BTC #Crypto #Bitcoin pic.twitter.com/jzeIlwxTgD

— Rekt Capital (@rektcapital) January 13, 2022

Roman Trading, meanwhile, who’s been consistently dubious of elements of Crypto Twitter’s bullish chatter just lately, is also calling for further patience with the OG crypto. He’s highlighting the low-trading activity (low volume) as a sign of a possible weak or unconvincing Bitcoin bounce.

It’s almost like you were warned a day in advance.

Oh well. 🙃#bitcoin #cryptocurrency #cryptotrading #cryptonews https://t.co/O6Rt1XIrkc

— Roman (@Roman_Trading) January 13, 2022

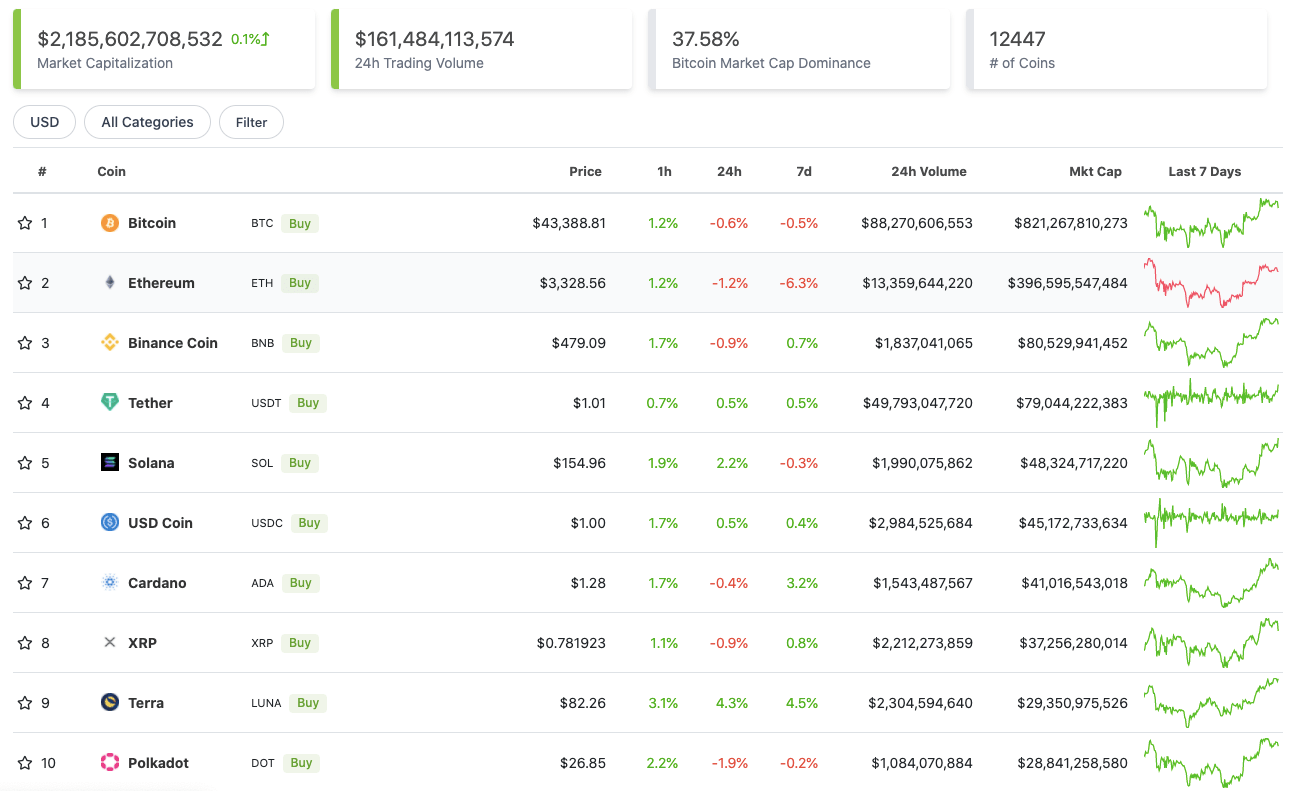

With the overall crypto market cap pretty much flatlining (+0.1%) since this time yesterday, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

Based purely on 24-hour price performance, Layer 1 protocols Solana (SOL) and Terra (LUNA) are looking the strongest in the top 10 just at the moment.

Although CoinGecko is showing SOL is currently only up a couple of percentage points on the daily timeframe, the token was earlier reacting positively to its ringing endorsement from the Bank of America.

Sweeping a market-cap range of about US$23 billion to about US$1.2 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Near Protocol (NEAR), (mc: US$11.7b) +10%

• Monero (XMR), (mc: US$3.9b) +9.8%

• Olympus (OHM), (mc: US$1.75b) +6.5%

• Oasis Network (ROSE), (mc: US$1.7b) +6%

• Harmony (ONE), (mc: US$4b) +5.5%

It’s been announced today that VC big gun Three Arrows Capital has led a US$150 million funding round for Near Protocol, with contributions from various other crypto-native funds and angel investors.

The funding will apparently be used to accelerate the adoption of Web3 technologies and Near’s involvement with them, as well as raise awareness of its brand.

📣 @NEARProtocol raises $150M to boost ecosystem growth! 🔥#NEAR has announced the close of a $150 million funding round led by @zhusu's Three Arrow Capital.

Participants included @MechanismCap, @a16z, @dragonfly_cap, #Alameda and many more.

Learn 🔽https://t.co/DjilZpkYPH

— NEAR Blockchain (@NEAR_Blockchain) January 13, 2022

DAILY SLUMPERS

• Frax Share (FXS), (mc: US$1.3b) -11%

• Internet Computer Protocol (ICP), (mc: US$6.4b) -7%

• Elrond (EGLD), (mc: US$6.2b) -6%

• Algorand (ALGO), (market cap: US$9b) -5%

• Theta Network (THETA), (mc: US$4.1b) -5%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Paint Swap (BRUSH), (mc: US$29m) +73%

• Soul Swap (SOUL), (mc: US$6.5m) +64%

• Moonbeam (GLMR), (mc: US$1.07b) +61%

• Goldfinch (GFI), (market cap: US$70m) +45%

• Cream (CREAM), (market cap: US$55m) +44%

Paint Swap and Soul Swap are two more DeFi plays within the Fantom ecosystem of tokens, many of which have been on a bit of a tear just lately. (Perhaps they’re stealing some speculator interest away from the likes of fellow Fantom coins Tarot and Spell – see below.)

Polkadot’s interoperability enabler Moonbeam, meanwhile, has bounced dramatically after a hefty dump upon its market arrival the other day.

DAILY SLUMPERS

• Fuse (FUSE), (market cap: US$174m) -13%

• Crypto Raiders (RAIDER), (mc: US$43m) -10%

• Tarot (TAROT), (mc: US$31m) -8%

• Spell (SPELL), (mc: US$1.2b) -7.5%

• Rmrk (RMRK), (mc: US$256m) -7%

#Bitcoin should be between $50,000 to $75,000 right now according to our internal models.

– CEO of Swiss bank, SEBA.— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) January 12, 2022