Cryptos complete rebound from January crash; KPMG Canada buys BTC, ETH and says it must be considered

Coinhead

Coinhead

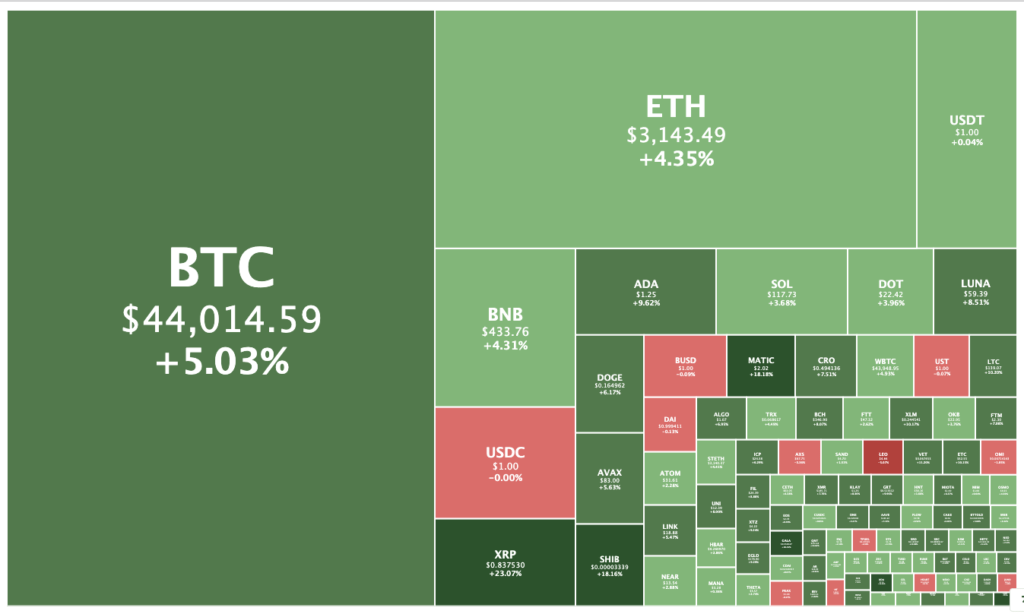

Cryptos are up for the fifth day in a row, and the 11th day out of the past 12 — finally clawing back all of the market’s losses from the brutal January 20/21 crash that saw Bitcoin slip to its lowest level since August.

At noon (Sydney time) Bitcoin was up 4.9 per cent to $US43,900, and at 5 and 6am AEDT had briefly traded as high as US$44,500, its highest level since January 14.

Ethereum was up 4.3 per cent to a two and a half week high of US$3,138.

The overall crypto market had gained 4.8 per cent to $2.1 trillion, with only five of the top 100 cryptos down more than one per cent.

Kadena was the biggest gainer in the top 100, rising 25.1 per cent to $8, followed by XRP, which gained 23 per cent to US83.7c following a bit of movement in Ripple’s lawsuit against the US Securitites and Exchange Commission.

Judge Analisa Torres unsealed three documents related to the case and granted a Ripple motion, Cointelegraph reported, indicating that the case might be finally heading towards a verdict.

Polygon, Shia Inu, Gala Games and Secret Network were all up around 15 to 16 per cent.

Bitfinex’s LEO token was the biggest loser, falling 5.3 per cent to $4.84.

Sentiment got a boost after accounting giant KPMG’s Canadian operation announced it had added BTC and Ethereum to its corporate treasury, as well as carbon offsets to maintain a net-zero carbon footprint.

“Cryptoassets are a maturing asset class,” said KPMG in Canada managing partner Benjie Thomas. “This investment reflects our belief that institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.”

Kareem Sadek, KPMG in Canada’s blockchain services co-leader, was quoted in the announcement as saying that the “cryptoasset industry continues to grow and mature and it needs to be considered by financial services and institutional investors”.

“We’ve invested in a strong cryptoassets practice and we will continue to enhance and build on our capabilities across decentralized finance (DeFi), non-fungible tokens (NFTs) and the metaverse, to name a few,” he added.

“We expect to see a lot of growth in these areas in the years to come,” Sadek said of the KPMG crypto move.

To be sure, nearly all of the top 20 cryptos – everything except XRP and stablecoins — are still in the red so far for 2022. BTC is down 4.9 per cent, Ethereum is down 14.5 per cent and Solana and Terra are down by 30 per cent.

But Bitcoin and Ethereum are now in the green for February, as is Cardano, Dogecoin and Crypto.com coin.