Another day, another dump for most cryptos, but Dash surges on Webull listing

Coinhead

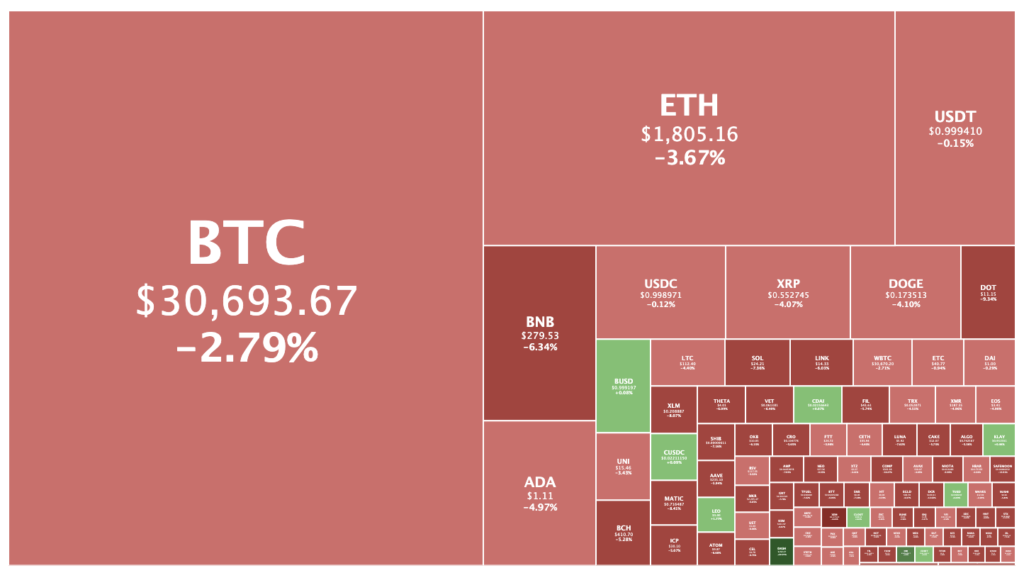

Ethereum has sunk to a fresh three-and-a-half week low as risk assets sell-off amid concerns about the Delta variant.

This morning Ether was trading for US$1,789, down 4.7 per cent from yesterday and the first time it has traded below US$1,800 since June 27.

Bitcoin was changing hands for US$30,661, down 2.7 per cent.

The only top 100 coins trading higher in the last 24 hours were Dash, Revain (REV), and iFinex’s Leo token.

The latter two were up marginally, but Dash was soaring after it was listed on Webull, a Robinhood-like commission-free trading platform.

Dash was up 20 per cent to a one-month high of US$134, making it the No. 50 cryptocurrency with a market cap of US$1.4 billion.

Can someone fill me in on this?$DASH pic.twitter.com/oUzqSRzecv

— ΛVΞ (@ave_eli) July 19, 2021

The privacy-oriented, masternode-governed Litecoin fork was a top 10 coin from 2015 through 2017, but its shine has faded in recent years with the rise of next-generation cryptocurrencies.

On the flip side, 18 of the top 100 coins were down by double-digits, with NEM (XEM) the worst performer, falling 19.2 per cent to US12.3c.

Gaming token Axie Infinity was trading at US$15.41, down 46 per cent in the last five days after rising more than sixfold in the three weeks before that.

Analyst Bitcoin Charts posted that things didn’t look great for Bitcoin.

“Another day, another dump. Is it done yet?”

He wrote that there was some still bullish divergence on the four-hour chart,

“But it’s important to note that, yes, we are still in a macro downtrend, and there’s a high probability for there to be hidden bearish divergence if we see a bounce.

“Ultimately it’s much more reasonable to expect continued downside in the coming days and possibly weeks.”

If Bitcoin did break its June 22 low of US$29,337, “there are a few daily support levels I’m keeping my eye out for as the first line of defence.”