Mooners and Shakers: Bitcoin pump loses steam; LUNA token takes off

Coinhead

Bitcoin made a strong move up past US$39k earlier, ultimately losing momentum and settling down to typically uncertain, choppy action. Maybe the rocket’s being pulled from the launchpad for a bit more maintenance.

But on the whole, it’s so far been an interesting day of diversion from crypto’s usual correlation. The S&P 500 and Nasdaq have been dipping sharply, while the crypto market is up by a couple of percentage points at the time of writing. The US dollar is also pumping, which would usually be sending crypto the other way, along with stonks.

It’s eye catching, but likely a bit premature to read much into it. The crypto market would love it to be a developing decoupling trend, though.

It's actually quite good that #Bitcoin is doing relatively well, while the stock markets are making new lows.

— Michaël van de Poppe (@CryptoMichNL) February 23, 2022

Meanwhile, just to follow up on the Twitter-based analysis Stockhead referenced half a day or so ago, let’s see what “CryptoCapo” was thinking after Bitcoin did actually momentarily breach the US$39k mark…

"Hard to see it going above 39k"

*goes slightly above 39k for few minutes"

"You were wrong… unfollowed!" https://t.co/VFw4baGP9f

— il Capo Of Crypto (@CryptoCapo_) February 23, 2022

Yeah, not much has changed there. As you were, then…

Before we look at what’s been moving in the market, another analyst’s quick take. As we also highlighted yesterday, the full-time options trader “John Wick” was zeroing in on a “double bottom” reversal formation for BTC. Seems like he’s feeling good about that… for the moment…

So Bitcoin can bounce due to TA regardless of Russia news? You don’t say.

Blasphemy.

If only there was an indictor signal and someone willing to show us this before the bounce…

🤔

— John Wick (@ZeroHedge_) February 23, 2022

That said, it might be prudent to tread carefully and see if it actually keeps playing out. Russia, Ukraine, Biden, Fed, inflation – these are all factors surely still very much in play, as much as we wish they’d leave our portfolios the hell alone.

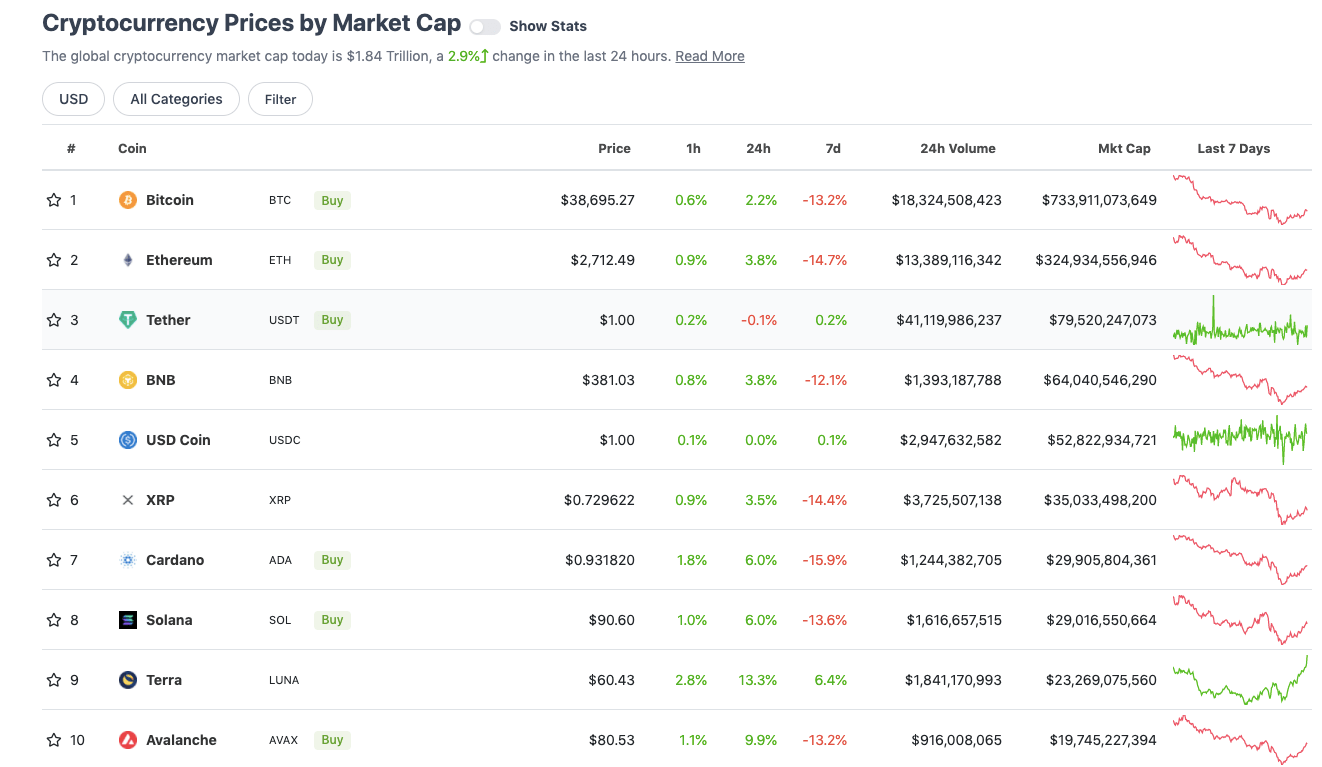

With the overall crypto market cap sitting at about US$1.84 trillion and up about 3% over the past 24 hours, here’s the state of play in the top 10 tokens right now – according to CoinGecko.

The big top 10-coin story of the past 24 hours is Terra (LUNA), which has had a major protocol-strengthening boost with the purchase of US$1 billion of LUNA tokens from some major VC crypto players.

The capital is being used to form a Bitcoin-denominated “Forex Reserve” fund as back-up for Terra’s UST stablecoin – if needed during times of financial instability. You can read more about that on Stockhead here.

Sweeping a market-cap range of about US$18.7 billion to about US$905 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• JUNO (JUNO), (market cap: US$1.49 billion) +19%

• Waves (WAVES), (mc: US$1b) +18%

• Osmosis (OSMO), (mc: US$2.7b) +12%

• Cosmos (ATOM), (mc: US$7.7b) +11%

• Stacks (STX), (mc: US$1.3b) +10%

DAILY SLUMPERS

• Humans.ai (HEART), (market cap: US$1.22 billion) -1%

• Radix (XRD), (mc: US$1.18b) -1%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Scream (SCREAM), (market cap: US$20m) +55%

• API3 (API3), (mc: US$357m) +30%

• Universe.xyz (XYZ), (mc: US$99m) +26%

• Smooth Love Potion (SLP), (mc: US$786m) +25%

• Voxies (VOXEL), (mc: US$42m) +24%

DAILY SLUMPERS

• ADAX (ADAX), (market cap: US$11.5 million) -11%

• Lido DAO (LDO), (mc: US$166m) -9%

• Lit (LIT), (mc: US$28m) -7%

• DeFi Land (DFL), (mc: US$33m) -6%

• Alpine F1 Team Fan Token (ALPINE), (mc: US$57m) -6%

For those of you who care about macro too, I think we are getting really really close to a buy bonds, buy tech, buy crypto set up.

More to come… watching closely but likely over next 2 weeks.

Meanwhile, patience….

— Raoul Pal (@RaoulGMI) February 21, 2022