Crypto roundup: Squid Game-inspired token rugpulls, dies swiftly; ‘Moonvember’ begins

Coinhead

Coinhead

Bitcoin may not have quite hit PlanB’s end-of-October $63K prediction, but it still recorded its highest-ever monthly close. So far, “Moonvember” is off to a solid start for the crypto market, despite the high-profile SQUID token exit scam.

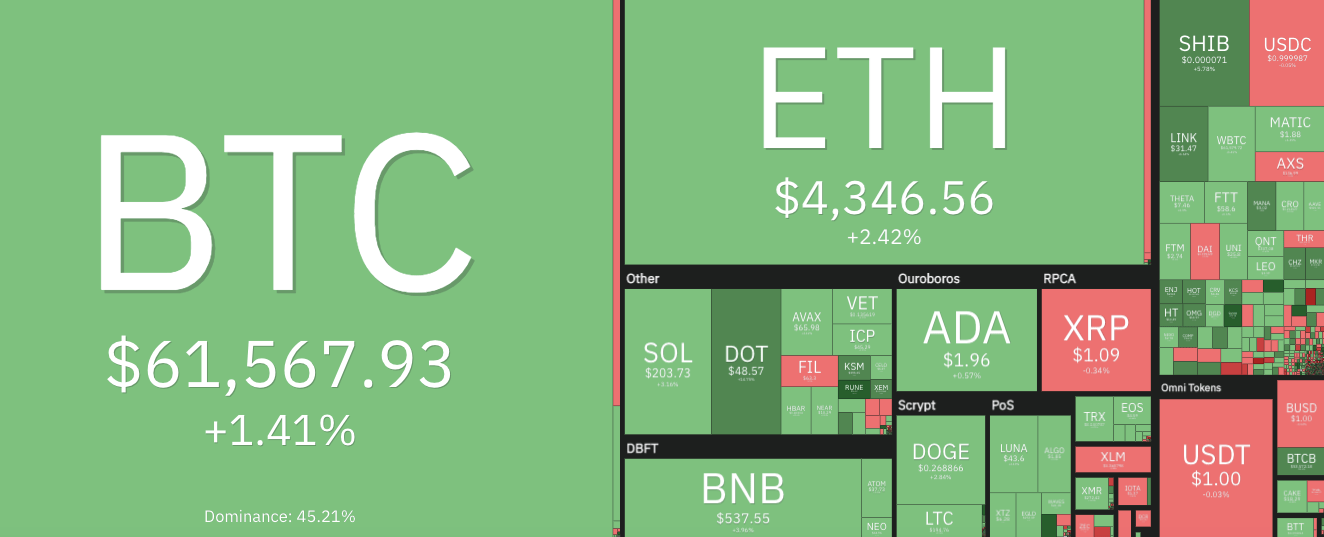

Bitcoin (BTC) and Ethereum (ETH) and much of the crypto market have entered 2021’s penultimate month with reasonable strength, at least at the time of writing.

The entire cryptocurrency market cap, according to CoinGecko’s data, is up 2.6 per cent since this time yesterday, with an all-time high total valuation of US$2.77 trillion, give or take a few billion dollars.

BTC, fresh from an all-time-high monthly close of US$61,343, is currently sitting around the same level, up about 1.4 per cent since this time yesterday and changing hands for about US$61,500.

Ethereum and every other altcoin in the top 10, plus the majority of the top 100, are all presently posting gains, some much more than others, which we’ll get to further below.

https://twitter.com/naiiveclub/status/1455178188837978126

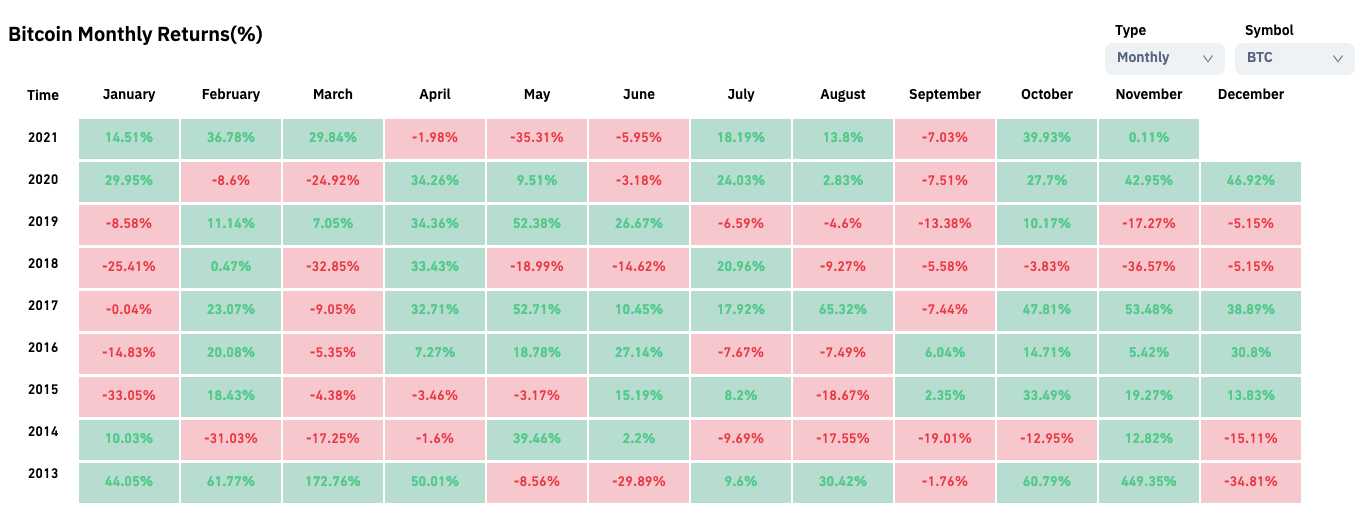

November is traditionally not only one of the best months in the stock markets, but most certainly historically in the crypto market, too, as can be seen from this Bybt chart below.

As for the likelihood of things continuing to follow past form, analyst Rekt Capital had a much-lower Bitcoin monthly close benchmark for a bullrun continuation. So it’s so far, so good in his, and numerous other chart-watching eyes…

#BTC needed to perform a Monthly Close above ~$54,500 to continue repeating its historically recurring mid-cycle price tendencies

This past October, $BTC Monthly Closed at ~$61,000#Crypto #Bitcoin

— Rekt Capital (@rektcapital) November 1, 2021

Nice chart! 🔥 https://t.co/2uwMScIckx

— Dr. Jeff Ross (Pleb counselor) (@VailshireCap) November 1, 2021

But, for balance, another respected analytical identity, Bitcoin Charts, suggests Bitcoin’s current chart pattern still has a strong chance of breaking to the downside.

$BTC Symmetrical Triangle#Bitcoin is consolidating in a Symmetrical Triangle. These patterns come with a continuation bias, implying there's a slightly higher likelihood we break to the downside. #BTC pic.twitter.com/zSyjQ6C0pA

— Bitcoin Charts by Mick (@charts_bitcoin) November 1, 2021

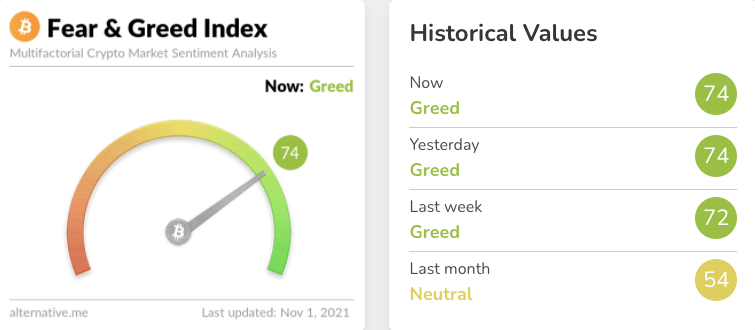

The crypto market’s top sentiment-tracking tool, meanwhile, has been pretty consistently in the Greed zone just lately. If and when it starts hitting Extreme Greed more consistently, the question is, how long will that last, because it might be the time to start looking at your profit-taking strategy. If you have one.

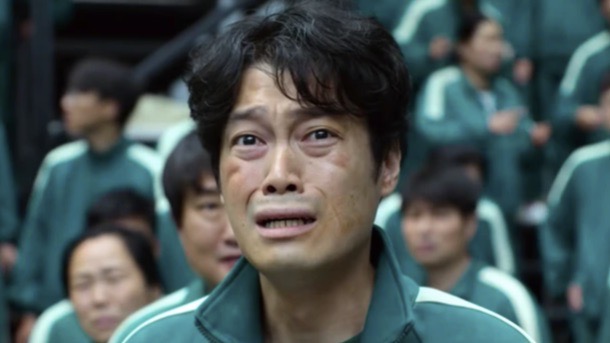

In a stark reminder that perhaps it’s wise to stick with the strongest team… or at least not go all in on overly hyped, low-substance, entirely speculative stuff, the crypto market today witnessed one of the fastest “rug pulls” in its history.

The Binance Smart Chain-built Squid Game token (SQUID) crashed by 100 per cent in minutes earlier today, plummeting from its high of US$2,861 and completely flatlining at US$0.003. Within about 15 minutes, about US$2 billion in market value was gone, just like that.

According to a Forbes article, the token’s alleged developers reportedly made off with about US$2.5 million worth of BNB, hiding transaction details using the Ethereum-based privacy protocol Tornado Cash.

VIRAL SQUID GAME CRYPTOCURRENCY CRASHES 100% IN MINUTES AFTER FOUNDERS REPORTEDLY RUN AWAY WITH $2.5 MILLION – FORBEShttps://t.co/qmG9wiCh4B

— MadNews.io (@MadNews_io) November 1, 2021

Even as fears emerged that the coin was largely proving to be illiquid, with holders reporting difficulty selling their tokens on the Pancakeswap exchange, SQUID had skyrocketed as much as 300,000 per cent since last week. Buyers were aping in based on very little else other than the surging popularity of the Squid Game Netflix drama.

The token’s founders had apparently pitched the project in its whitepaper as a “play-to-earn cryptocurrency” inspired by the South Korean series in which contestants play games that can end in wealth or death.

In a user notice, CoinMarketCap said it had received multiple reports that the websites and socials related to SQUID were no longer working. The popular crypto price-tracking site and app had apparently warned investors on Friday that multiple users were having trouble selling their SQUID coins, and that the project was “unlikely to be affiliated with the official intellectual property”.

#RugPull everyone dead on $SQUID GAME #SquidGameToken RIP pic.twitter.com/8jaI6oV57v

— BanditBurns (@Bandit_Burns_) November 1, 2021

Damp-squib SQUIDs aside, let’s take a quick look at some of the more prominent movers in the market at press time.

By far the two best performers in the top 10 right now are layer 1 smart-contract beast Polkadot (DOT) and dog-meme du jour, Shiba Inu (SHIB), posting 24-hour 14% and 10% gains respectively.

The Polkadot pump can be put down to the fact it seems its highly anticipated parachain crowdloan event could actually be beginning earlier than its previously touted November 11 date.

Polkadot crowdloans look to be starting to open by Thursday this week, ahead of the Nov 11th start of the first parachain slot auction.

It’s happening. https://t.co/MwexaP7JLR

— Dan Reecer 🅰️🕊⚪️ (@danreecer_) November 1, 2021

As for Shiba Inu, the persistent rumours of a potential Robinhood exchange listing seem to be growing even stronger.

JUST IN: Rumors about $SHIB getting listed tomorrow on Robinhood are going around.

We are unable to confirm this as accurate information at this time. Robinhood has NOT made any official announcement regarding a Shiba Inu listing.

Please do not trust everything you read. pic.twitter.com/pMCIOWleeo

— Watcher.Guru (@WatcherGuru) November 1, 2021

Others looking particularly strong in the top 100 right now include: THORChain (RUNE), +16%; Decentraland (MANA), +10%; Chiliz (CHZ), +10%; Sushiswap (SUSHI), +15%; Spell Token (SPELL), +9%; OMG Network (OMG), +11%; The Sandbox (SAND), +36%; and Qtum (QTUM), +17%.

As for THORCHain’s recent positive price action, the protocol, considered a crucial part of the wider DeFi infrastructure, has now put its much-vaunted cross-chain trading between Bitcoin and Ethereum into play.

Thorchain is such a leap forward that most haven’t processed it yet.

There is nothing else remotely like it available. https://t.co/6QhfvQFBdK

— Erik Voorhees (@ErikVoorhees) November 1, 2021

Decentraland and The Sandbox, among several other “metaverse” tokens, have been riding a wave the past few days – on the back of widespread media attention given to Facebook (or at least its parent company) rebranding as “Meta”. Mark Zuckerberg has been hinting at strategic movement towards a metaversal future for his company for some time now.

While we’re at it, here are a few more notable cryptos moving up the charts and playing into the metaverse narrative: Wilder World (WILD), +83% over the past week; Netvrk (NTVRK), +109% over the past seven days; and Illuvium (ILV), +30-40% over the past week or so.

In fact, ILV hit another all-time high just a few hours ago, touching US$1,046. The open-world RPG auto-battler released its gameplay-reveal trailer over the weekend, to much buzz within the gaming sector of crypto and on CT (crypto Twitter).

Witness the elemental clash of the ETHereal Illuvials across vast and varied biomes. Autobattle encounters, the mining of shards, and harvesting resources are revealed in this showcase of #Illuvium’s in-game overworld and battle boards. https://t.co/MopN52U1yZ

— Illuvium (@illuviumio) October 30, 2021