Cryptocurrency, tax and you

Coinhead

The self-filing tax deadline is just over a month away, and for crypto investors there’s plenty of things to think about. To help pick apart the puzzle, we’ve brought crypto tax expert Nicholas Falzon, partner at PKF, to weigh in on what should be top of mind for Aussie investors this tax-time.

For retail investors, your gains and losses will be assessed under the existing capital gains tax legislation. The exception here is if you are in the business of trading cryptocurrency – in that case you’ll need to establish that with the ATO, which is a bit of a subjective topic, but we’ll focus on retail investors here.

Crypto trading is similar to equities for most of us, in the sense that if you dispose of one cryptocurrency to acquire another cryptocurrency, you dispose of one CGT asset and acquire another CGT asset. Because you receive property instead of money in return for your cryptocurrency, the market value of the cryptocurrency you receive needs to be accounted for in Australian dollars.

If for this reason alone, you need to have an easily-accessible record of your cryptocurrency transactions. We recommend cloud-native options such as Google Sheets or Excel (with a cloud backup-service) for most retail investors. Keep this sheet populated with:

The record-keeping doesn’t stop there. To be bulletproof, you should also keep a file (again, at the very least backed-up locally) for each tax year that contains:

The last point is really valuable for crypto investors who trade often. The complexity can scale very quickly, utilising software to track and manage this can be very beneficial (and can be tax-deductible expenses too, just like the use of a tax agent!).

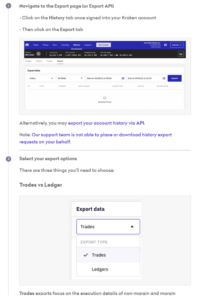

That’s the basics for retail investors. It is often tax-time where the use of reputable crypto exchanges (such as Kraken) become the most valuable, as their record keeping is usually comprehensive enough to fill most of the required data points for you. Look for an account export function which will help you fill out your tax return.

The final category you might fall into is a Self Managed Super Fund (SMSF). Ideally, you would have already spoken to an auditor/accountant before utilising this vehicle for trading cryptocurrency. The vital element for this group is that it is clear the fund owns all assets and that those investments are allowed under the fund’s trust deed/investment strategy.

For SMSFs, crypto investing can get very complex very quickly, the use of professional services is strongly advised. For low-volume retail investors, many will be absolutely fine with good record keeping and tax software. If you have jumped both feet into crypto this year, and are unsure where to start when it comes to tax, or if you simply have a high volume and potential gaps/missing data, that’s your trigger to talk to an accountant who can guide you through the next steps.

Cryptocurrency is a rapidly growing and evolving space. Whilst it currently shares capital gains tax legislation, this can change. We will all be watching and waiting for any other regulations that will either increase or change the current reporting requirements over the next financial year.

This article was developed in collaboration with Kraken, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.