Crypto roundup: Bitcoin piles off exchanges but wrestles with $40K, Ethereum steady

Coinhead

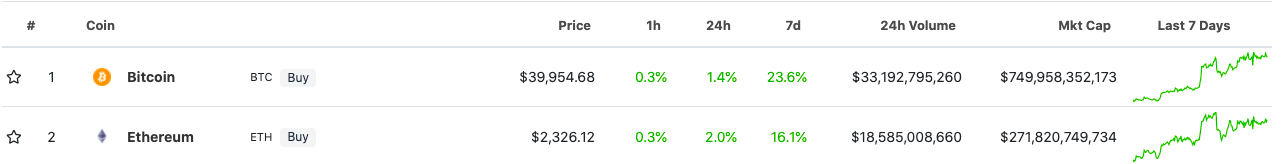

The US$40K mark is proving to be a cruel mistress for Bitcoin. The no.1 crypto continues to flirt around the alluring level but keeps copping rejections. Ethereum, meanwhile, is showing solid form, trading above its 200-day moving average.

At press time, the entire cryptocurrency market cap is up 1.4% in the past 24 hours, a shade above US$1.6 trillion.

It’s not like Bitcoin’s giving up, though. At least not for the moment. It’s currently dealing at US$39,954, also up 1.4% on the day.

And here’s something… According to reports, analysts and the evidence right there on analytics charts, Bitcoin has been leaving exchanges by the droves in the past 24 hours or so.

Yesterday it had the largest single-day outflow in the past five years, with about 60,000 of the OG tokens seeking a safe new home.

This is considered a bullish sign, because it can mean those with diamonds for hands, or indeed any type of hands responsible… aren’t looking to immediately sell. The implication could be that all this BTC is currently being shifted to cold-storage positions.

FYI yesterday was the largest day of net outflows from exchanges since mid-2016, with exchange balances dropping by 60,004 BTC.

Watching to see if we get a continued decline of exchange balances in the coming weeks. pic.twitter.com/0REQUPY4pM

— Will Clemente (@WClementeIII) July 29, 2021

Ethereum, meanwhile, with a wide-ranging network effect other smart contract platforms can only dream of, is up 2% and changing hands for US$2,326.

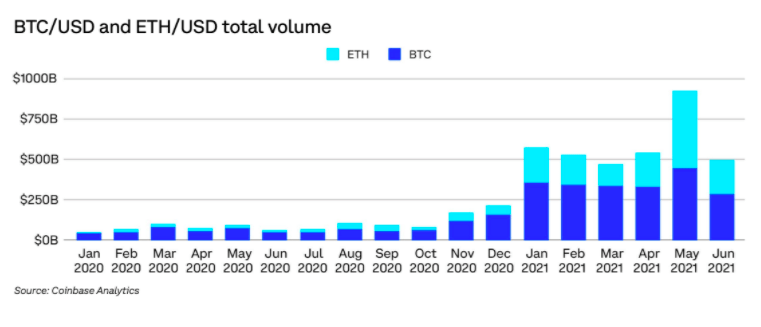

And ETH’s trading volume has been crushing it lately, outpacing Bitcoin’s considerably in the first half of 2021, according to new data from Coinbase Global Inc.

Its trading volume dominance doesn’t necessarily reflect this in the past 24 hours, however, as seen in this CoinGecko screen grab…

But the longer-range statistical analysis is keeping Ethereum “flippening” fans practically flipping out with excitement.

$ETH is getting scooped out of exchanges at a fast pace. Throw in EIP-1559 in (08.04.21) and we are in for some serious sell side liquidity crisis. #flippening pic.twitter.com/KK4ZtoSl5N

— CapitulationCapital (@nofreenameWTF1) July 22, 2021

Some news snippets from the past 48 hours or so that might grab you…

• Analysts from the Rand Corporation – an influential American policy think tank – have recommended crypto be included in a US-Japan digital trade deal. Nice.

• US senators are reportedly looking to nab an additional US$28 billion in infrastructure revenue by tightening the nation’s taxation measures on crypto transactions. Not so nice.

• Payments provider PayPal is planning to roll out a “super app” soon. It will feature crypto capabilities, high-yield savings and more, according to CEO Dan Schulman.

• Ghana’s vice president, Dr. Mahamudu Bawumia, has called on all of Africa to embrace crypto and help facilitate trade and empower the contintent’s economies. Crypto forever.

The top two gainers in the top 100 by market cap in the past 24 hours, by some considerable margin, are blockchain interoperability project Quant (QNT), up 34.5% at US$127; and cross-chain DeFi play THORChain (RUNE), up 29.1% and changing hammer blows for lightning at US$5.29.

After a spate of recent hacks and exploits on the protocol, the THORChain team has taken to social media to reveal they’ve been hosting 20 “white hat security specialists” for a “code walkthrough”.

In a particularly crypto in-jokey reference to something US Senator Elizabeth Warren said the other day, the THORChain tweet also referred to the white-hat hackers as “shadowy super coders”.

We hosted over 20 white hat security specialists for a Thorchain code walkthrough yesterday. The onboarding is speeding up.

As of now, there are more shadowy super coders working on security then core devs building.

We are fully committed to delivering a safe multi-chain DEX. https://t.co/vJs6NIZr5z

— THORChain (@THORChain) July 28, 2021

Other decent top 100 gainers at the time of press, include: Terra (LUNA), up 9.97%; Fantom (FTM, up 9.31%; Amp (AMP) up 8.53%; and the high-performance smart-contract platform Solana (SOL) up 5.57%.

Gaming-based projects are the talk of crypto town lately and Aussie-based project Illuvium (ILV) is one of them. It hit another all-time high about 12 hours ago, of US$212. It’s currently down from that, at US$202, but still up 88.5% over the past week.

Chain Games (CHAIN) is a lower-cap one that might be worth looking into as well, as it seems to have some pretty impressive game partners, according to its website. Sitting all the way down at 336 on CoinGecko, it’s up 43% in the past 24 hours.