News

The MONEYME Group is a leading disruptor and innovator in the consumer lending market.

Leveraging AI and cloud-based technology, The MONEYME proprietary and modular technology platform ‘Horizon’ facilitates, offers automated loan approval and settlement, meaning approvals in minutes and fast settlement for end customers.

Their advanced tech-driven platform provides consumers flexibility with a seamless online process via their mobile phone, offering diversified products such as personal loans, point of sale instalment products. real-estate expenses and auto financing.

KEY PEOPLE

RELATED STOCKHEAD STORIES

News

Quarterlies Top 5: Adslot leads this morning’s winners

Tech

Wisr flags more quarterly growth as consumer finance market heats up

Tech

IPO Watch: SME-focused fintech Propell set to land on the ASX next week

Stockhead TV

V-Con: Fintech – huge scaleability, big valuations and the buffer of post-COVID tailwinds

News

RBA to maintain historic low rates until at least 2024

Tech

StockDoc Podcast: MME set for bright 2021 after strong quarterly update, new loan momentum and continued diversification

Tech

MME shares are rising; here’s why today’s half-year numbers are so important for its profit outlook

Tech

With booming growth in Q4, MoneyMe has laid the groundwork for a big year in 2021

News

Top Quarterlies: Most stocks have slid today, but these 5 are defying the tide

News

These ASX-listed lenders are benefiting from rising lending volumes

Tech

ASX fintech stocks 2020: Can the BNPL boom continue into next year?

News

The RBA has ‘little choice’ but to cut interest rates today; which stocks could benefit?

Tech

ASX fintechs have had a spectacular 2020; here are the biggest winners

News

Rise and Shine: What you need to know before the ASX opens

News

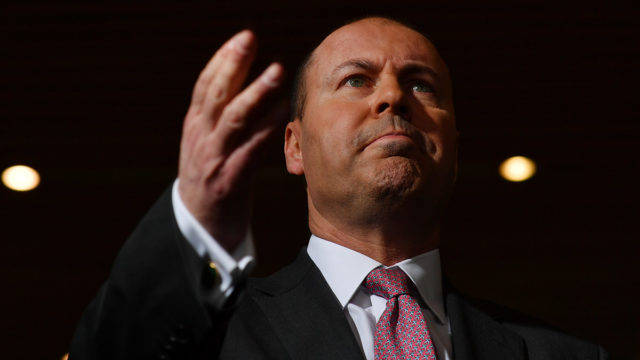

How Josh Frydenberg’s responsible lending proposal will affect ASX small caps

IPO Watch

IPO Watch: Plenti becomes the ASX’s latest fintech stock; stumbles 20pc

Tech