Mooners and Shakers: Bitcoin could leave both Tesla and gold in its dust, believes Bloomberg analyst

Coinhead

Coinhead

Ahead of a big week that’ll reveal the Fed’s next move, Bitcoin and plenty of other cryptocurrencies are ticking back up again today. Meanwhile Bloomberg has some interesting “bottoming” analysis for BTC.

The financial media company’s Senior Commodity Strategist Mike McGlone occasionally tweets about Bitcoin. And why not – it’s the only digital asset that seems to be regarded as a commodity by both the bosses of the US Securities and Exchange Commission and the Commodity Futures Trading Commission. (Although we still have to wait and see whether Ethereum and other cryptos will eventually end up being classified as securities.)

McGlone’s latest tweet regards the prospects of both Bitcoin (BTC) and Tesla (TSLA), in which he shares an extract from a recent Bloomberg report.

In short, he’s seeing the potential for Bitcoin to surge against shares of Elon Musk’s famous electric vehicle firm.

Bitcoin May Be Bottoming vs. Tesla – At about 93x #Tesla's price at the start of December, #Bitcoin may be bottoming vs. the automaker. The graphic shows a potential low in the crypto-to-automaker ratio around the 2020 trough and a notable connection: risk measures about the same pic.twitter.com/xCKXkhFC6l

— Mike McGlone (@mikemcglone11) December 8, 2022

Bloomberg notes that both BTC and TSLA have lost US$500 billion in their market capitalisation from February to this point. However…

“Both represent rapidly advancing technologies,” wrote McGlone, adding: “In the near term, a world leaning toward recession should buoy Bitcoin vs. Tesla, and in the longer term limited supply may give the crypto a performance advantage.”

McGlone also has a thesis that Bitcoin should outperform gold over time – something he’s posited a few times before. Here’s another tweet from yesterday, in which he describes BTC as “the world’s most fluid 24/7 trading vehicle” and a potential “high-beta version of gold”.

What Stops Bitcoin From Rising vs. Gold? The world's most fluid 24/7 trading vehicle, #Bitcoin, has gained status in 2022 as a leading indicator and declined in a risk-off environment, but the crypto may be transitioning toward a high-beta version of #gold and US Treasury #bonds pic.twitter.com/glmEdBtRcs

— Mike McGlone (@mikemcglone11) December 7, 2022

“The nascent technology asset is a top contender to outperform the metal in the long term, as we see it, and is backing up into a too-cold price zone,” said McGlone.

So, how are Bitcoin and pals faring today? Let’s take a look through the circular window…

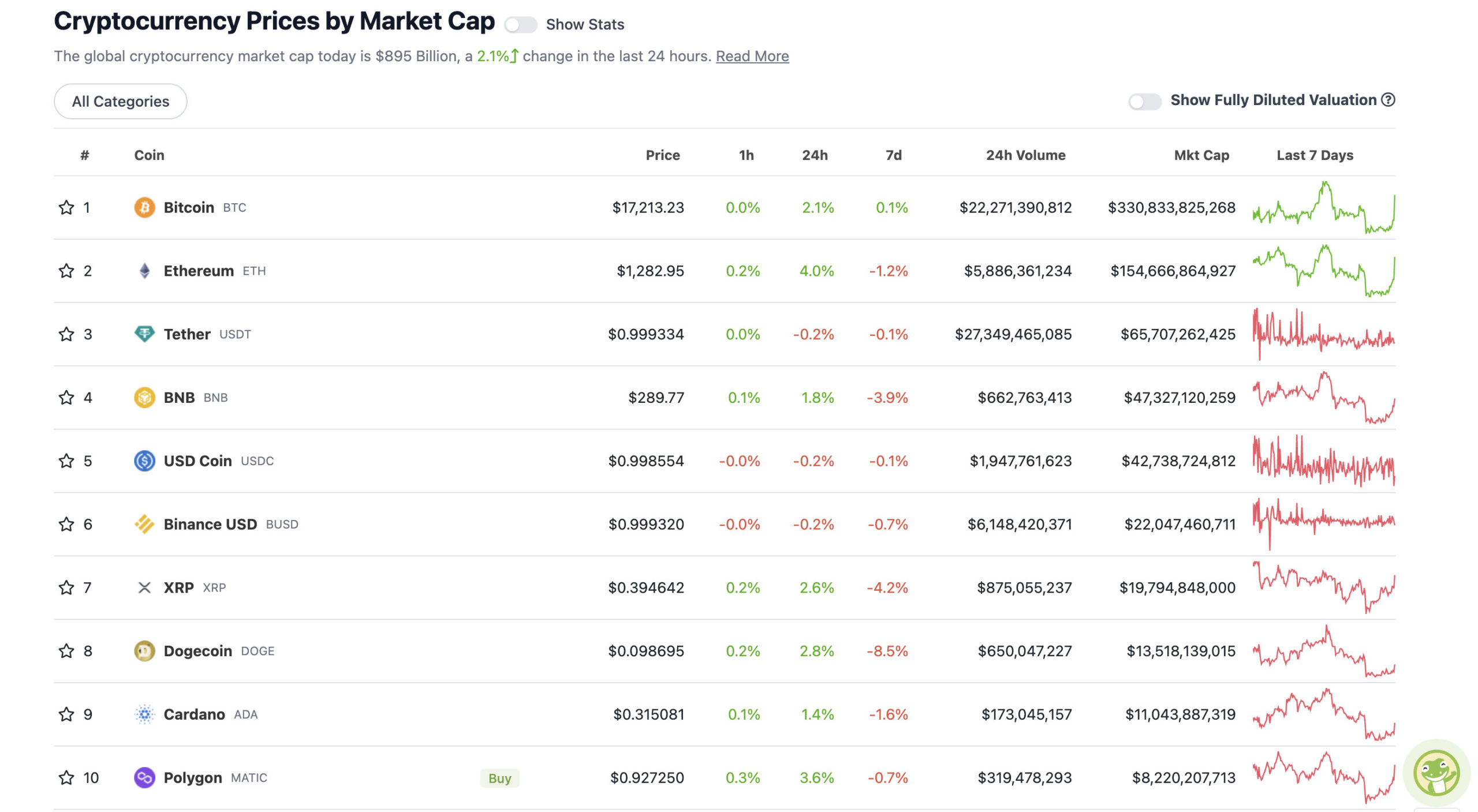

With the overall crypto market cap at US$895 billion, up 2.1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

While it’s nice to see some green in the crypto majors today, the choppy nature of the market right now is a little seasick-inducing. (Or maybe this columnist is just a little worse for wear after the Stockhead Christmas party yesterday.)

The biggest daily mover is the bull goose smart contract platform, the Michael Jordan of layer 1s, the Bradman of altcoi… you get the picture. It’s Ethereum (ETH), with a 4% surge.

A big Ethereum core developers meeting was held overnight, in which they’ve targeted March 2023 for the next network upgrade, dubbed Shanghai. Part of that development will apparently allow users to be able to withdraw their staked ETH for the first time.

This function has been nominated as a priority, however, it’s not completely set in stone yet that it will happen as soon as the devs have earmarked.

Ethereum developers are prioritizing Beacon Chain withdrawals for the network’s next major upgrade 'Shanghai' 🚀

This marks the first time @ethereum devs have provided a set window for staked $ETH withdrawals.

Shanghai is expected to go live during the second half of 2023. pic.twitter.com/d74HQdekLS

— The Defiant (@DefiantNews) December 8, 2022

One likely reason we’re seeing Bitcoin back above US$17k again and other cryptos faring similarly well over the past 24 hours, is that US stocks and traders have responded positively to a new US Labor Department report that’s just come in.

The takeaway from the report is that there’s been an increase in Americans lining up at dole queues/filing for jobless benefits as unemployment figures hit a 10-month high.

The very basic thesis is: high unemployment will lead to prices of goods and services likely remaining stable, leading to inflation potentially coming down. We shall see.

What happens if we get an inflation (CPI) under 7,7% on Tuesday and a 50bps rate hike on Wednesday?

I would prepare for this scenario!🚀🚀🚀

— Ran Neuner (@cryptomanran) December 8, 2022

Sweeping a market-cap range of about US$6.4 billion to about US$324 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Radix (XRD), (market cap: US$475 million) +10%

• Trust Wallet (TWT), (mc: US$1.09 billion) +7%

• Frax Share (FRAX), (mc: US$434 million) +5%

• Bitcoin SV (BSV), (mc: US$830 million) +5%

• BitDAO (BIT), (mc: US$336 million) +5%

DAILY SLUMPERS

• Axie Infinity (AXS), (market cap: US$943 million) -3%

• Synthetix (SNX), (market cap: US$466 million) -2%

• Tether Gold (XAUT), (mc: US$426 million) -1%

• Chain (XCN), (mc: US$821 million) -1%

Some randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Lies are circulating @CNBC that I am not willing to subpoena @SBF_FTX. He has been requested to testify at the December 13th hearing. A subpoena is definitely on the table. Stay tuned.

— Maxine Waters (@RepMaxineWaters) December 8, 2022

So in the past 24 hours we have learned:

– SBF hired a lawyer who represented Maxwell & El Chapo

– SBF being investigated for market manipulation wrt to Terra collapse

– Could be subpoenaed to speak in CongressAm I missing something? 🤔

— Coin Bureau (@coinbureau) December 8, 2022

The more undervalued we get, the more correlations break down, the less other market factors matter, the more likely Bitcoin will do its thing.

— Charles Edwards (@caprioleio) December 8, 2022

The global bond market is worth $120T. Imagine when these people understand #bitcoin. Let’s say $60T flows in. This makes 1 BTC worth $3.2M.

— Bitcoin for Freedom⚡️ (@BTC_for_Freedom) December 8, 2022