DeFi’s ‘broadband moment’: Dozens of protocols compete for Tokemak’s first liquidity reactors

Coinhead

Coinhead

A total of 42 top DeFi (decentralised finance) protocols are competing to win Tokemak’s first five offerings of optimised liquidity. As its C.o.R.E voting event heats up, Stockhead spoke to three of the innovative project’s team members, including founder “LiquidityWizard” (aka Carson Cook, PhD).

Hi, Tokemak team. I’ve noticed your project mentioned quite a lot on Crypto Twitter just lately… looks like a high-level concept. What it’s all about?

end0xiii (community manager): Tokemak is a novel primitive designed to generate sustainable, deep DeFi liquidity and more capital-efficient markets by decentralising and disaggregating the market-making process. It’s a highly composable, effective, and affordable way for new and established DeFi projects to procure deeper liquidity for their tokens.

How would you describe it to people outside the crypto/DeFi bubble?

LiquidityWizard (founder): I’d say Tokemak is the “broadband moment” of liquidity in Web3 [the next stage in the evolution of the internet]. Value flow in Web3 is replacing data flow from Web2. In the new world of value flow, liquidity plays the role of bandwidth.

T0k3m3ch (tokenomics lead): Think about the early days of the internet. In the beginning, start-ups had to dedicate a large amount of effort running their own servers etc. When AWS came around, the road to services such as Netflix were paved. Web 3.0 is facing similar constraints – but instead of data flow, the bottleneck is now value flow. Tokemak strives to pave the road for the next generation of killer apps.

Got it. So, potentially a crucial part of a new, decentralised internet…

LW: Yep, we almost exclusively describe ourselves as liquidity infrastructure and utility. We believe liquidity is the next key layer of infrastructure, as nothing in DeFi/Web3 works without it – just like electricity or internet and network access.

The Web3 infrastructure stack of the future:

1) Electricity: charge in laptops or power to desktops and servers

2) Network access: high bandwidth internet for data transfer

3) $ETH: enough ETH to pay for transactions

4) $TOKE: enough TOKE to access liquidity on demand pic.twitter.com/U9GswV7PLQ— ┻┳ Liquidity Wizard (@LiquidityWizard) August 16, 2021

end0xiii: Our end goal is to be the vessel through which all liquidity flows – not just for DeFi protocols but for all future tokenised platforms, such as gaming or social tokens, and eventually, even cross-chain. Protocols spend an immense amount of time and money attempting to generate the necessary liquidity for their project to succeed. Tokemak will allow these tokenised projects to bypass that energy and effort by plugging into this liquidity engine.

I’ve seen you use the words “sustainable liquidity”. Can you explain what that means?

end0xiii: Sustainable liquidity means evolving beyond the expensive, inflationary liquidity mining of early DeFi. It means generating deep liquidity, with tight spreads and thus low volatility. The Web3 world needs to get in and out of positions or tokens without fearing the unpredictability of mercenary capital, or be beholden to the whims of whales [entities who hold huge amounts of any particular crypto tokens].

So, what is the token TOKE? What’s it used for?

LW: TOKE is tokenised liquidity. TOKE holders, called Liquidity Directors, are able to generate liquidity on demand for whatever tokens they want on whatever exchange they want, by directing the TVL [total value locked] of Tokemak.

Can individual investors in TOKE generate passive income from holding the token?

end0xiii: Yes – TOKE holders have the immense power of being able to direct massive amounts of liquidity within the protocol and earn yield in the process. Governance will also play a large role in the evolution of the protocol. Remember, we call TOKE generalised, tokenised liquidity. The utility of TOKE itself will be attractive to not just individuals, but DAOs (decentralised autonomous organisations) and even exchanges.

LW: Ultimately, anyone or anything that needs to access liquidity and the markets can use Tokemak to establish or deepen the liquidity they need. So if you need capital to trade with, which is basically all of DeFi, you need Tokemak.

I’m getting “gap in the market” vibes. Does Tokemak have any major competitors that you know of trying to achieve similar things?

T0k3m3ch: No competition that we are aware of – the future success is not only the code but the cooperation with other projects.

end0xiii: This would be difficult to reproduce, given the headway we’ve made with other DAOs and the plans to quickly establish and integrate unique composability ideas we’ve been drumming up with established projects.

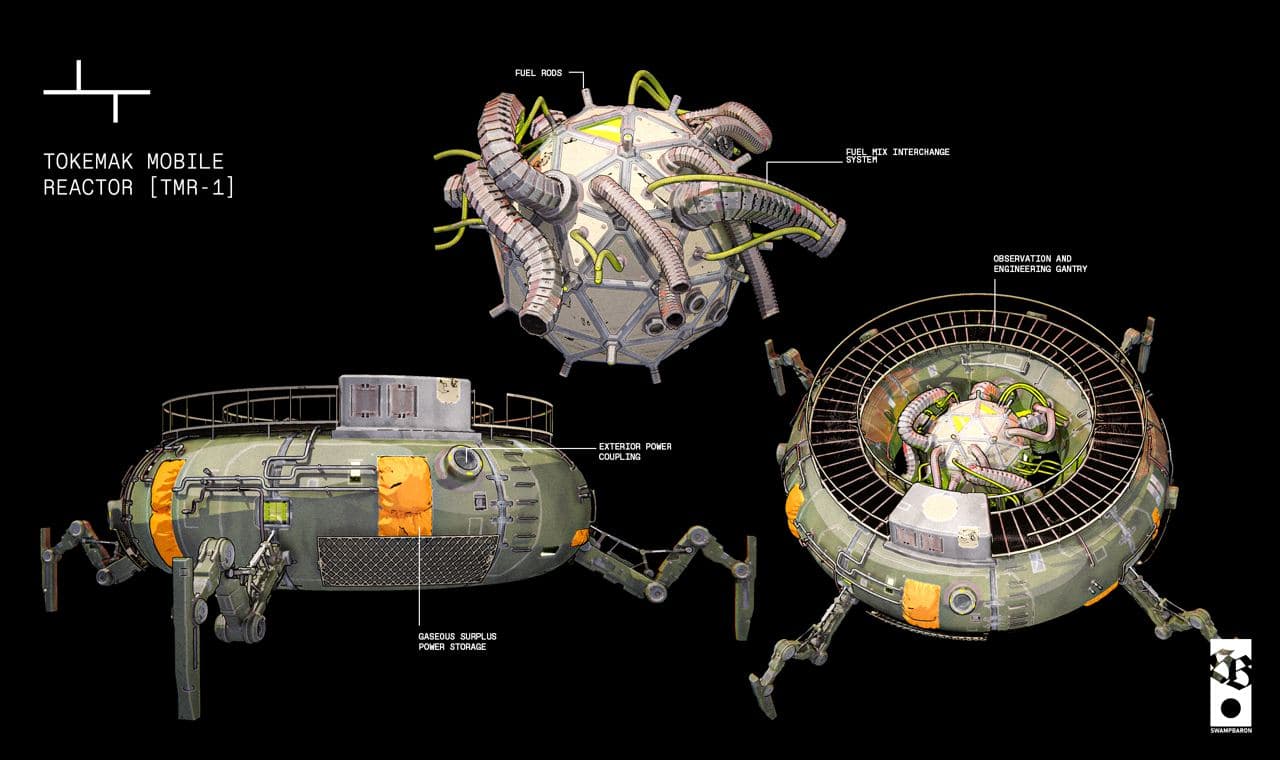

You use a lot of nuclear science-based and sci-fi-related imagery and terms to help describe Tokemak’s utility (e.g. above). What are Tokemak “Reactors”?

end0xiii: Token Reactors are the primary interface for users to interact with Tokemak. The project-specific Reactors are where assets are deposited and paired with the base assets from our genesis pool reserves, and then directed to the different venues by the Liqudity Directors [TOKE holders].

LW: The reactors have two sides, Liquidity Providers on one side and Liquidity Directors on the other. LPs flow assets into the Reactors, and LDs direct those assets out into the markets on the exchanges.

What does “balancing the reactors” mean? Is this part of some gamification angle you’ve got going on?

end0xiii: For liquidity deployment to run efficiently (and safely) it’s important to keep a certain balance of assets on both side of the Reactors. The concepts of market making, liquidity etc are very complex, so we simplified it into a more easily understood game of “balance the Reactors”. If the “ABC” token side of the Reactor has an excess of assets and a lack of TOKE, the TOKE side becomes incentivised to bring in more Liquidity Directors, and vice versa.

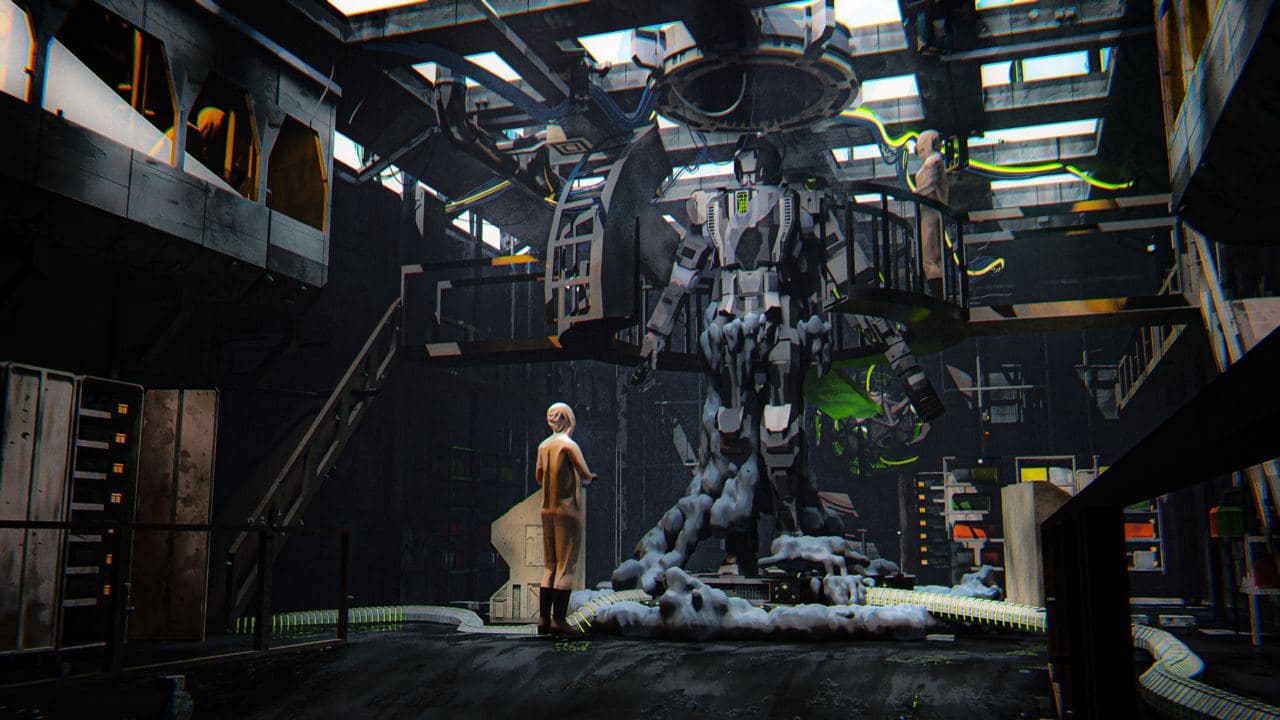

And just touching further on the sci-fi angle you’ve got going on in… what’s the idea behind the mechs used in the imagery?

end0xiii: Tokemak… Tokemechs… it made sense for us when dreaming up a community aesthetic and identity to rally around. The “tokamak” analogy [the name is derived from a nuclear-fusion process] is pretty sci-fi, so we liked the idea of creating the Tokemechs.

Is it an engagement angle for your community? NFTs, for example?

T0k3m3ch: Correct. While NFTs are not our main focus we are definitely looking to expand in the area of community engagement, also via NFTs – and are also looking forward to cooperating with established gaming and NFT projects.

While building the protocol is our main focus, we definitely have some things in store, as we believe DeFi will be essential to the metaverse, and that the evolution of NFTs (obviously) are of equal significance to the future of that space.

So, the C.o.R.E voting event that’s drawing to a close this week… tell us a bit about this (and what the acronym stands for).

LW: C.o.R.E determines which projects receive the first liquidity from Tokemak.

T0k3m3ch: It stands for Collateralisation of Reactors Event and is one of the initial steps into DAO governance and engagement with other DAOs and communities. It’s a highly competitive vote to determine the first tranche of five reactors we will spin up (we aim to expand quickly).

Why should DeFi users vote for their favourite protocol? How will they benefit?

LW: It benefits different users in different ways… Any holders of the protocol token will be able to earn yield (in TOKE) by depositing in Tokemak and acting as an LP. Meanwhile, projects will get deeper liquidity across DeFi, which means better pricing. They can also lower their inflation as they will not need to incentivise liquidity providing as much.

So, in short, deeper liquidity and rewards. There are also a LOT more things that will come after that.

How many times can an individual vote? Presumably there are some rules in place to make it a fair event? And does it cost TOKE to vote?

T0k3m3ch: We have given liquid TOKE more voting power than the vesting tokens (investors etc) in order to level the playing field. It’s broken down like this:

• TOKE staked in the single asset pool: 4 x voting power over vesting TOKE.

• TOKE liquidity providers (Sushi/Uni LP tokens): 8x voting power over vesting TOKE.

And users can reallocate their votes throughout the event – it’s a signature only, so no gas cost.

Looks like most top DeFi projects are participating – 42 of them. Why 42? That’s not a “meaning of life” Hitchhiker’s Guide to the Galaxy reference is it?

end0xiii: While we’re confident 42 is the answer to the question “what is the meaning of life?”, we had to make a cut-off for the chosen Reactors – and 420 is a common meme within the “TOKE” community, so it seemed fitting. “42.0” candidates.

How much time is there left to vote in C.o.R.E? And what happens once the event is done?

T0k3m3ch: The event ends on Wednesday, October 6 at 12pm PST.

end0xiii: We’ll begin the process of standing up the Token Reactors – a proper timeline to be announced soon.

What does the future look like for Tokemak, and what’s exciting you most about the road ahead?

LW: We are just getting started. Tokemak will touch every single transaction in Web3 in the future, and will become the biggest piece of infrastructure in DeFi. Everything needs liquidity.

Also, we often count down to the Singularity, which is the moment that we no longer need outside Liquidity Providers and the protocol itself owns enough assets to be the ultimate liquidity utility. I’m very excited for that day.

How concerned are you about all the regulatory bluster going on in the US at present? Not worried about DeFi being over-regulated out of existence in the world’s biggest economy?

LW: We have no US entity – we’re dispersed and distributed… that said, if the US cracks down, I think all innovation will flee the US for other territories and, in Web3, the US will miss out on the biggest value creation event of the last 1,000 years.

Strong words! Anything else you want to mention about C.o.R.E and/or Tokemak in general?

LW: The future is going to be far wilder than any of us realise, both for Tokemak and all of DeFi, Web3 and the Metaverse. Tokemak is positioned to touch every single piece of this and provide significant value to all other protocols and users. C.o.R.E. is just the beginning…

You can learn more about Tokemak and its C.oR.E event here. And you can vote for your favourite DeFi protocols (including Aave, Synthetix, Uniswap, 1Inch, Illuvium, Chainlink and many more) here – until midday October 6, PST.

This interview has been lightly edited for clarity. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

At the time of writing, the author was holding Bitcoin, Ethereum and other cryptocurrencies, not including TOKE.