Why Cooper Energy could emerge a big winner from the gas shortage

Energy

Energy

Cooper Energy, a small oil and gas stock that reported a strong profit result yesterday, is tracking one of Australia’s great success stories by developing new sources of gas for Sydney and Melbourne — and next year is shaping as its time to really shine.

A glimpse of what’s to come was in the numbers for the latest financial year and in management comments about the conversion of a loss of $12.3 million in 2016-17 to a profit of $27 million in the latest year to June.

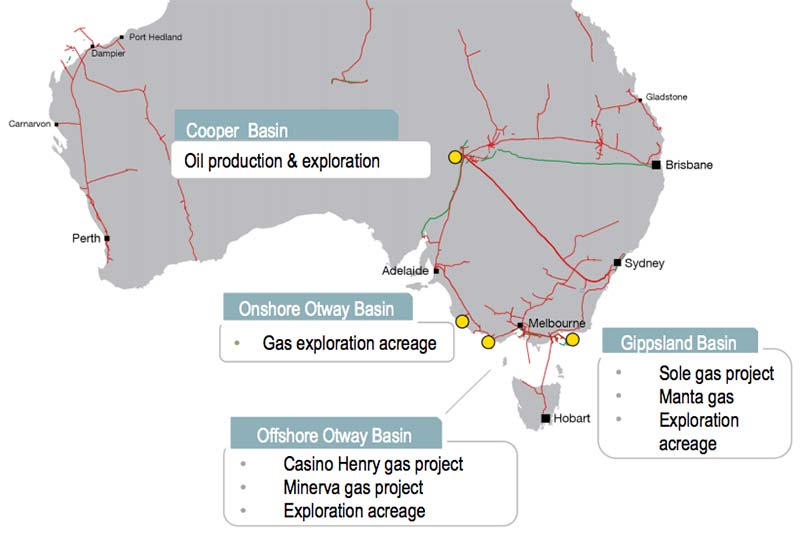

Low-key for much of its life, Cooper (ASX:COE) took its name from the oil and gasfields of central Australia. But its shift of focus to waters off the coast of Victoria and South Australia is shaping as a company-making move.

Cooper’s Sole gasfield is scheduled to start feeding gas into the east-coast pipeline system around the middle of next year from a processing plant near the south coast town of Orbost.

Discovered in 1973 the Sole field has had a number of owners — none of which could see how to make money from its reserves, though that was at a time when gas prices were less than half what they are today.

Restricted supply and a lack of exploration, caused largely by government bans, has opened the way for Cooper to monetise Sole and expand the exploration footprint around the platform it is building about 65km off the Victoria coast.

Work on the $355 million Sole project is 64 per cent complete with gas from the platform to be delivered by pipeline to the Orbost plant which was previously operated by Santos and known as the Patricia Baleen gas plant.

Pipeline and gas plant specialist APA Group, which acquired the processing plant from Cooper, is spending an estimated $255 million upgrading the onshore facility with commissioning scheduled to start in the second quarter of next year.

Just the right size

By the standards of the oil and gasfields developed in Bass Strait by BHP and its partner, ExxonMobil, the Sole field is a minnow but it could prove to be just the right size for Cooper which first became involved in Sole through a 50-50 joint venture with another big oil company, Santos.

Cooper’s full ownership of Sole was achieved in late 2016 when Santos sold its half share to Cooper for $82 million as part of its corporate revival plan. As part of that deal Cooper also got a 50 per cent interest in the Casino Henry gas assets in the Otway Basin off South Australia.

Much of the cash for the extra stake in Sole came from a $62 million capital rising, a high-risk commitment by Cooper shareholders with the oil price at the time below $US$50 a barrel, and the east coast gas crisis not at boiling point.

In hindsight, Cooper’s deal to acquire assets from Santos could hardly have been better timed, perhaps reflecting the fact that for a small company it has a particularly high-powered management team led by David Maxwell, a career oilman who once filled senior positions at Woodside, Santos and BG Group which is now part of Shell.

Other members of Maxwell’s team also have big oil-company experience behind then which raises an interesting point about whether the Sole project is the height of their ambitions for Cooper or whether there’s more to come.

The answer to that question is easy because Sole is very much a stepping stone to building a bigger business, but only after the gas starts flowing out from Sole and the cash starts flowing in.

When it starts, Sole will have a dramatic effect on Cooper with indicative modelling showing that annual production will rise to almost six million barrels of oil equivalent from the 2020 financial year.

Maxwell said in yesterday’s profit statement that the latest result was an early instalment of the financial growth anticipated from Cooper’s gas strategy.

“Strong cash flow and earnings growth are the highlights of the financial result, largely driven by the Otway Basin gas assets,” he said.

On the Sole project in the Bass Strait Maxwell said it was now within 12 months of start-up and the forecast ramp up of annual gas production.

“Delivering the Sole Gas Project on time and within budget is clearly the highest profile and most significant task in our program,” he said.

“Alongside this, there is a package of other commercial and drilling projects we expect to advance with the object of providing revenue and production growth additional to that which will flow from Sole.”

All of Cooper’s gas assets are ideally located to feed gas into the south-east Australian market.

For investors, Cooper is a growing player in the gas market with some assets already in production and with a lot more to come through the Sole project and with the exploration potential of the Otway Basin and Bass Strait.

On the market, the stock has been marching higher since an early-2016 low point when it was trading at 12c, receiving a significant boost yesterday to close at a 12-month price high of 50c.