Crypto market shows signs of life; Fed doesn’t rock the boat; another US regulator brings the FUD

Coinhead

Coinhead

It’s been a better day for Bitcoin and crypto broadly, but nerves are still frayed. As Evergrande fears are pushed aside (for now), attention turns to US regulators and today’s Fed meeting.

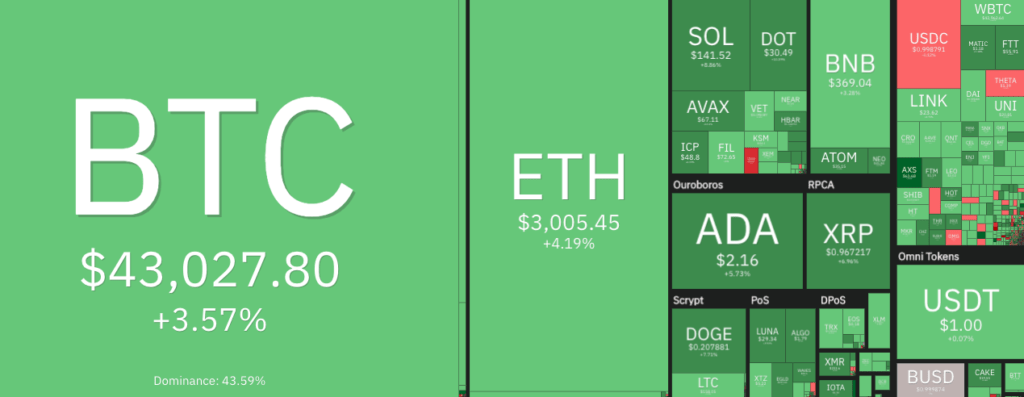

At the time of writing, Bitcoin (BTC) is about somewhere it needs to be to keep the more positive analysts happy, changing hands for US$43,027 (+3.57%).

Ethereum (ETH) is above its psychological support of US$3K, right now, but only just. It’s been hanging above $2,900 for about nine hours and at press time is trading at US$3,005 (+4.1%)

The entire crypto market cap, meanwhile, is US$2.02 trillion and up about 1 per cent since this time yesterday.

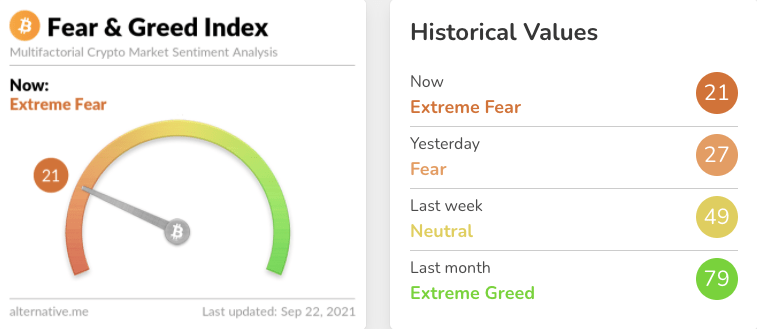

As for one of the market’s go-to sentiment indicators, the Fear and Greed Index, it’s the lowest it’s been since July 22, dipping down into “Extreme Fear”. For some crypto traders, seeing the needle this left and low is a definite buy signal.

From Extreme Greed to Extreme Fear in less than a month – that’s crypto.

Most of that fear, or FUD (fear, uncertainty and doubt) this week can be attributed to the debt issue (let’s not call it a crisis yet) faced by Chinese property giant Evergrande, which has sent tremors through all markets.

But, on that narrative at least, over-exposed investors can put away their forehead-dabbing hankies for the minute while Evergrande scapes together the cash for a scheduled bond payment.

It’ll no doubt rear its ugly head again, but in the meantime, Gazza Gensler over at the US Securities and Exchange Commission (SEC) has been getting all metaphorical on crypto’s ass.

Yesterday, he went from brushing aside stablecoins as “poker chips in Wild West crypto casinos”, to lamenting the arduous task of cleaning up a DeFi mess in “aisle three”. Sigh… a regulator’s work is just never done.

Gary Gensler over on aisle 3 rn like… pic.twitter.com/aIr0M2VyPg

— Fullerene206 (@fullerene206) September 21, 2021

Which is probably why the chief of the Office of the Comptroller of the Currency (OCC), Michael Hsu, has stepped in with a few choice words of his own.

“I have seen one fool’s gold rush from up close in the lead up to the 2008 financial crisis,” Hsu told the US Blockchain Association in a speech late yesterday.

“It feels like we may be on the cusp of another with cryptocurrencies and decentralised finance,” he added.

As for the US Federal Reserve news, market watchers were sweating on chairman Jerome Powell’s announcement after the Federal Open Market Committee (FOMC) meeting late this afternoon (EST).

The concern for the crypto market surrounded a potential Fed “tapering” decision. That is, winding back the bond-buying stimulus program that has pumped billions, and billions of dollars into the US economy.

The pandemic-era, high-spending policy has played beautifully into the hands of the cryptocurrency market, with many participants viewing Bitcoin, in particular, as a hedge against an increasingly devalued US dollar. “Money printer goes brrr” and all that.

And the verdict from Powell? The TLDR on it is this: the Fed will keep interest rates around 0 per cent and, for now, will keep buying bonds at the same US$120 billion-a-month rate it’s been cranking.

But scaling back these bond purchases “could be warranted soon”. So, for the Fed at least, tapering is a matter of when, not if… but nothing much changes in the immediate.

The FED signaled it COULD reverse course…

Meanwhile, look at the blue-line on the chart below. This would be like a person stuffing their face with donuts and saying, I COULD be on a diet… https://t.co/XW9uI8uRe8

— Preston Pysh (@PrestonPysh) September 22, 2021

• US-based Bitcoin miner, Genesis Digital Assets, has raised US$431 million in fresh capital in a funding round led by Paradigm, NYDIG and FTX.

• A US Federal judge in New York overseeing the XRP-vs-SEC stoush has denied Ripple Labs’ request to see SEC employees’ crypto-transaction records.

• Ex-Monero developer Riccardo Spagni, aka “Fluffypony”, has been released by a US court after being held in custody since July for cookie-related fraud.

I am very pleased that the U.S. court has released me. I am actively working with my attorneys on a way to return to South Africa as soon as possible so I can address this matter and get it behind me once and for all. That’s what I’ve always wanted to do.

— phluffypony.lmdb (🖖,🖖) (@fluffypony) September 21, 2021

• It looks like Robinhood customers will soon, at long last, be able to move Bitcoin, Ethereum, Dogecoin and other cryptos off its trading app.

• Big global banks, including JP Morgan Chase, are opposed to Basel Committee on Banking proposals that could preclude them from crypto-market fun.

• A huge, US$12.4 million, 85MW crypto mining centre will be built in US state Ohio, after a deal brokered between BIT Mining and Viking Data Centers.

• After recent scrutiny from the SEC, US crypto exchange Coinbase is reportedly drafting a pitch to Federal regulators on how to oversee the crypto industry.

• Crypto hedge fund One River Digital, which offers exposure to BTC and ETH, has raised US$41 million in a funding round led by Goldman Sachs and Coinbase Ventures.

• Solana decentralised exchange Orca has closed Series A funding, raising US$18 million from VCs including Polychain, Three Arrows Capital and Coinbase Ventures.

• US cinema chain AMC might add Dogecoin to the list of crypto-payment options it plans to integrate by the end of the year, per this tweet from CEO Adam Aron…

I sincerely want to hear your opinion, via this Twitter Poll. By year-end 2021, AMC will take Bitcoin, Etherum, Litecoin and Bitcoin Cash for online payments. I hear from many on my Twitter feed we should accept Dogecoin too. Do you think AMC should explore accepting Dogecoin?

— Adam Aron (@CEOAdam) September 21, 2021

Taking a quick look at some of the more notable altcoin gainers today at press time…

In the top 10 by market cap, Cardano (ADA), Solana (SOL), Dogecoin (DOGE) and XRP have all regained some lost ground, up between about 4 per cent and 5 per cent since yesterday.

Polkadot (DOT) is faring even better (+7.1%), as is Avalanche (AVAX), which is just outside the top 10, and up 5.16% in the past 24 hours.

Further down the market cap lists, automated DeFi protocol Gelato (GEL) is looking sweeter again, up 36.47% on the day. It might’ve had a rocky token launch, but the project seems to be building partnerships and gaining traction.

We're ecstatic to announce that @MakerDAO has added G-UNI as collateral!

You can now sit back, relax, and LP like a pro on @Uniswap V3's USDC-DAI pool 😎🍦 https://t.co/MNQ5dPwo9I

— Gelato (@gelatonetwork) September 22, 2021

Others doing well include: Avalanche-based decentralised exchange (DEX) Trader Joe (JOE), 28.04%; decentralised oracle Umbrella Network (UMB), 23.52%; and the developing play-to-earn game and metaverse Illuvium (ILV), which is 22.52% to the positive and currently changing hands for US$552.

Illuvium fans, of which there seem to be many, will like this particular news bite today…

We're proud to announce that the $ILV token will be listed on @Binance! In 24 hours, active trading of $ILV will commence. Withdrawals for $ILV will open on 23 Sep 06:00 UTC. https://t.co/6l5bGAQoB7

— Illuvium (@illuviumio) September 22, 2021

On the other side of the coin, some of the day’s more notable losers include the Avalanche DEX Pangolin (PNG), -24.69%; Loot currency project Adventure Gold (AGLD), -20.17%; and gaming project Chain Guardians (CGG), down 13%.