January Crypto Winners: Bitcoin had a great month but Ethereum rival Aptos led the January surge

Coinhead

Coinhead

And that, was January in crypto. Twas a surprisingly good one at that, given all the doom and gloom in November/December (thanks again for that, SBF).

Before we delve into altcoin specifics, let’s just take a moment to acknowledge how well Bitcoin (BTC), the crypto market-mover in chief, fared across the first month of 2023.

Because, as you can see from this Coinglass BTC monthly returns chart, it smashed it.

That’s a near 40% monthly gain for the OG crypto, and its best January performance since 2013. If things were to play out the way the rest of that year did, then it wouldn’t be too shabby, would it?

Suddenly remembers macroeconomic turmoil and recession-related concerns and, ahem, tempers expectations somewhat. That said, if reduced inflation in the US continues to play out, the jobs sector behaves, regulations don’t stifle and the crypto industry fails to shoot itself in the foot again, then who knows.

There are still crypto-contagion-related worries floating around, for instance potential Digital Currency Group/Genesis implosion, but perhaps any fallout there will be limited, given it’s almost expected now.

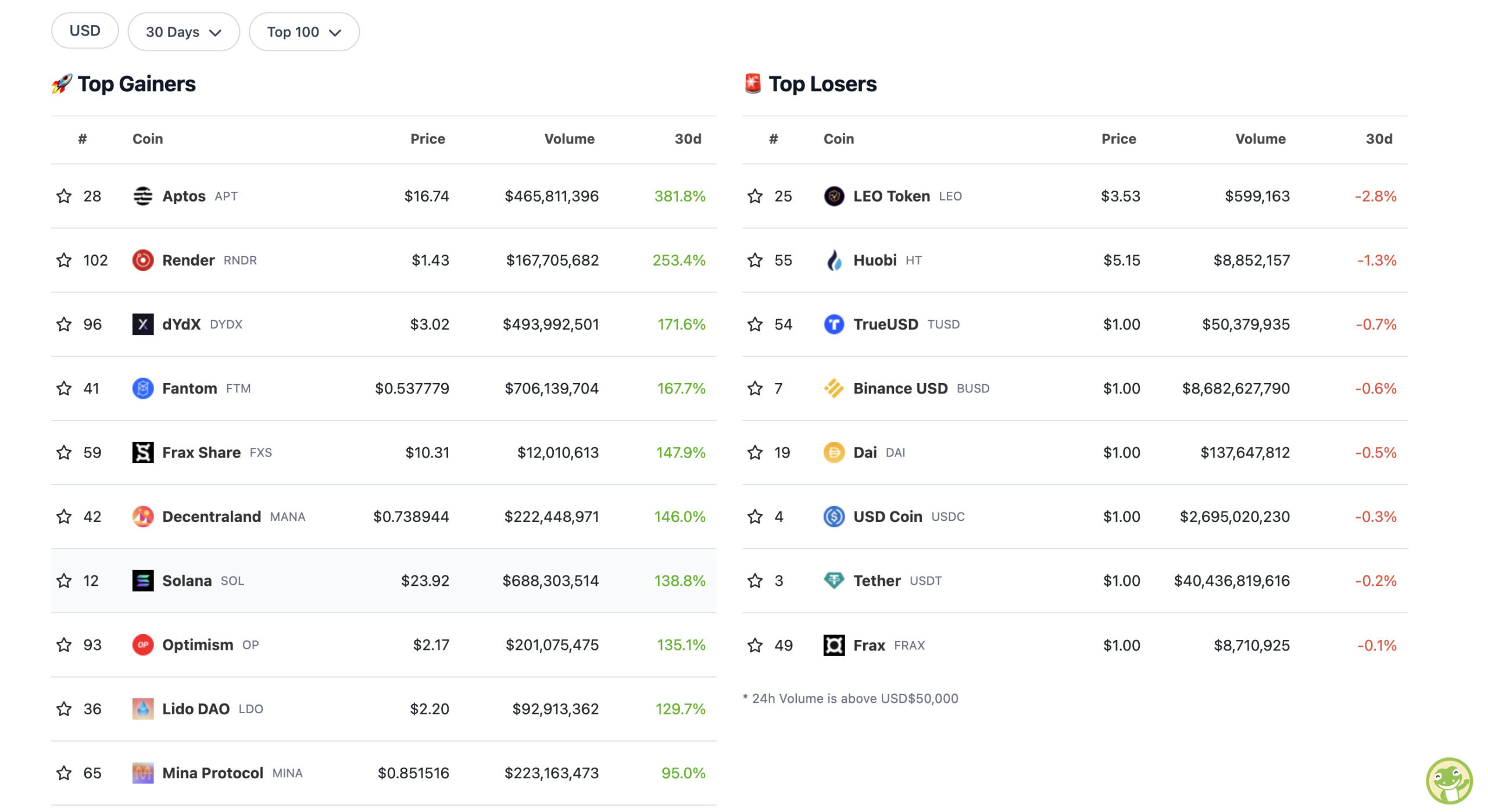

The fact that there weren’t many losers to show this month (courtesy of CoinGecko’s data) and that most of them were, in fact, dollar-pegged stablecoins just fluctuating slightly under a percentage point, also tells you it was a pretty decent month for crypto.

We’ve covered some of the reasons Aptos (APT) was pumping mid-way through January, but since then it’s largely kept up a strong showing.

The project didn’t launch at the greatest of times in the market late last year – in October, right before everything crapped the bed due to the FTX implosion and subsequent fallout.

The thing about it, though, is that it’s a much-vaunted layer 1 Ethereum competitor. And like Solana and Polkadot and Avalanche and Cardano before it, we know how high that particular crypto narrative can ride on waves of hype.

Said hype stems largely from the fact Aptos is a proof-of-stake blockchain that’s borne from the tech belonging to Facebook/Meta’s abandoned blockchain project, Diem. Aptos’ team comprises former Meta engineers and its CEO and co-founder Mohammad Shaikh worked on Meta’s Novi wallet and has a strong background in financial services and the blockchain industry.

The protocol seems to be doing its best to keep the hype ball rolling, too, announcing a string of developer and Aptos community events for this year, which it’s dubbed the Aptos World Tour. Get your T-shirts with the dates on the back now.

Another reason for the surge might be an increasing interest in NFT usage for the blockchain. NFTs – they don’t created much froth, do they?

You're about to see a bunch of Aptos NFTs flood the market over the next few days/weeks imo.

Where there's a massive pump, there's [sudden] massive interest and innovation.

It's all genuine and we're all here for the uhhh tech.

— Loma (@LomahCrypto) January 22, 2023

Also kicking up in January, we saw metaverse/3D modelling project Render (RNDR) on the back of no major news we could discern.

Decentralised perpetual options exchange dYdX (DYDX), however, we know that’s pumped partly because of this (from this morning’s Mooners and Shakers column):

“Decentralized derivatives exchange dYdX has been surging on the news the protocol has delayed the unlock of its DYDX token for investors until the fourth quarter this year. The exchange announced it in a blog post overnight (AEDT).”

Fantom (FTM), another Ethereum competitor, meanwhile, has been pushing its interoperability capabilities thanks to a collaboration with Axelar. More on that, here.

Also of note on that list is fellow layer 1 protocol Solana (SOL), which has had a particularly wretched time amid the FTX drama, seeing value seep and certain projects depart its blockchain (e.g. top NFT projects DeGods and y00ts).

But, thanks to a short-squeeze or two, and perhaps some settling down of negative sentiment, it’s managed to claw back some price positivity.

And we’d best mention Frax Share (FXS) here, too, as it’s one of a few liquid staking derivative protocols that have had particularly fine months. (Others include Lido DAO and Rocket Pool, for instance, and you can learn a bit more about this sector and why it’s frothy right now, from reading our recent chat with Aussie fundies Apollo Crypto.)

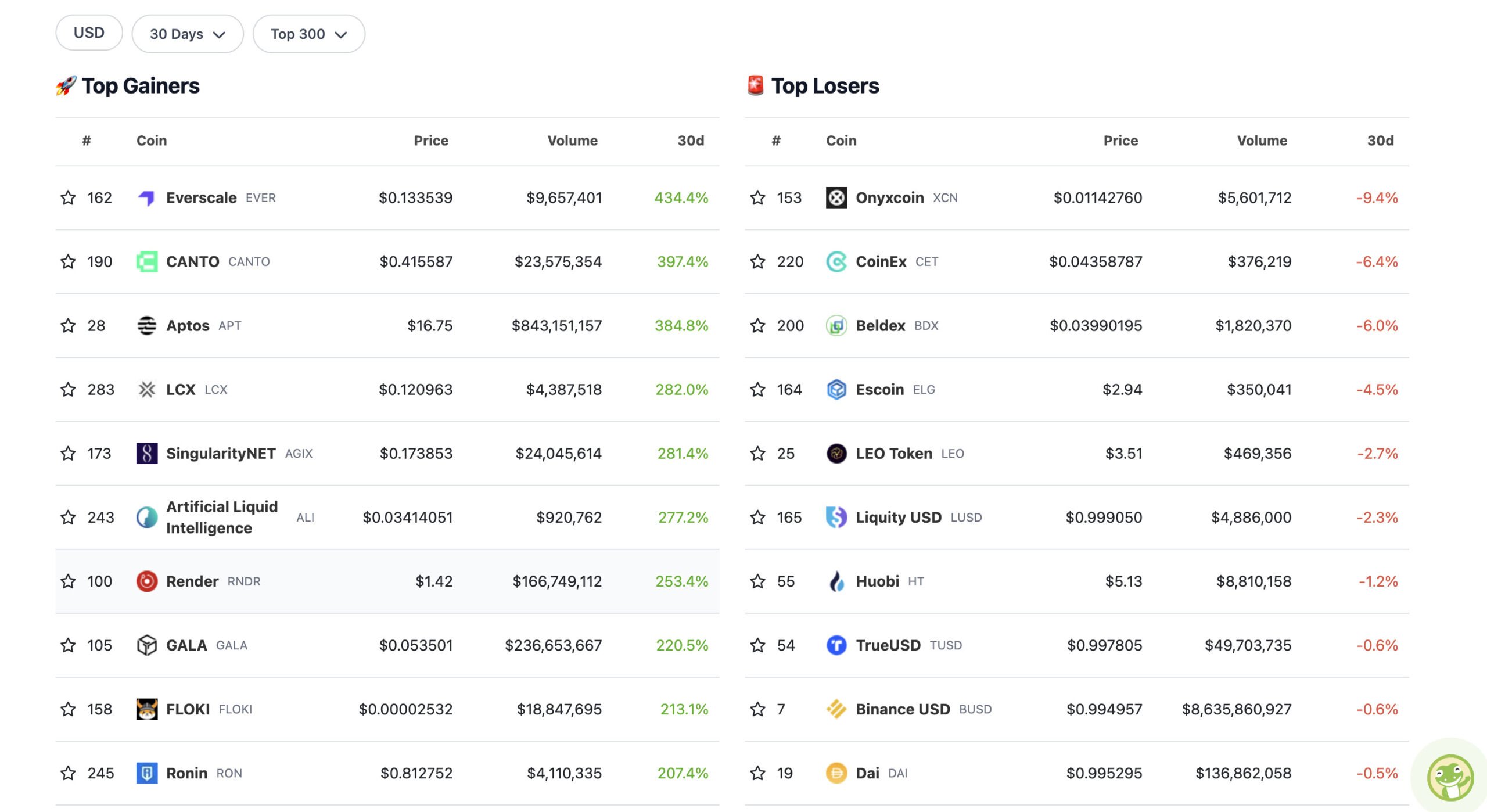

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

There are a few things on this list that stand out to us…

Gala (GALA), is one, and that’s because it’s one of the leading Web3 gaming protocols in the space – a narrative that many a crypto head has latched on as a potential boomer for the next bullish cycle.

And then there are a couple of AI-related projects (SingularityNET and Artificial Liquid Intelligence) with highly impressive monthly gainage, too. AI is another particularly buzzy narrative that’s seeped its way, like some sort of advanced Terminator, into the crypto realm.

We didn’t cover those particular two projects in this related article, but that’s because it purely focused on the top AI Google searched AI and big-data cryptos, which was led by The Graph (GRT).