Mooners and Shakers: Bitcoin and crypto market flat ahead of next week’s Fed rate hiking

Coinhead

Coinhead

The US dollar is dipping fractionally – has it finally run out of pumpage? This would normally mean a good day for crypto prices, but Bitcoin and mates aren’t taking that much notice so far.

And that might be due to the fact markets are bracing for the US Federal Reserve’s highly likely 50 basis points interest-rates increase when it holds its next major meeting on May 3-4.

Oh, and Vladimir Putin still isn’t helping market jitters much, either.

But as for the rate hiking, some analysts have been suggesting a 50bps increase is “priced in”…

Next week’s FOMC meeting should be a ‘buy the news’ event for #BTC pic.twitter.com/tjOkFIdyVH

— tedtalksmacro (@tedtalksmacro) April 29, 2022

That’s possible… but is caution the best non-financially advised mentality in this ongoing, uncertain, macro-influenced economic landscape? That’s probable.

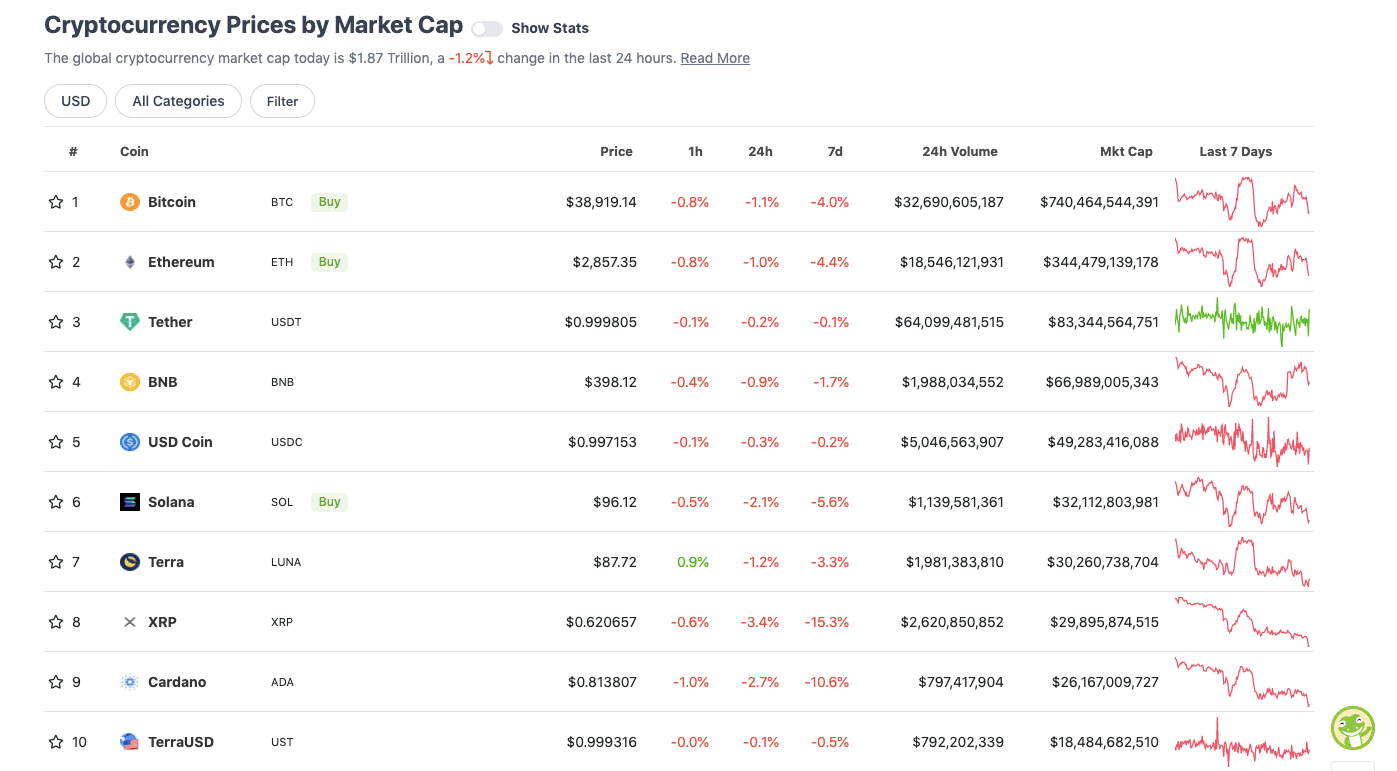

With the overall crypto market cap at roughly US$1.87 trillion, down about 1.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So, to reiterate, it’s a pretty lacklustre day in the crypto majors… which is also largely mirroring the performance of the stock markets (S&P 500: -1.7%). Perhaps this is a lull before some sort of storm. Crypto Twitter seems to be sensing a big week ahead – one way or the other.

Bitcoin, Ethereum and the other crypto big dogs appear to be showing little signs of strength, though, heading into the weekend.

Perhaps, as popular trader and technical analyst Rekt Capital posits, a higher low on the relative strength index (RSI) might need to form for a decent Bitcoin bounce to occur.

#BTC ultimately rejects at this resistance

Now pulling back

Could $BTC find a base and then rebound once the RSI Higher Low has been revisited?#Crypto #Bitcoin https://t.co/nneXL2BrKe pic.twitter.com/AKMzmmdGds

— Rekt Capital (@rektcapital) April 29, 2022

Sweeping a market-cap range of about US$18.3 billion to about US$962 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• ApeCoin (APE), (market cap: US$6.36 billion) 7%

• TRON (TRX), (mc: US$6.6 billion) +3%

• GateToken (GT), (mc: US$964 million) +2%

• NEXO (NEXO), (mc: US$1. billion) +1%

DAILY SLUMPERS

• Chain (XCN), (mc: US$1.3 billion) -15%

• The Graph (GRT), (mc: US$2.4 billion) -11%

• Zcash (ZEC), (mc: US$1.67 billion) -10%

• Maiar DEX (MEX), (mc: US$962 million) -10%

• Axie Infinity (AXS), (mc: US$2.7 billion) -9%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Market Making Pro (MMPRO), (market cap: US$37 million) +49%

• Everdome (DOME), (mc: US$401m) +37%

• Velas (VLX), (mc: US$493m) +32%

• Tenset (10SET), (mc: US$258m) +29%

• Mantra DAO (OM), (mc: US$49m) +13%

DAILY SLUMPERS

• Offshift (XFT), (mc: US$5.6m) -58%

• MAD Bucks (MAD), (mc: US$43m) -27%

• DEUS Finance (DEUS), (mc: US$40m) -26%

• Tomb Shares (TSHARE), (mc: US$104m) -26%

• DeFi Kingdoms (JEWEL), (mc: US$183m) -20%

Here’s an interesting thread worth half a look if you’re interested in how Elon Musk could potentially take Twitter down a decentralised path…

Elon Musk's Twitter takeover could become the biggest turning point in Web3, ever.

How?

By turning $TWTR into a cryptocurrency, obviously.

🧵

— Jack Niewold (@JackNiewold) April 28, 2022

Oh, and this was some pretty big news from the past couple of days. Blackrock, the world’s biggest asset hogger, has just launched a crypto ETF. The institutional financial titan has been showing plenty of interest in crypto lately. Follow the money?

The world’s largest asset manager is embracing blockchain. @BlackRock has officially launched a blockchain-focused ETF that provides investors with exposure to the crypto and blockchain industry without needing to directly own digital assets. https://t.co/bk4OGcTKV1

— Cointelegraph (@Cointelegraph) April 28, 2022

Meanwhile, one for the short-to-midterm bears…

This is going to be an unpopular tweet.

But if you plan to just buy and hold you “could” be waiting until just before the next halvening in 2024 for an extended bull run.

The only way to make money or more #BTC right now is to TRADE IT.

— John Wick (@ZeroHedge_) April 29, 2022

… and one for the “I want it all, and I want it now” bulls…

HUGE #BITCOIN PUMP SOON! 🔥🚀

Looking back to the RSI based on the $DXY chart, you can see that every time it went overbought, a #Bitcoin pump followed up afterward!

LOOKS BULLISH TO ME! 👇 pic.twitter.com/y8OPj5Vyc0

— Crypto Rover (@rovercrc) April 29, 2022

… and just a general Bitcoin meme to round things off.

#Bitcoin pic.twitter.com/47PTdEM9bT

— naiivecat (@naiivememe) April 29, 2022