Mooners and Shakers: Bitcoin and crypto market dip as bearish sentiment takes hold

Coinhead

Coinhead

It’s a sea of red today in the crypto market, with major digital assets kicking off the week with a dump and Bitcoin heading further towards US$40k.

A discouraging weekly close for BTC below US$43.1k support foreshadowed today’s price action. And with various macroeconomic and geopolitical factors at play right now, there’s certainly a lot about to fuel bearish sentiment.

What’s largely keeping the market subdued and suppressed in the short term, though, is concern about the next US Consumer Price Index inflation-data reveal (happening Tuesday – expected to be high, of course). That, and the US Federal Reserve’s increasingly “hawkish” economy-tightening tapering rhetoric that will no doubt soon follow.

And this is despite potentially positive market-moving events including:

• Terra’s Luna Foundation Guard buying another 4,130 Bitcoin on the weekend to add to its UST stablecoin reserve.

• Ethereum’s keenly anticipated “Merge” to proof-of-stake, which has now completed testnets, albeit with an actual launch date still to be determined.

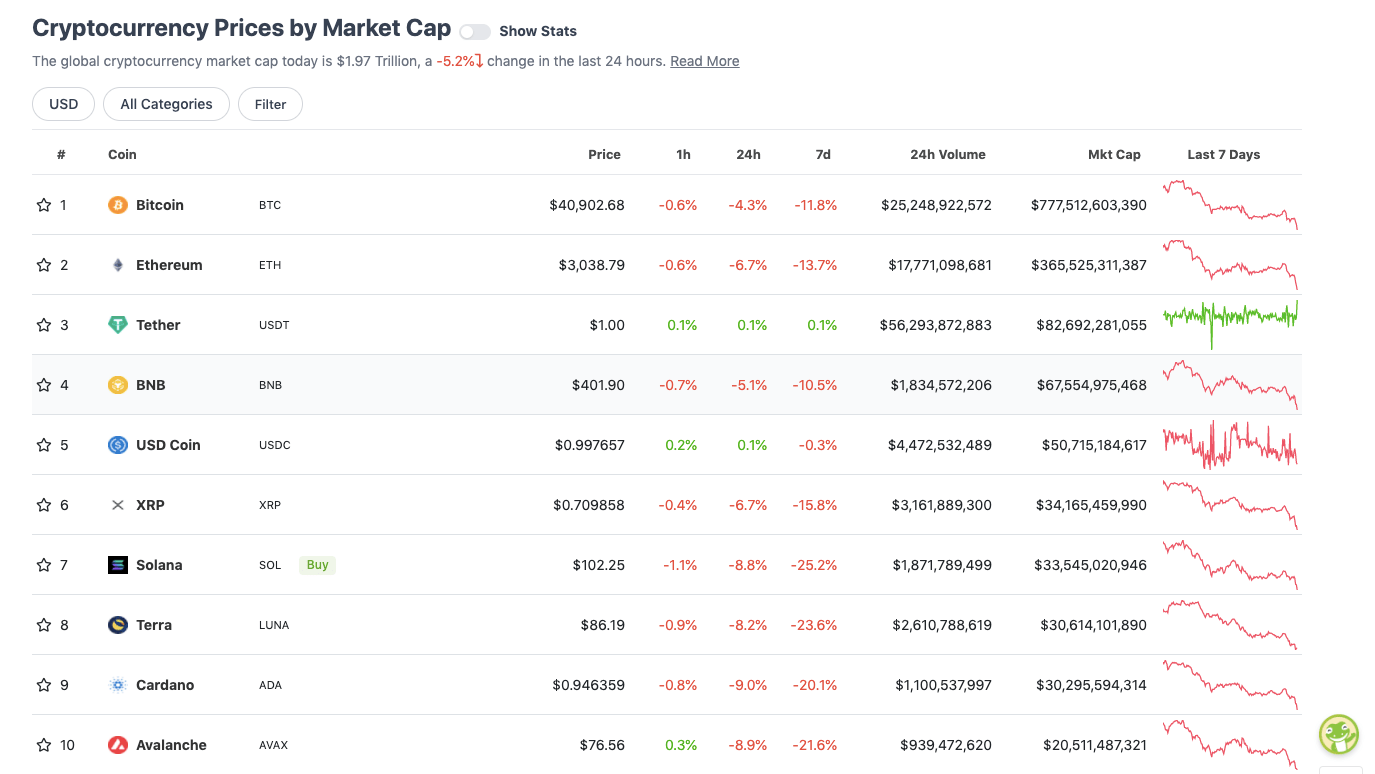

With the overall crypto market cap at about US$1.97 trillion, down about 5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Layer 1 blockchains Cardano (ADA), Avalanche (AVAX) and Terra (LUNA) are the biggest-dipping crypto majors today, although every top-10 coin is well down, following the lead of Bitcoin (BTC) and Ethereum (ETH), as per.

Also as usual, our Crypto Twitter journey scrolls us past about as many bearish Bitcoin analysts as bullish chartists. Here’s one who’s seeing “consolidation”, even if the BTC tumble continues to US$38k…

New #BTC Weekly Candle has closed below black ~$43100 support

This close differs from past bullish Weekly Closes, like in blue/orange circles

Now ~$43K could figure as resistance

Overall, $BTC has broken back down into the 2022 consolidation range ($38000-$43100)#Bitcoin pic.twitter.com/SPgXFsP4i5

— Rekt Capital (@rektcapital) April 11, 2022

… while here’s a case for “capitulation”…

$BTC Weekly Death Cross

Respecting the cross we've been following. Capitulation is the next "big" thing to come.

Nothing here is bullish but DCA opportunities are coming soon.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/u4rxqBAu1k

— Roman (@Roman_Trading) April 11, 2022

Bearing (pun intended) in mind, that’s a pretty negative view from Roman Trading there. A potential 63 per cent drop from the “death cross” he’s pointing out? Hmm… guess crazier things have happened.

Meanwhile, former CEO of BitMEX, Arthur Hayes, is also spreading the short-to-midterm highly bearish view today, which seems to be grabbing a fair amount of attention.

In a blog post today, Hayes wrote that he thinks a continued dip in the Nasdaq 100 is the likely course, along with “crypto carnage” including a correlated Bitcoin slump to about US$30k before the end of June and a US$2.5k ETH.

Bitcoin’s tendency to move in tandem with tech stocks means the biggest crypto may slump to $30,000 by June, according to BitMEX co-founder Arthur Hayes https://t.co/CoEfsw9wsr

— Bloomberg (@business) April 11, 2022

Not everyone’s in the mood to listen to Arthur Hayes, though…

— Grogu (@eip1559) April 11, 2022

And do take anything Hayes says with a grain of salt. It probably shouldn’t be forgotten he was sentenced in May to two years’ probation with six months’ home detention after pleading guilty to a lack of anti-money laundering compliance at BitMEX.

One thing’s for sure, no one can really say with any level of certainty what’s going to happen next in the crypto market. In it for the long haul? Good, us, too.

Sweeping a market-cap range of about US$19.6 billion to about US$1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• STEPN (GMT), (market cap: US$1.44 billion) 8%

• Zilliqa (ZIL), (mc: US$1.74 billion) +1.5%

DAILY SLUMPERS

• Humans.ai (HEART), (mc: US$1.3 billion) -17%

• THORChain (RUNE), (mc: US$2.4 billion) -14%

• Theta Network (THETA), (mc: US$3 billion) -14%

• Frax Share (FXS), (mc: US$1.5 billion) -14%

• Mina Protocol (MINA), (market cap: US$1.2 billion) -13%

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• PLEX (PLEX), (market cap: US$486 million) +60%

• Meter Governance (MTRG), (mc: US$35m) +51%

• PAID Network (PAID), (mc: US$38m) +30%

• ShapeShift (FOX), (mc: US$118m) +24%

• PARSIQ (PRQ), (mc: US$45m) +11%

DAILY SLUMPERS

• ICHI (ICHI), (mc: US$284m) -53%

• Silo Finance (SILO), (mc: US$51m) -36%

• TitanSwap (TITAN), (mc: US$337m) -23%

• Cult DAO (CULT), (mc: US$125m) -23%

• Wrapped Nexus Mutual (WNXM), (mc: US$71m) -21%

Here’s some more news amid the wrap-up of the Bitcoin 2022 conference in Miami, which ended on the weekend. Ark Invest CEO Cathie Wood has revealed she’s now sold out of the firm’s PayPal position completely, instead favouring Block’s Bitcoin-payments-enabling Cash App.

“We tend to put our bets with who we believe will be the winners,” Wood said to CNBC. “As we consolidated our portfolios during a risk-off period, we chose Block over PayPal.”

Cathie Wood's @ARKInvest "has sold, completely got out of Paypal, whose Venmo is a big competitor to Cash App"

ARK analysts "had higher conviction because of #bitcoin” pic.twitter.com/4RDAmB0wfC

— Documenting Bitcoin 📄 (@DocumentingBTC) April 11, 2022

Meanwhile, even as the market dips further as we type this, here’s some hopium for you – a tweet from the popular BTCfuel account, proving there are about 100 different ways to look at the charts…

#Bitcoin is following Justing Mamis sentiment cycle perfectly👌

Now it is at the aversion stage. Up soon 🔥🔥 pic.twitter.com/fVSVJT0fOe

— BTCfuel (@BTCfuel) April 11, 2022

And for Merge-frothing Ethereum fans, a “DeFi educator” who goes by the handle “korpi” gives a highly detailed breakdown of why he thinks the proof-of-stake transition is going to be a major catalyst for ETH moving up and to the right this year…

The Merge – the most significant Ethereum upgrade ever.

Big events like this are often "sell the news" opportunities. Some claim this is what will happen with $ETH.

I disagree.

Here is why $ETH will melt faces after the Merge.

🧵👇 pic.twitter.com/AHXW5fjf2C— korpi (@korpi87) April 11, 2022

Oh, and finally, in vaguely related crypto news you might have heard by now, it seems Elon Musk has opted out of becoming a Twitter board director.

Parag Agrawal: There will be distractions ahead. Let's tune out the noise, and stay focused.

Elon: pic.twitter.com/sQEZHV095F

— Rich Rogers (@RichRogers_) April 11, 2022

Some are theorising that by keeping his distance from board meetings, the tech billionaire may actually have more influence on the direction of Twitter as simply its largest shareholder. More “noise” on it all likely to follow, then.