Why Core Exploration’s Top End lithium project could soon take off

Mining

Mining

Lithium play Core Exploration could be due for a re-rating with a soon-to-be released maiden resource estimate writes Barry FitzGerald in his weekly Garimpeiro column

The speed and scale of Western Australian lithium project developments has meant Northern Territory lithium specialist Core Exploration has spent the last couple of years in the shadows.

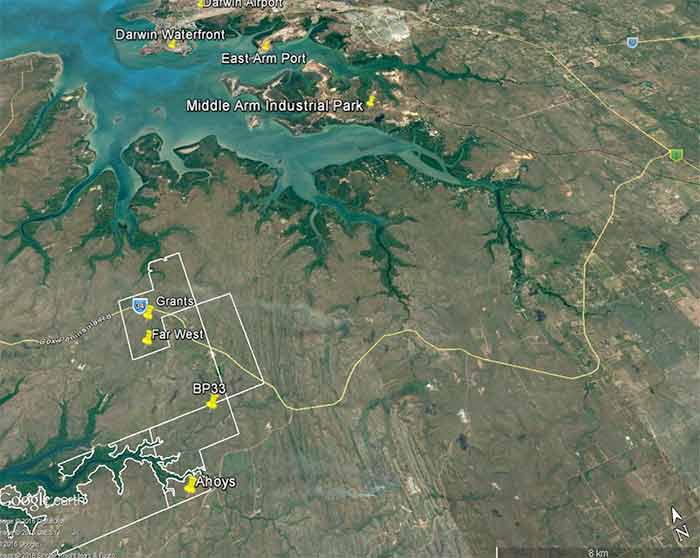

But Core (ASX:CXO) is out to change that in coming months with a strong newsflow set to confirm it’s on its way to becoming a producer from its Finniss project — all of 80km by road from Darwin, or 25km as the jabiru flies.

The near-Darwin location, with all of its attendant logistics and infrastructure, means Core is well-positioned to make the transition to producer status as early as mid-2019 — and at a low capital and operating cost.

Confirmation of that capability in coming months could trigger a re-rating of Core which last traded at 5.2c for a market cap of $32 million.

The ball on a potential re-rating starts rolling with the soon-to-be released maiden resource estimate for the BP33 prospect where Core recent returned an impressive 55m hit grading 2 per cent lithium.

It will be the second resource estimate for the Finniss project, following on as it will from the previously announced 2mt at 1.5 per cent lithium estimate for the Grants deposit.

Then in about a month, Core is expected to release a pre-feasibility study in to the development of Grants, about 5km from BP33.

Clearly, Grants is not in the same league as the 100mt-plus deposits in WA.

But it has to be seen as very much a starter project in the broader Finniss area which has hundreds of potential lithium-bearing pegmatites to test over time — something that steps up soon with a new exploration and resource definition program planned by Core.

Core’s strategy in launching in to a study on the comparatively small Grants resource was so that it could become a producer as early as possible, using cash flows from the initial development to grow the business over time.

Having an initial resource under its belt on which to build a stand-alone economic case for a mine development also gives the regulatory approvals process, and talks with customers, fresh momentum.

Unlike many of its WA peers which launched into construction without supporting offtake (future sales) arrangements, Core is already part way there thanks to a binding offtake agreement with one of China’s biggest lithium groups, the Shenzhen-listed Yahua.

Yahua is a 9 per cent shareholder in Core and recently took up a $1.4 million placement in the company at 5.3c a share in support of Core’s Finniss ambitions.

While it is best to wait for the study, Core has flagged in some of its previous announcements that it thinks Grants will support a low capex spodumene concentrate (about 6 per cent lithium) operation as distinct from the cheaper option of going down the direct shipping ore (DSO) route employed by some in the Pilbara.

(DSO typically requires only simple crushing and screening process before it is exported, making it an inexpensive strategy.)

The study will be its first chance to talk about the economics of the spodumene concentrate versus DSO option.

The tip here is that with the support of Yahua – it has also stumped up to provide a $US20 million pre-payment facility available for the development of the project – the spodumene route will win hands down.

There is little wonder in that. Spodumene concentrate currently sells for $US900 to $US1000 a tonne compared with $US100 a tonne for DSO.

Essentially the DSO route makes money, but the spodumene concentrate route makes much more.

On the assumption that like its WA peers, Core’s cost of producing a spodumene concentrate is something around $US300 a tonne, a low capex concentrate plant based on Grants alone could deliver high value to the company.

The aim would be to then build a supporting resource base to at least 10 years.

By that point, Core won’t be the $32 million company it is today.