Mooners and Shakers: Bitcoin bounces a bit, but Ethereum’s ‘Merge’ is reportedly delayed

Coinhead

Coinhead

The crypto market at large is having a nice little bounce back up at the time of writing, while the US dollar index (DXY) takes a shallow dip (-0.4%).

The US stock market is also currently spiking (S&P 500: +1%; Nasdaq 100: +1.8%), with Bitcoin (+2.3%) clinging to its coattails in a classically correlated move. All a bit of short-term fun? Probably… maybe.

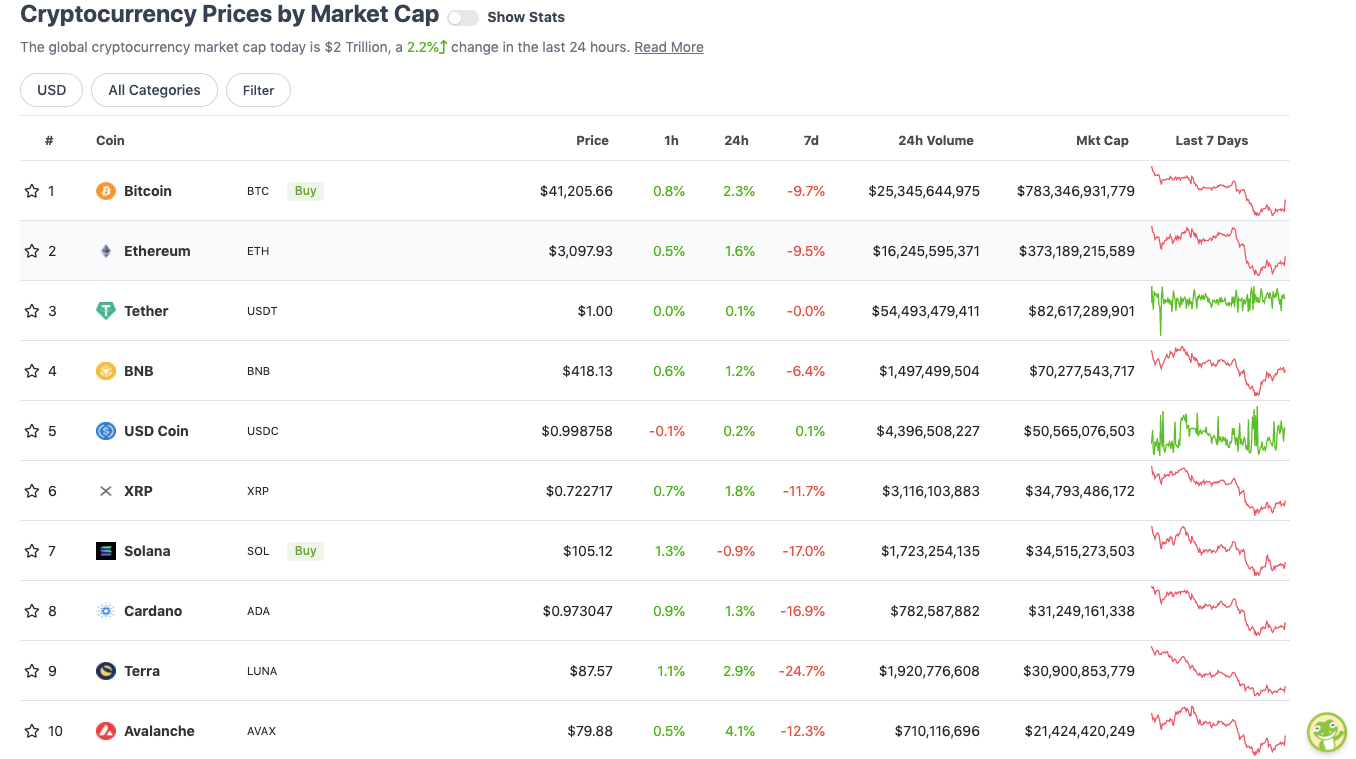

With the overall crypto market cap back at roughly US$2 trillion, up about 2.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) still has a zoomed-out, up-trending position with a “higher low” intact on the charts, according to the popular (pretty much perma-bullish) analyst Rekt Capital…

Macro #BTC Higher Low still remains intact$BTC #Crypto #Bitcoin pic.twitter.com/Hm1PwcLpEH

— Rekt Capital (@rektcapital) April 13, 2022

Although, he also points out that in order for bullish momentum to really resume, the OG digital asset needs to reclaim previous support at US$43,100… toot sweet.

#BTC lost ~$43100 as support earlier this week

This is the level $BTC needs to reclaim as support on this recovery to regain bullish momentum#Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 13, 2022

Meanwhile, Ethereum’s hotly anticipated transition from proof-of-work network to proof-of-stake, aka the “Merge”, will likely be delayed until Q3 this year, according to a tweet response from Ethereum Foundation member Tim Beiko…

It won't be June, but likely in the few months after. No firm date yet, but we're definitely in the final chapter of PoW on Ethereum

— Tim Beiko | timbeiko.eth 🔥🧱 (@TimBeiko) April 12, 2022

Although ETH’s price is travelling okay right now (+1.6%), the news has caused some consternation on Crypto Twitter, which is generally a “degen”-dwelling hive of extreme impatience. But not sure it should be particularly unexpected.

One of Ethereum’s main competitors, Cardano (ADA) gets a bad wrap for taking its sweet time building out, but the OG smart-contract blockchain doesn’t exactly have a stellar rep for hitting roadmap targets, either.

And besides, as “enchain.eth” alludes below, developing solid tech will always encounter the odd speed hump…

people freaking out in the comments never programmed a damn thing in their life.

be grateful for the developers making this ecosystem flourish properly.

go buy SHIB if you want.

— enchain.eth (@k00laid_jammer) April 13, 2022

Sweeping a market-cap range of about US$20.1 billion to about US$1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Frax Share (FXS), (market cap: US$18.4 billion) 15%

• Bitcoin Cash (BCH), (mc: US$6.4 billion) +11%

• Chiliz (CHZ), (mc: US$1.3 billion) +10%

• ApeCoin (APE), (mc: US$3.5 billion) +8%

• Litecoin (LTC), (mc: US$7.7 billion) +5%

DAILY SLUMPERS

• Humans.ai (HEART), (mc: US$1.31 billion) -16%

• Waves (WAVES), (mc: US$2.16 billion) -7%

• Shiba Inu (SHIB), (mc: US$14.7 billion) -3%

• Convex Finance (CVX), (mc: US$1.7 billion) -2%

• Quant (QNT), (market cap: US$1.57 billion) -1.5%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• APY.Finance (APY), (market cap: US$11.5 million) +59%

• Silo Finance (SILO), (mc: US$75m) +25%

• Ellipsis (EPS), (mc: US$123m) +24%

• DEUS Finance (DEUS), (mc: US$70m) +23%

• GMX (GMX), (mc: US$276m) +22%

DAILY SLUMPERS

• ICHI (ICHI), (mc: US$24m) -50%

• Parsiq (PRQ), (mc: US$45m) -21%

• MATH (MATH), (mc: US$45.5m) -20%

• Savanna (SVN), (mc: US$106m) -18%

• Rich Quack (QUACK), (mc: US$52m) -15%

💥BREAKING: Brazilian Senate announces imminent approval of the #Bitcoin law.

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) April 13, 2022

JUST IN 💥 Rappers Snoop Dogg and Drake invest MILLIONS into #Bitcoin and crypto exchange MoonPay 💥 pic.twitter.com/2mFKcVBTrW

— Bitcoin Magazine (@BitcoinMagazine) April 13, 2022

This is the most 2022 thing ever

— Crypto King (@Cryptoking) April 13, 2022