7% APY: Sydney fintech Block Earner launches first-ever direct connection to popular DeFi protocols

Coinhead

Coinhead

Sydney-based fintech Block Earner has launched a platform that will allow users to earn high yields using two leading decentralised finance protocols.

Block Earner says it’s the first fintech in the world to offer a direct connection with borrowing and lending protocols Compound and Aave.

Users can deposit Australian dollars into Block Earner using traditional bank transfers or the instant PayID system, which are then converted to USDC stablecoins.

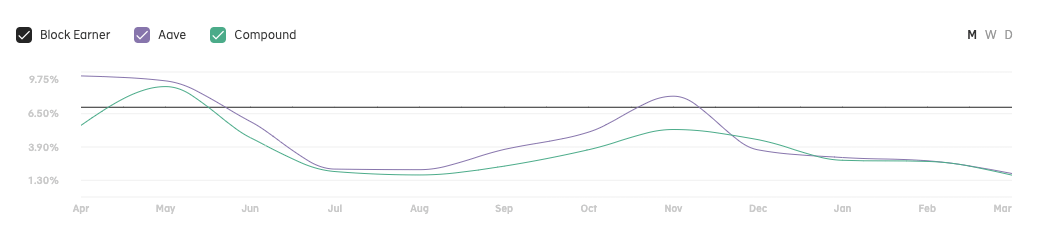

The protocol is promising seven per cent fixed or “up to” 18 per cent variable yields, but the variable yield on offer on Thursday wasn’t anything near that. Aave was offering 1.88 per cent APY while Compound was offering 2.01 per cent, both compounded daily. That’s still obviously much better than what’s available at Australian banks, and there’s no fees or lock-in periods.

Block Earner says a mobile app will also launch in the coming weeks.

It also plans to broaden its scope this year, expanding from mainnet Ethereum to Avalanche, Polygon and Optimism.

“There are only 4 million wallets using decentralised finance platforms around the globe right now,” said Charlie Karaboga, Block Earner chief executive officer and co-founder.

“We designed our fintech with a user-friendly interface that builds a bridge and drastically simplifies access to DeFi platforms. In doing this heavy lifting, we are hoping to encourage many more people to use DeFi platforms, and boost overall awareness and adoption of DeFi’s benefits.”

Karaboga said that Block Earner offered customers a “safe middle ground” between the volatility risks of share trading or traditional crypto, and the lacklustre returns of traditional savings accounts.

“With regular education about DeFi, we are convinced that people will see a relevant proposition to strengthen their financial health in the months ahead, and Block Earner is the bridge that can easily connect them to this world,” he said.

The company said customers would still be exposed to volatility between the Aussie dollar and the US greenback, although this could work both for and against them. Block Earner is working on an add-on product that would let customers fix the exchange rate.

The company is backed by Coinbase Ventures, Framework Ventures and Australian crypto veteran Kain Warwick.