Cryptos gain even as stocks tank; Ethereum regains US$3,000 level

Coinhead

Cryptos have diverged from other risk assets, gaining even as equities suffer some of their worst losses in months.

Bitcoin was trading at US$43,488 at 11.42am AEST, up 1.6 per cent from the same time yesterday. Ethereum had advanced 1.9 per cent to a three-day high of US$3,004, while the total crypto market cap was at US$1.93 trillion, up 2.97 per cent.

Meanwhile Wall Street had suffered another sharp day of losses, with the S&P500 falling 1.2 per cent and the Dow Jones down 1.6 per cent. Close to lunchtime, the ASX200 was down 2.08 per cent, putting the local bourse on track for one of its worst days this year.

“Bitcoin and other crypto-assets have traditionally been following risk-on, risk-off type moves, they’ve been moving in tandem with equities,” but the crypto market gained overnight, City Index analyst Tony Sycamore told Ausbiz TV this morning.

“I think that’s a really good sign of some stability coming back into the market,” Sycamore said, although adding he wants to see BTC reach last week’s highs of around $44,500 to confirm the uptrend has resumed.

Think Markets analyst Carl Capolingua put the key level for Bitcoin slightly higher, at $45,167.

“If we see a close above that – not just a ticket of it, but a close above that … we can go up and test those highs around $52,936,” he told Ausbiz.

#Bitcoin breaking #stocks risk-off shackles?🤔

ST trend/Price action:⬇️/↔️

LT trend:⬆️

Sup: 39585

Res: 45167

Note: Compressing between pink ST Res/dark green LT Sup zones. Close >45167 =👍 price action & ST trend

Bias: ST, wait for close >45167 or <39585; LT, #HODL#crypto $BTC pic.twitter.com/4gnCVaTK6u— Carl Capolingua (@CarlCapolingua) October 1, 2021

Bitcoin chartist Mick Krypto was more pessimistic, posting that “essentially, nothing has changed” as Bitcoin was still range-bound.

“We’re stuck in this range until we’re out of it,” he wrote. “Ranges are meant for ranging from the top of the channel to the bottom of the channel, and vice versa. … At this exact moment, I still am more bearish than bullish, but I can still see the light.”

Remarks from US Federal Reserve chairman Jerome Powell to a congressional hearing confirming that the central banker has “no intention to ban” cryptocurrencies may have helped bolster sentiment.

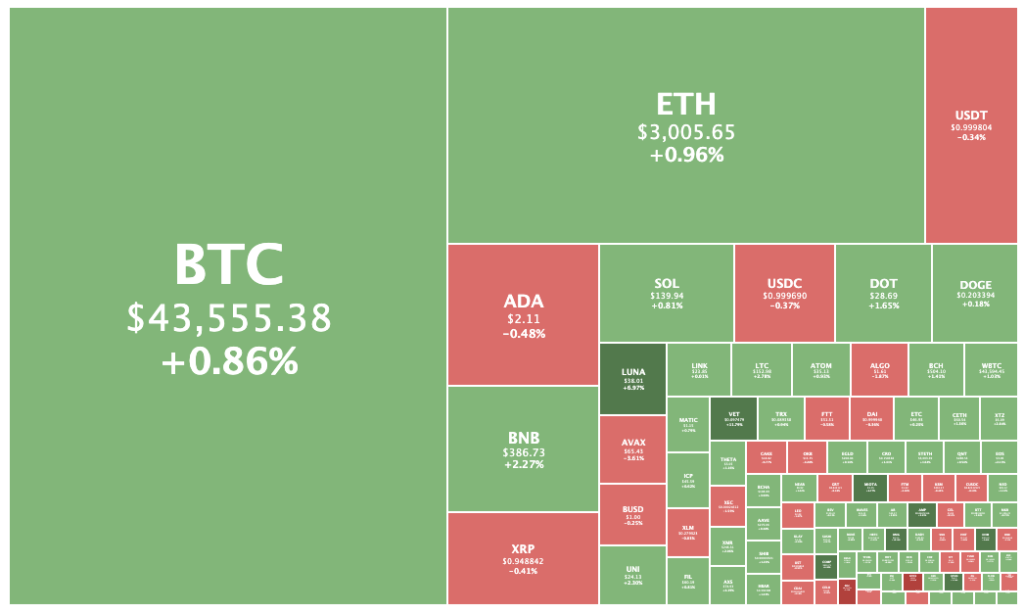

Most of the crypto market was in the green, with only 16 in the top 100 losing ground.

dYdX was the worst performer after days of double-digit gains, falling 14.1 per cent to US$23.58 after setting an all-time high of US$27.86 yesterday.

Rival decentralised derivatives platform Perpetual Protocol was the second-worst loser in the top 100, falling 7.4 per cent.

Both tokens – dYdX particularly – had been on a tear following China’s latest crackdown on crypto, with the market apparently speculating that Chinese traders will switch to the decentralised exchanges.

Qtum was the biggest gainer in the top 100, rising 14.7 per cent to US$10.71.

VeChain and Amp had also posted smaller double-digit gains.

Terra (LUNA) was the biggest gainer in the top 20, rising 9.3 per cent to US$38.14.