Goldman Sachs predicts $8K ETH by end of year; BIG money keeps pouring into crypto

Coinhead

Coinhead

US investment bank giant Goldman Sachs thinks the price of Ethereum (ETH) could rise to US$8,000 before the end of 2021, describing the cryptocurrency as a viable hedge against inflation.

The prediction has reportedly been attributed to Bernhard Rzymelka, Goldman Sachs’s Global Markets managing director, who apparently wrote a research note for investors a few days ago.

The note is said to have stated that crypto assets “generally trade in line with inflation breakevens”, or at least have done since 2019.

It’s a trend that has played a big part in Bitcoin’s rise, in particular, as an alternative to gold as a hedge against rising inflation in the US. But, by the sounds of it, it appears Goldman Sachs thinks Ethereum has a convincing case to play strongly into this narrative as well.

The #Ethereum ecosystem is absolutely on fire today 🔥

ETH hits new ATH & goes over $4500

Goldman Sachs predicts $8000 ETH by end of year

CME Group to launch Micro ETH Futures Dec 6

NFTs displayed on Times Square billboards

Nike joins the Metaverse

Layer 2 TVL ATH – $4.75b— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) November 2, 2021

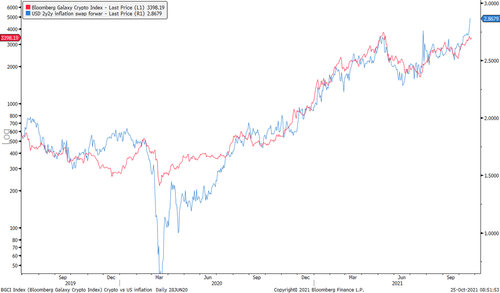

The Goldman Sachs man referenced a chart displaying the Bloomberg Galaxy Crypto Index (in red, below) on a log axis and the USD two-year forward, two-year inflation swap (blue) noting that “the local backdrop looks supportive for Ethereum”.

The US investment-bank analyst added: “[ETH] has tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as ‘network based’ asset. And the latest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold.”

What Goldman Sachs is basically saying, in plainer English, is this: if Ethereum’s historical correlation with inflation continues, it could surge “as high as US$8,000 in the next two months”.

The fact that Ethereum has now officially become a deflationary asset seven days running, due to its gas-fee-burning mechanism, doesn’t hurt this thesis, either.

More than 100,000 #ethereum were burned last week… wow, just wow!

— Lark Davis (@TheCryptoLark) November 3, 2021

A flood of big-player money keeps surging into the crypto space, as it has been for much of the year. Here are just some of the more notable funding raises and deals making headlines most recently…

• Digital Currency Group (DGC): The parent company of several big-name crypto entities, including Grayscale Investments, has cut a US$700 million deal to sell shares to Japanese tech-investor Softbank; Ribbit Capital; and CapitalG (owned by Google’s parent company Alphabet) among others. The deal gives the DGC digital-asset conglomerate a valuation of more than US$10 billion.

Digital Currency Group has raised $700 million at a $10 billion valuation.

Congratulations to @BarrySilbert and team.https://t.co/Bn31tI05jc

— Pomp 🌪 (@APompliano) November 1, 2021

• Siam Commercial Bank (SCB): One of Thailand’s largest banks, and its oldest lender, has announced its subsidiary, Siam Commercial Securities Company, is acquiring a 51 per cent stake in one of the nation’s biggest crypto exchanges – Bitkub. How much are they forking out for this? Just some fiat they found at the back of their couch – 17.85 billion baht (about US$536 million).

Bitkub company and coin value surges as SBC buys 51% of shares – more at https://t.co/U8OIgBauwT #Thailand

Crypto just got a big boost in Thailand as Siam Commercial Bank Group's parent company SBCX struck a deal to take over 51% of shares of Bitkub from its parent company Bi… pic.twitter.com/UuSVGguQSm— The Thaiger (@ThaigerNews) November 3, 2021

• CMCC Global: These Hong Kong-based venture capitalists are seeking and expecting as much as US$300 million for their latest crypto fund, according to Bloomberg. Among investors reportedly backing the VC firm are Gemini founders Cameron and Tyler Winklevoss as well as Hong Kong billionaire tycoon, Richard Li. CMCC Global was an early investor in the Solana blockchain, and has also put its cash behind Cosmos and Terra.

Excited to invest in CMCC Global via the @Gemini Frontier Fund. @Martin_CMCC and his team have been building an impressive investment track record on the frontier of crypto. Onward! 👍🚀https://t.co/OqH0i4gHRL

— Tyler Winklevoss (@tyler) October 29, 2021

• Alchemy: Blockchain and Web3 infrastructure provider Alchemy has raised US$250 million in its series C funding round, led by VC companies a16z (Andreessen Horowitz), Lightspeed, and Redpoint, with the participation of Coatue, Addition, DFJ, and Pantera as well. This gives the company a valuation of US$3.5 billion – not too shabby, considering it publicly launched only just over a year ago.

1/ What will it take to onboard the next billion users to web3? Killer apps. Scalable and performant blockchains. And bridging the 2, web3 developer platforms. @alchemyplatform is the leader today, and @ravi_lsvp and I are thrilled to join this round.https://t.co/mxzRGXXR9v

— Amy Wu (@amytongwu) October 29, 2021