Sunstone is on the trail of a big copper discovery in South America

Mining

Mining

The proof of any exploration concept lies in drilling.

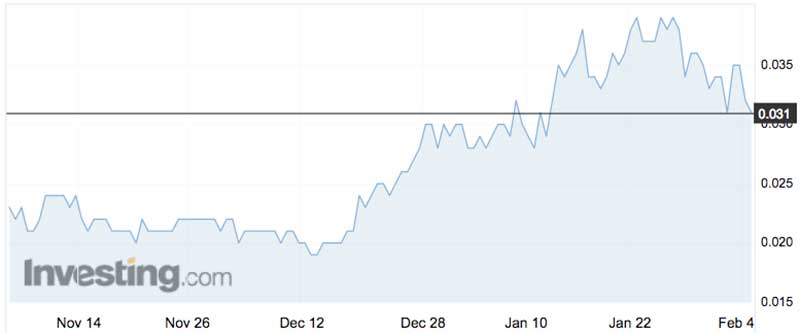

And with Sunstone Metals about to start its first drilling campaign to follow up an exciting set of copper and gold surface samples — in one of the world’s hottest exploration locations — it’s easy to see why the stock has risen 85 per cent in two months.

There are other reasons for speculators taking an interest in Sunstone (ASX:STM), not least that the management team has an enviable success record, and because some of the biggest names in Australian mining are travelling the same road to South America.

Ecuador is Sunstone’s destination, just as it is for the Australian iron ore miner Fortescue Metals, which is looking for a way to diversify.

And while Ecuador has long been considered a backwater, the outlook is improving — though a cautious investor should keep an eye on the activity of a notoriously unreliable government.

Political risk is always a factor in South America and can outweigh the remarkably attractive geology found along the copper-rich Andes mountain range that runs the full-length of the continent with Ecuador at the northern end.

Despite its attractive location Ecuador has never been able to replicate the mineral exploration and project development achievements of its southern neighbours, Peru and Chile.

That might be changing thanks to the Cascabel discovery in the north of Ecuador by the Australia-based (but London and Toronto-listed) SolGold, and a recent influx of other international explorers.

SolGold was a runaway success in 2016 and 2017 when its London shares rocketed more than 1400 per cent from 3 pence to 46p. But the stock has been sold down over the past few months to 23p as it tries to demonstrate that Cascabel has a high-grade core that could permit an early start on mining.

Sunstone’s primary target is the Bramaderos project near Ecuador’s southern border where limited exploration in the past has returned tantalising results which have rarely been followed up.

Led by Malcolm Norris, the Sunstone management team was responsible for the discovery of the Tujuh Bukit copper gold and copper mine on the Indonesia island of Java when working with ASX-listed Intrepid Mines.

For a brief period in 2011 Intrepid was valued at more than $1 billion when its share price rose to more than $19, and would today be a world-class copper and gold producer if a slippery Indonesia deal hadn’t seen ownership of Tujuh Bukit transferred to a well-connected local investor.

From a geological perspective Sunstone appears to be on the trail of a Tujuh Bukit look-alike in Ecuador, but will hopefully not suffer the same fate political fate as Intrepid.

On the market, Sunstone (which was known as Avalon Minerals until early last year) has risen from 1.9c in mid-December to recent trades around 3.5c thanks to the flow of encouraging assays from trenching – an exploration technique which is precisely what it sounds like, digging a shallow trench across a target ear-marked for future drilling.

Last week, Sunstone reported a 146.6 metre zone grading 0.57 grams of a gold a tonne, plus 0.15% copper, with a 68.2m section in the trench assaying 0.8g/t gold and 0.18% copper.

For a geologist like Norris the results from trenching are exactly what he wants to see as he hunts for a big copper/gold porphyry structure of the type found along the Andes – and as he discovered at Tujuh Bukit in Indonesia.

Bramaderos contains a number of exploration targets with the immediate focus on Bramaderos Main, with follow-up prospects called West Zone and Limon.

Preparing for drilling

“These latest results continue to strengthen our confidence in the potential to discover porphyry gold/copper at Bramaderos Main,” Norris said in a statement with the latest trenching assays.

“We have built a solid picture of mineralisation which we will test with diamond drilling once the permits are received. We are preparing access for drilling in the lead-up to the permits being issued.

“Through a combination of trenching, and two historic drill holes at Bramaderos Main, we are building a three-dimensional picture of mineralisation over and area measuring 300m by 200m.

“The area is expanding with each phase of trenching which is continuing with further assays expected in mid-to-late February.”

For investors with an appetite for the risks associated with early-stage exploration which is targeting the mining world’s equivalent of a geological elephant the process at Bramaderos should be well worth watching, especially when drill assays start to flow.

And, if Ecuador is too high on the risk/reward scale there is another reason to follow Sunstone and that’s a left-over from its days as Avalon, a copper project in Sweden called Viscaria.

A rising copper price has returned Viscaria to the status of potential mine, but whether Sunstone has the capacity to take two copper projects to the development stage at the same time, on different continents, is an interesting question.

Whatever the answer the point about Sunstone is that it has at least two copper prospects with project development potential at a time of rising metal prices, and that’s got to be good news.