Will investors show love for floating Cygnus?

Mining

The trip from penny dreadful to a $600 million stock-market value for Gold Road was based largely on a geological theory about what might be found in the far east of WA.

Now that theory is being re-applied in the far west through a new float, Cygnus Gold.

The key to Cygnus is whether a repetition of the gold-bearing fractures from which most of WA’s gold was generated a few billion years ago will be found under farms relatively close to Perth.

Hints that something rich is hidden from view by layers of soil which yield Australia’s biggest wheat crop — and a sizeable chunk of the wool clip — have been detected over the past 150 years, but rarely converted into a mine.

Cygnus — which takes its name from the Latin for Swan, WA’s State emblem — believes it can solve the riddle of the wheat farms.

Deeply buried, very ancient fracture

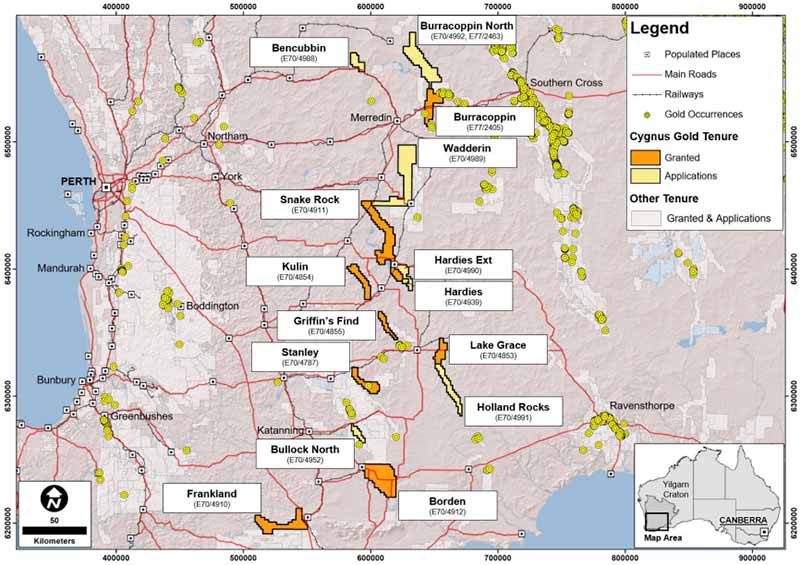

It started that process by pegging a line of claims that run roughly north-to-south from close to the regional wheatbelt centre of Merredin in the north to Borden in the south.

For most investors, especially those outside WA, the names of those country towns, along with Bencubbin, Kulin, and Lake Grace, will mean little.

But if you draw a line on a map you can see the pattern of pegging undertaken by Cygnus in the belief that there is a deeply buried, very ancient fracture (or shear zone), running the length of the claimed area from which gold once flowed as the earth was being formed.

Non-geologists might find this type of hunt for gold somewhat fanciful, but it is the way in which the southern portion of WA was shaped, with massive north-south fault lines neatly slicing the geology of a region known as the Yilgarn Craton.

The most prolific of the shear zones is one which runs through Kalgoorlie, with other major structures on either side, with all shear zones have a close association with what are known as greenstone belts, the primary target of gold explorers.

Gold Road tested the fracture theory by going further east than most explorers to test the Yamarna shear, discovering what is now recognised as another commercially valuable gold province.

Cygnus has picked up that theory and started looking to the west, an area largely off limits to explorers because it was already becoming covered in farms before the Kalgoorlie discoveries of the 1890s.

Sneak preview of float

Details of the Cygnus float, which is understood to be planned for late this year, or early next year, are not yet available.

But a sneak preview can be gleaned from a document lodged by Gold Road at the Australian Stock Exchange earlier this month.

In that report — filed on October 10 but largely ignored at the time — Gold Road said it had earmarked $750,000 to buy a slice of Cygnus when it floats, as well revealing that it had entered into two exploration joint ventures with the new company.

Gold Road exploration director Justin Osborne said the investment in Cygnus was Gold Road’s first venture outside the Yamarna Belt.

“We are excited by the cutting edge work that Cygnus have conducted to identify historically overlooked overlooked areas of greenstone in WA’s prolific Yilgarn Craton,” Osborne said in the stock exchange statement.

“We believe this is a potentially new gold district in an area of WA which has been neglected for many years, and is an area that offers tremendous upside potential.”

Cygnus chief executive James Merrillees welcomed Gold Road’s involvement which follows earlier funding support from private-equity mining investors Resource Capital Funds.

“We are excited to be partnering with one of Australia’s most successful gold explorers, and by Gold Road’s strong endorsement of our team and dominant land position in the highly prospective south-west of WA,” Merrillees said.

Next step for Cygnus

The next step for Cygnus is to finalise its prospectus.

Then comes the hard work which will involve drill test targets in 3500 sq km of pegged tenements which have largely been identified using recently acquired geophysical data — the common way of describing information gathered by electromagnetic or gravity surveys.

The priority — given Gold Road’s declared preference through its joint venture deals — will be the Wadderin project south of Merredin and the Lake Grace project to the east of that town.

At Wadderin, Gold Road plans to spend $1.6 million over 30 months to potentially earn a 51 per cent stake in the prospect with the right to earn up to 75 per cent by spending an additional $900,000.

At Lake Grace, Gold Road can earn an initial 51 per cent by spending $700,000, and possibly up to 75 per cent by spending another $500,000.

For investors with an appetite for grass roots exploration in a low-risk location, Cygnus will be an interesting proposition when it goes public — with strong backing from a successful explorer which has developed an industry leading understanding of the geology of south-west WA.