Tin juniors such as Kasbah may be ready to rock

Mining

Mining

The tin price has stirred and the hope now is that the share prices of a bunch of ASX juniors advancing tin projects will follow suit.

The metal is currently trading at $US19,590 a tonne. That’s down from recent highs but still represents a handy 22 per cent gain on the 2015 average and a 9 per cent improvement on the average price last year.

Steady growth in traditional uses (solder, chemicals, tinplate and lead-acid batteries) and a lack of investment in new capacity has put the squeeze on global supplies, with stocks at multi-decade lows.

And then there is a range of new growth areas for the soft metal, particularly in electronics and the next generation of battery technologies.

All that is enough you would have thought to give the tin stocks the same sort of buzz that the lithium, graphite, cobalt and nickel stocks have enjoyed.

But to date at least, the junior ASX tin stocks have not responded to the more buoyant outlook.

Today’s interest is in the exotically named Kasbah Resources (ASX:KAS), a cultural nod to its Achmmach tin project in north Morocco.

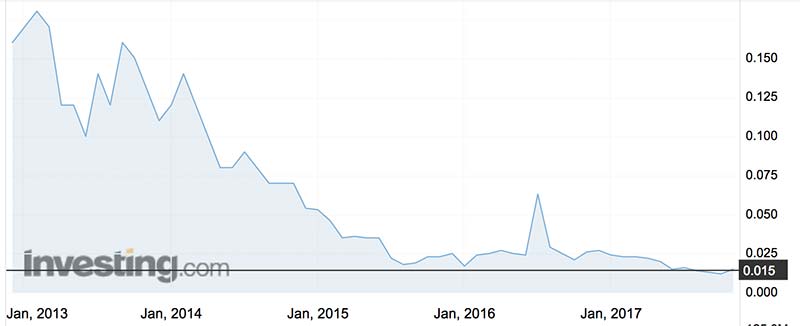

Kasbah’s share price performance has been anything but exotic in the last couple of years.

And there have been some good reasons for that, most notably the controversy around a failed merger with Asian Mineral Resources, a Canadian company backed by Russian billionaire Vladimir Iorich’s private equity group Pala Investments.

A (small) book could be written on the saga which included the independent expert advising on the fairness of the offer having to admit it had got its numbers wrong. Suffice to say, that’s all history now.

There’s a new board and management team, and Pala has a supportive 21.5% stake, most of which came from a placement of Kasbah shares. The focus now, under new chief executive Russell Clark, is very much on getting Achmmach in to production.

Clark is something of specialty metals specialist having previously led UK tungsten producer Wolf Minerals (WLF), and before that, Tasmanian iron ore pellets producer Grange Resources (GRR).

Clark only came on board in mid-October but on a recent roadshow to promote the “new’’ Kasbah, he was comfortable enough to declare that the company was being seriously undervalued in light of tin’s improved outlook, and the advanced nature of Achmmach.

His job is to move Achmmach through the definitive feasibility study (DFS) stage, funding, construction, and eventual production. Achieving each of those tasks will trigger a re-rating event, which is something Kasbah could do with given it last traded at 1.5c for a market value of $16m.

The first of the potential re-rating events will be the release of an updated DFS in the March quarter next year. While it will be an updated version, it is expected to confirm a project capable of producing 4,000tpa of tin in concentrates.

Once a decision to mine and financing are completed, Achmmach could be in production 12 months later.

The DFS is based on reserve of 6.56 million tonnes grading 0.85% tin for 55,500 tonnes of contained tin which would be good for a mine life of 10 years. The project’s resource base of 127,000 tonnes of tin ranks as one of the biggest undeveloped tin resources in the world and points to the potential for a much longer mine life.

Back in July, broker Taylor Collison said Achmmach was a well understood project which at a tin price of $US20,000 a tonne could enjoy strong margins after all-in-sustaining costs of $US11,507 a tonne.

The value of the project is highly sensitive to tin price movements. An increase in the tin price to $US25,000 a tonne – which is not out of the question – would more or less double the value of project.