Bitcoin choppy after strong weekly close; Paradigm launches crypto’s biggest ever VC fund

Coinhead

Bitcoin may have just had it’s highest-ever weekly close, and PlanB might still have great expectations for November, but the crypto market is stuttering into the new week so far.

That’s not to say it can’t all make a boldly decisive and positive move in a hurry, of course. There are good-news stories floating about here and there, which could help matters. For example… the successful Bitcoin soft-fork Taproot upgrade; funding pouring into crypto by the billions; and VanEck’s futures Bitcoin ETF kicking off tomorrow… just to name a few.

We’ll get to some of that further below.

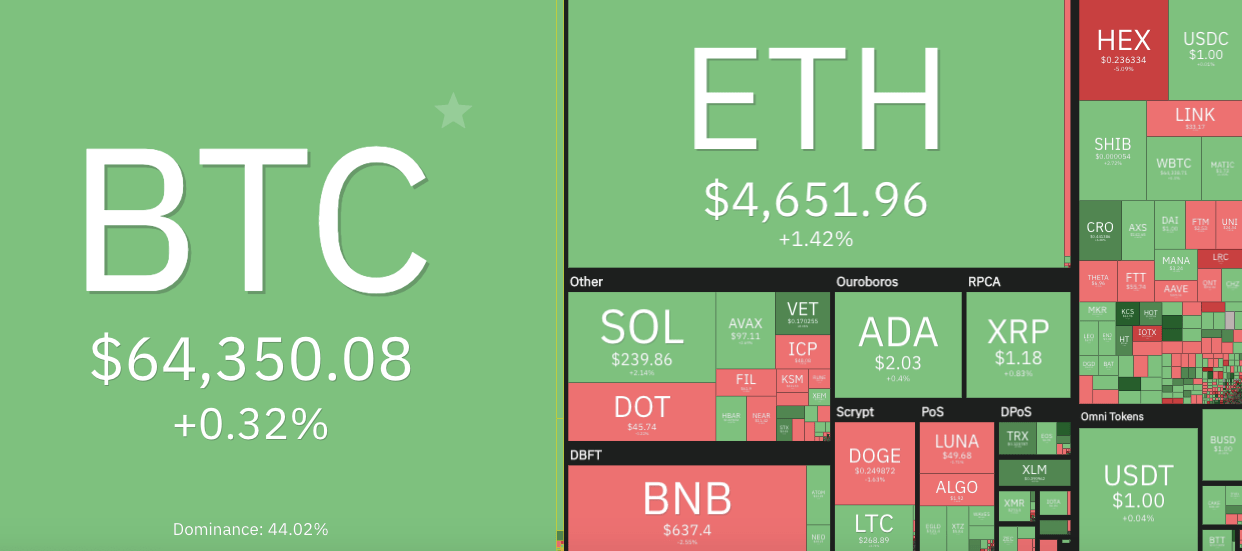

But taking a brief look at the market overview, at the time of writing the entire crypto market cap is up by about half a percentage point, chopping around US$2.96 trillion, give or take a few hundred billion dollars.

There’s nothing much to write home about in the top 10 at the present moment, or for that matter the top 100, aside from one coin – KuCoin Token (KCS). The exchange token is the only double-digit performer on the first page of CoinGecko, currently registering a 16 per cent gain since this time yesterday.

As for the OG crypto market mover, however (that’s Bitcoin), Dutch trader Michaël van de Poppe is one analyst still watching the rising-wedge bearish-divergence pattern forming on the BTC chart, which points to a potential bearish breakdown.

Moving back above US$66.4K in the short term is his level for a bullish continuation.

Still looking at a potential rising wedge structure here.

Clear bullish breaker if #Bitcoin breaks above $66.4-66.8K. pic.twitter.com/gOqSQjCcSZ

— Michaël van de Poppe (@CryptoMichNL) November 15, 2021

Analyst Bitcoin Charts, on the other hand has spotted an inverse head and shoulders pattern forming for Bitcoin, which can be a positive precursor for upwards price action…

$BTC Inverse Head & Shoulders (IHS)#Bitcoin is forming an IHS pattern, which comes with a bullish reversal bias.

Technical target (based on the point of breakout): Roughly 68.2k#BTC pic.twitter.com/d5HNaWHpbr

— Bitcoin Charts by Mick (@charts_bitcoin) November 14, 2021

… although two hours earlier, the same analyst also posted the following, keeping a move down to at least US$61.2K in play. “Always prepare for all scenarios,” reads Bitcoin Charts’ Twitter analysis – which, of course, is easier said than done.

That said, if preparing for all scenarios means not risking more than can be afforded to lose, then perhaps that’s all the preparation required.

$BTC CME Gap#Bitcoin still has yet to fill the CME Gap at 61.2k. I strongly believe that it's just a matter of time before #BTC fills the gap

Always prepare for all scenarios! pic.twitter.com/yC2eBZpQp7

— Bitcoin Charts by Mick (@charts_bitcoin) November 14, 2021

Which ever way Bitcoin decides to move the market, November might well remain a good month to keep things in perspective. Inactivity can sometimes be the best activity…

BREAKING: Bitcoin crashes to prices not seen since yesterday.

— Galaxy (@galaxyBTC) November 15, 2021

You're not really gonna panic sell #Bitcoin at $64K…are you? 😂🧐

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 15, 2021

• Venture capital firm Paradigm, created by Coinbase co-founder Fred Ehrsam and former Sequoia partner Matt Huang, has announced a new US$2.5 billion investment fund focused on the next generation of crypto companies and protocols.

The fund eclipses the previous highest in the crypto world – US$2.2 billion – which was announced by fellow VC giant Andreessen Horowitz in June.

Paradigm has raised $2.5 billion for the largest crypto VC fund ever, surpassing the $2.2 billion raised by Silicon Valley monolith Andreessen Horowitz earlier this year: by @jon_poncianohttps://t.co/MBvNVwKLGW

— Forbes Crypto (@ForbesCrypto) November 15, 2021

Paradigm's new fund is like 20% of the size that the entire crypto market was when I first joined in 2013. 😂

WAGMI (especially Paradigm)

— Ryan Selkis 📖 🖊🔑 (@twobitidiot) November 15, 2021

• Taproot, the first Bitcoin upgrade in four years has occurred, seemingly without a hitch.

The “soft-fork” upgrade helps expand the Bitcoin network’s capabilities, so it’s viewed as important by some – not that there’s been that much excitement about it on Twitter, or in BTC’s price action just yet.

The update means the OG crypto will now have greater transaction privacy and efficiency, but more interestingly, it also unlocks the capability for smart contracts on the network.

#Taproot activated 🥳, now lets get back to work on #Bitcoin. pic.twitter.com/TaLzy6onoK

— Raul O. Gonzalez Castilla (@RaulGlzC) November 14, 2021

• Crypto custody provider BitGo, which is being acquired by Mike Novogratz’s Galaxy Digital, today announced more than US$64 billion in assets under custody (AUC).

Just about one year ago, BitGo held US$16 billion AUC. The company’s CEO, Mike Belshe, attributes the surge to a rush of institutional investors delving into crypto this year.

We don't always announce our Assets-Under-Custody numbers, but when we do it's in powers-of-2. $64B! https://t.co/ZW0akqLR4z

— Mike Belshe (@mikebelshe) November 15, 2021

• VanEck, one of the first US-based asset managers to file for a Bitcoin exchange-traded fund (ETF), is at last launching its Bitcoin futures ETF. It will begin trading this week – from November 16 – on the Chicago Board Options Exchange (CBOE), under the ticker XBTF.

⚡️ BREAKING: VanEck’s #Bitcoin futures ETF to list tomorrow pic.twitter.com/QgMGt9tgUM

— Crypto Rand (@crypto_rand) November 15, 2021

VanEck joins the growing list of futures-backed BTC ETFs in the US. ProShares’ BITO fund trades on the New York Stock Exchange, and Valkyrie’s BTF trades on the Nasdaq. (It’s still a shame the Valkyrie one wasn’t called BTFD.)

Late last week, the US Securities and Exchange Commission rejected VanEck’s application for a spot-backed Bitcoin ETF, which is the type of ETF the crypto market is mostly craving, as it would track actual Bitcoin and not contract agreements based on the price of the asset at a future date.

Get with the program, SEC… maybe next year, eh?