Avalanche launches $200 million ‘Blizzard’ fund for DeFi and NFT ecosystem; crypto market steady

Coinhead

Coinhead

The layer 1 smart-contract platform Avalanche (AVAX) continues to surge today after unveiling “Blizzard” – a US$200 million developer fund – earlier this week. Meanwhile, the crypto market looks to be on solid ground.

Avalanche, now number 13 on the market-cap lists with a valuation just over US$16 billion, is up 13.2 per cent since this time yesterday. It’s currently changing mittened hands for US$74.05 – the first time it’s been back in the 70s since late September.

The climbing crypto’s newly announced fund is designed to boost early-stage projects that innovate decentralised finance (DeFi), non-fungible token (NFT) projects, and various other parts of its growing ecosystem.

A proof-of-stake crypto, Avalanche is compatible with the Ethereum Virtual Machine (EVM), which means developers can port decentralised applications (dApps) over from the Ethereum network. It self describes as “the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality”.

Ok, news is finally out.

Blizzard is a new $220M ecosystem fund that will invest in all those building on Avalanche. To be deployed rapidly.

Lots of participants, including 3AC, Polychain, Jump, and more. https://t.co/Yf6W07v6TP

— ./kevinsekniqi 🔺 good vibes only (@kevinsekniqi) November 1, 2021

In an announcement made this week, Avalanche revealed that the Blizzard fund is being led by the Avalanche Foundation, with contributions from Ava Labs, Polychain Capital, Three Arrows Capital, Dragonfly Capital, CMS Holdings and Republic Capital, among a handful of others.

“The last two months have shown incredible growth across Avalanche, with users, assets, and applications joining the community in record highs,” said Emin Gün Sirer, director of the Avalanche Foundation. “Blizzard will play a key role in further accelerating this growth, and solidifying Avalanche’s position as the premiere home for projects and people pioneering the next era in our space.”

Avalanche now has more than 320 projects building on its platform, including decentralised exchange SushiSwap (SUSHI), oracle provider Chainlink (LINK) and Web3 indexing protocol The Graph (GRT).

Another thing that also might be helping AVAX surge today, could be this… a listing with the prominent crypto lending and borrowing platform Nexo.

#AVAX is now available on @NexoFinance, one of the world's leading regulated digital assets institutions and a pioneer of crypto-backed credit 🔺 https://t.co/6ApceOzfZt

— Avalanche 🔺 (@avalancheavax) November 3, 2021

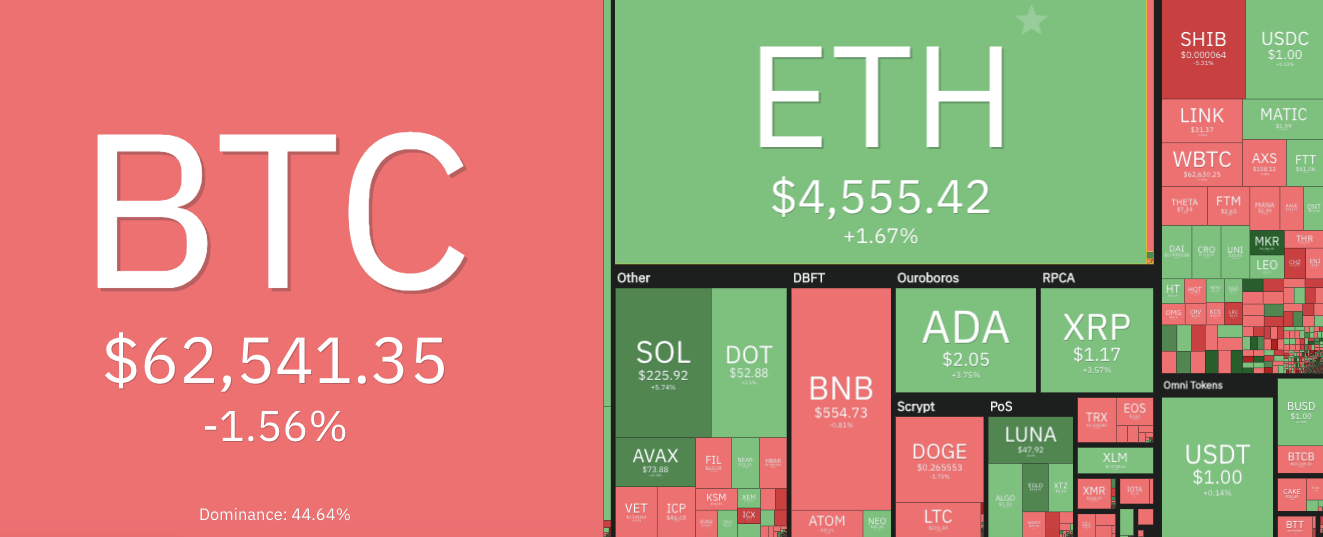

Meanwhile, the rest of the crypto market is doing just fine today with an overall market valuation of about US$2.85 trillion, about 0.2 per cent down in the past 24 hours.

Bitcoin (BTC) is down a fraction compared with this time yesterday, as shown above, and there’s nothing much else exciting happening in the top 10 just at the minute.

That said, as we reported earlier, Solana (SOL) has surpassed its smart-contract-platform rival Cardano (ADA) in the past 24 hours.

Not by much, though, and Cardano has actually staged a bit of a price-movement comeback, hitting as high as US$2.13 a short time ago after languishing below two bucks for much of the past week.

Here’s a jazzy take on its current state of play for you, courtesy of YouTuber BitBoy’s talented pal, Piano Matty B.

Looking further down the market-cap chart for some notable daily positive price action, here’s what we’re seeing…

DAI stablecoin enabler and Ethereum DeFi stalwart Maker (MKR) +30%; payments solution app Amp (AMP) +20%; gaming ecosystem The Sandbox (SAND) +14%; supply-chain solution Origin Trail (TRAC) +140%; gaming company Atari (ATRI) +80%; digital horse-racing game DeRace (DERC) +27%; and plenty more 24-hour double-digit gainers besides.

Even something called Boring (BORING), ranked #718 on CoinMarketCap, is having an exciting time of it. It’s up about 50 per cent at the time of writing. Looks like it’s a decentralised autonomous organisation (DAO) DeFi play of some sort – “building decentralised tunnels between blockchains”.

(Note: it may or may not be one to look into, but we’re only mentioning it because of its boring name.)