Crypto: Bitcoin drops $2k in 30 minutes, as Evergrande fears spook markets

Coinhead

Coinhead

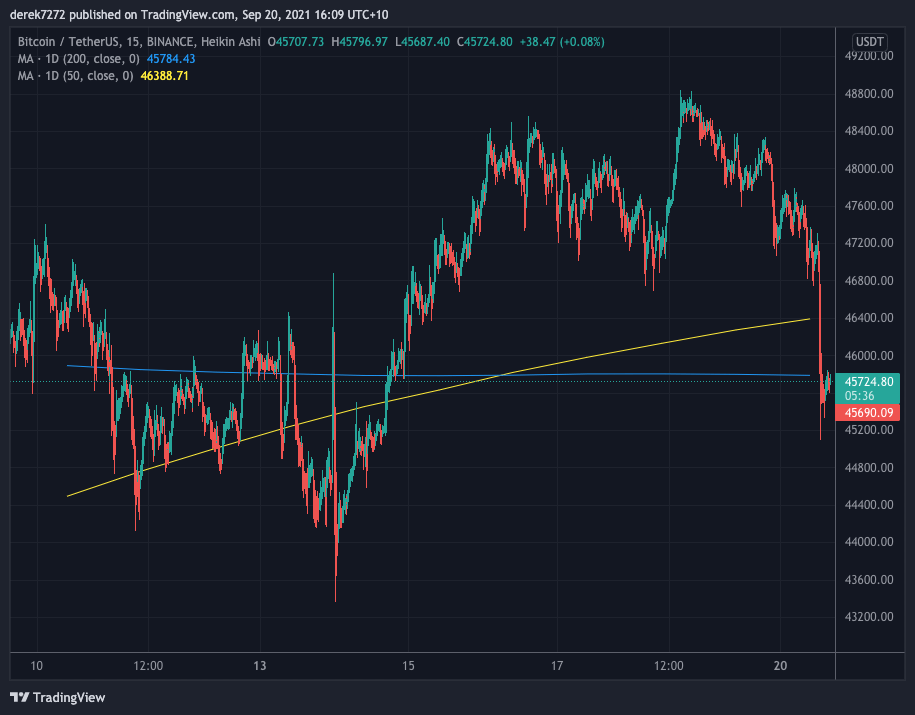

Bitcoin fell four per cent in less than half an hour this afternoon, as risk assets around the world drop on fears over fallout from the looming default of Chinese property developer Evergrande.

BTC fell from US$47,200 to as low as US$45,200 from 12.26pm AEST to 13.05pm, mirroring a plunge in Australian and Asian equities and US futures.

At 4.16pm AEDT, Bitcoin was trading at US$45,773, down 4.7 per cent from 24 hours ago.

“This is a risk-off move,” City Index analyst Tony Sycamore told Ausbiz TV this afternoon. “We’ve got the third leg of a correction playing out currently.”

Looking at it through an Elliot Wave framework, Sycamore predicted that BTC could drop as low as US$40,000, “give or take one thousand”, before heading higher.

“I still like Bitcoin in the bigger picture, so this for me would be a corrective pullback within an uptrend,” he said.

It’s a “phenomenal” buying opportunity for bulls, Sycamore said, although adding that people who are already long crypto might not be as happy. He was predicting another four or five per cent drop.

Perth-based ThinkMarkets analyst Carl Capolingua tweeted that uncertainty over Evergrande and losses from Hong Kong’s Hang Seng Index were leaking into crypto markets.

He also saw BTC’s long-term uptrend intact, but the short-term momentum has been lost, he wrote. He recommended staying out of the market until BTC had climbed to US$48,818 or dropped to US$42,582.

#evergrande uncertainty, $HSI losses leaking into #crypto markets…#Bitcoin now down 3%

❌Lower swing @ 48818

❌7 Sep supply candle <0.618 retrace

✅Support @ 42582

✅LT uptrend intact @ 40900-43200

>Bias: LT #HODL, but ST momentum gone…abstain until ⏫48818 or ⏬42582.$BTC pic.twitter.com/NndVdWS1E1— Carl Capolingua (@CarlCapolingua) September 20, 2021

But Bitcoin chartist Mick Krypto saw some reason for optimism.

$BTC Bounce!!!#Bitcoin just casually bouncing at the Golden Pocket. Will it hold? Guess I'll find out when I wake up in the morning #BTC pic.twitter.com/sFfeODy35T

— Bitcoin Charts by Mick (@charts_bitcoin) September 20, 2021

El Salvadoran President Nayib Bukele tweeted at 2.53pm AEST that El Salvador had bought another 150 BTC – roughly US$6.9 million worth.

We just bought the dip.

150 new coins!

El Salvador now holds 700 coins.#Bitcoin🇸🇻

— Nayib Bukele 🇸🇻 (@nayibbukele) September 20, 2021

Bukele was also offering trading advice.

Presidential advice 🇸🇻

— Nayib Bukele 🇸🇻 (@nayibbukele) September 20, 2021

And in an apparent bit of trolling, the controversial president has also changed his Twitter bio to “Dictador de El Salvador” (“dictator of El Salvador).

Truly incredible. Like a 4chan joke, but from a sitting president.

— Craig Johnson (@HistOfTheRight) September 20, 2021

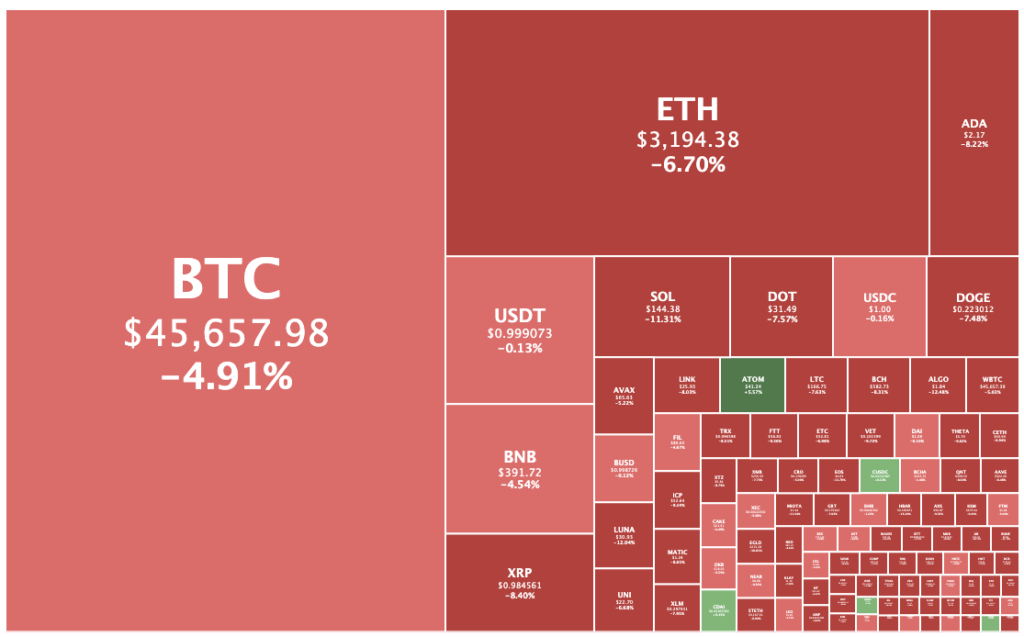

Overall the crypto market was down 5.7 per cent to US$2.1 trillion, with Ethereum dropping 6.8 per cent to a nine-day low of US$3,191.

Seventeen of the top 100 coins were down by double-digits, while just three had gained ground.

The biggest loser was Algorand, the No. 19 coin, which was down 14.6 per cent to US$1.81.

THORChain, Hedera Hashgraph, Icon and Waves were close behind, all falling 12 to 14 per cent.

On the flip side, Cosmos (ATOM) was the biggest gainer, rising 5.5 per cent to US$41.32.

Osmosis, a decentralised exchange built on Cosmos that’s a recent addition to the top 100, gained 4.3 per cent to US$7.16.

Both coins had hit all-time highs a little after lunchtime (Sydney time), at US$44.42 and US$7.61, respectively.

Currently the No. 16 coin on Coingecko, Cosmos is an interconnected “internet of blockchains” – an ecosystem of sovereign blockchain apps connected by the Cosmos Hub.

When whole market is crashing $ATOM is like pic.twitter.com/cQELnbETBr

— CryptoNaut🚀🚀 (@CryptoNaut333) September 18, 2021

Compound Dai had also edged slightly higher.