Crypto mooners and shakers: The Fed speaks, market reacts, AVAX pumps

Coinhead

It’s a critical day in the markets as the influential US Federal Reserve reveals its latest fiscal-policy plans. Let’s take a (tentative) look at what’s happening in crypto as Fed chief Jerome Powell clears his throat…

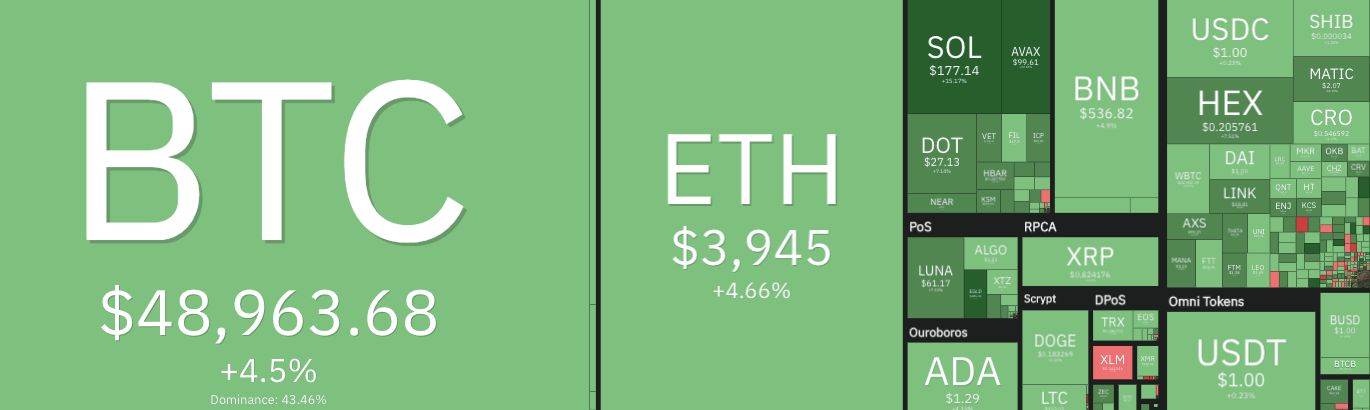

At the time of writing, the entire cryptocurrency market cap is up 4.9 per cent compared with this time yesterday.

Having been a sea of red shortly before the Fed’s FOMC (Federal Open Market Committee) meeting, we now have a pretty green scene in the top 10 by market cap right now, with most coins there currently boasting 4-5 per cent gains in the past 24 hours.

Solana (SOL), having endured a bad start to its week related to network-clogging issues, is faring the best in the top 10, up 15% just now.

Dogecoin (DOGE) looks like it might be about to drop back out of the top 10 any second now, though. It’s posting a 1.3% gain at the moment, but Avalanche (AVAX) is nipping at its heels (see further below).

With nerves high ahead of today’s Fed meeting, most laser-focused crypto eyes were on Bitcoin (BTC), as the main crypto health barometer, and to a slightly lesser extent Ethereum (ETH).

As things stand right now, they’re both up about 4.5% since this time yesterday and the market looks hopeful after the Fed announced fairly unsurprising tapering and interest-rate hike plans. Unsurprising to those watching these things closely, that is…

BREAKING: FED to end tapering by March 2022. 3 rate hikes in 2022 and 3 in 2023. Can we move on now?

— Ran NeuNer (@cryptomanran) December 15, 2021

BREAKING: FED keeps its interest rate at 0-0.25% as it is committed to employing the full range of instruments available to help the US economy.

Which means.

The bull market continues for #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) December 15, 2021

— DAO Maker (@TheDaoMaker) December 15, 2021

Whether this positivity continues, or is as short-lived as a random dog-meme pump… we’ll just have to wait and see.

In the rest of the top 100, which is currently a market-cap range of about US$22 billion to US$1 billion, let’s find the top five daily gainers and losers right now. (All subject to rapid change, of course, as reactions to the Fed meeting continue to evolve.)

DAILY PUMPERS

• Ecomi (OMI), (market cap: US$1.6b) +28%

• Avalanche (AVAX), (mc: US$23.2b) +23%

• Elrond (EGLD), (mc: US$5.3b) +15.78%

• Polygon (MATIC), (mc: US$14.1b) +14%

• Near Protocol (NEAR) (US$5.8b) +8%

The AVAX surge probably has something to do with the Bank of America describing the smart-contract platform as a viable alternative to Ethereum (ETH). That, and the fact the stablecoin USDC has now been integrated into Avalanche’s DeFi ecosystem.

❄️ Just in time for the winter holidays, Avalanche USDC has arrived! Starting today, businesses and users can now transact native #USDC near-instantly across @avalancheavax's fast, low-cost, and eco-friendly blockchain.https://t.co/GL6hcWG5vt

— Circle (@circlepay) December 14, 2021

Ecomi’s pump, meanwhile, comes on the back of the NFT/digital collectibles ecosystem integrating further with the gas-fee-avoiding layer 2 Ethereum protocol Immutable X (IMX).

Exciting news! Phase 2 of the Immutable migration continues today (14 Dec) from 6PM PT 🥳

During Phase 2, we are re-minting all @veve_official NFTs on Ethereum Layer 2 via @Immutable!

Migration is expected to take 3-10 hrs. We will keep you updated on its completion. [THREAD]

— ECOMI ⭕️ (@ecomi_) December 14, 2021

DAILY SLUMPERS

• Loopring (LRC), (market cap: US$2.5b) -7.5%

• Tezos (XTZ), (mc: US$3.6b) -6%

• BitTorrent (BTT) (mc: US$2.5b) -5.5%

• Chiliz (CHZ) (mc:US$1.4b) -5.2%

• Cosmos (ATOM) (mc: US$5.8b) -5%

Moving below the crypto unicorns, then (in some cases well below), let’s find some standout price action in both directions…

DAILY PUMPERS

• Ramp (RAMP), (market cap: US$81m) +21%

• Chain Guardians (CGG), (mc: US$48.2m) +16%

• Nuls (NULS), (mc: US$87.7m) +14%

• Trader Joe (JOE), (mc: US$310m) +12%

• Yield Guild Games (YGG), (mc: US$472m) +11.5%

Sometimes described as “the PayPal for crypto”, part of the reason Ramp is having a particularly good day is because it’s just raised US$52.7 million in a Series A funding round, led by Balderton Capital.

Some of the biggest names in #DeFi and IT are backing this payments provider that allows users to purchase crypto directly in the apps and wallets https://t.co/crlJPT3wjs

— Cointelegraph (@Cointelegraph) December 15, 2021

DAILY DUMPERS

• Meme (MEME) (market cap: US$578,000) -63%

• Banana (BANANA) (mc: US$3.3m) -53%

• Mobius (MOBI) (mc: US$83.3m) -24%

• Unibright (UBT) (mc: US$196m) -21%

• Achain (ACT) (mc: US$4.3m) -18%