Elementos isn’t waiting around for sentiment to turn on tin

Mining

Mining

Tiny tin group Elementos reckons the low rating of junior ASX-listed tin stocks has much to do with their single project and small-scale focus.

So Elementos isn’t waiting for investor sentiment to turn — in response to a much-anticipated bull run for tin prices — to give its own market value a push on the strength of its Cleveland tin project in Tasmania.

Instead, it’s setting out to become a multi-project tin producer of scale.

Elementos (ASX:ELT) has a point.

Unlike much of the mining industry where investors wanting scale in a particularly commodity have at least a handful of major listed company choices, the tin industry is characterised by a myriad of small players.

Elementos was in that category itself on the strength of its Cleveland project.

But in a recent flurry of deals, the company has set out to become a multi-project tin producer with the potential for annual production from 2024 of 6,600 tonnes of tin-in-concentrates.

That sort of production would mean Elementos would mix it with the $435 million Metals X (ASX:MLX) as Australia’s biggest tin producer. (MLX has substantial copper-gold and nickel interests in Western Australia as well).

Elementos has a long way to go though to achieve its ambition.

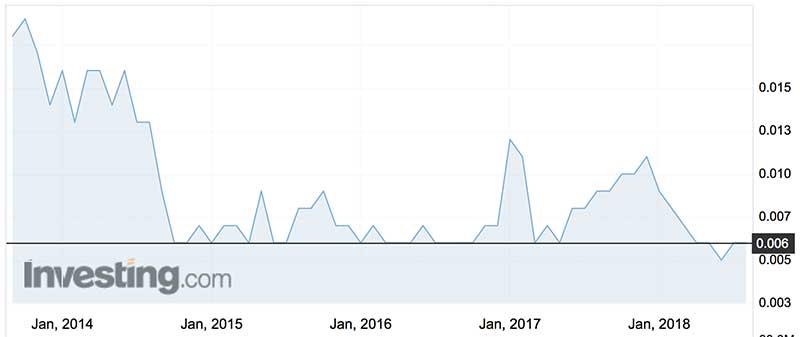

That is reflected in its lowly market price of 0.6c.

But the market did sit up and take notice earlier this week when Elementos announced it would be acquiring a 96 per cent stake in the advanced Oropesa tin project, 180km north-east of sunny Seville in Spain’s Andalucía province.

Elementos believes Oropesa is one of the best-undeveloped tin resources in the western world — something that has more meaning than it used to because the world is worried about a US-China trade war. China is the world’s biggest tin producer.

Like other metals, tin has taken a bit of tumble recently because of the trade war fears.

The price averaged $US20,961 a tonne in the June quarter and fell as low as $US19,400/t in mid-July.

But it has punched back recently to last trade at $US19,990/t.

The reason for that is simple enough. Expectations for a 40,000t annual supply shortage by 2020, because of a lack of new mine developments and moderate consumption growth assumptions, has not gone away.

Tin’s role in new technologies

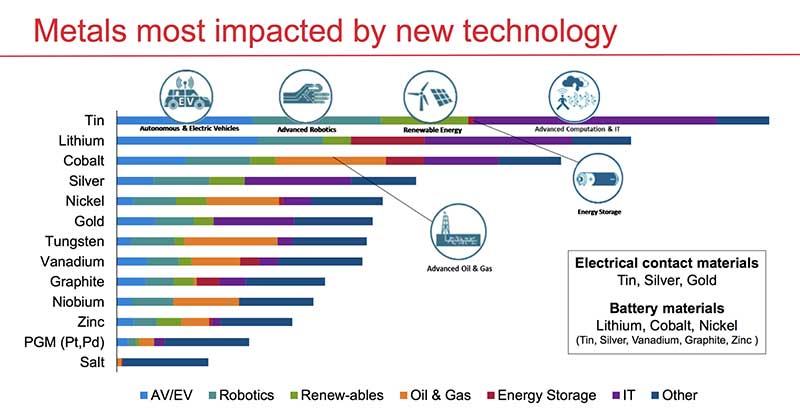

Then there is tin’s blossoming role to play in high-growth sectors, as identified by the Massachusetts Institute of Technology in a new technologies metal impact study for Rio Tinto (see graph below).

Demand for tin is the most affected because of its use as an electric contact and in battery chemistries.

Electric vehicles, robotics, renewable energy storage and advanced computation – tin is found in them all.

Tin mineralisation was first recognised at Oropesa beneath an olive grove in 1982.

About $25 million of work since by the seller of the project, Toronto-listed Eurotin, has defined a measured and indicated resource of 9.34mt grading 0.55% tin, and an inferred resource of 3.2mt grading 0.52% tin, for a combined 67,525t of contained tin.

Oropesa is now in the approvals stage and is slotted to become a 3,000tpa tin producer from 2021.

The sale price was the issue of one billion Elementos shares to Eurotin. Elementos will have 2.53 billion shares on issue on completion of the deal.

Elementos envisages that its previous mainstay project, the Cleveland project 80km south-west of Burnie, would follow with initial production of 1,400tpa from 2023, rising to 2,500tpa from underground ore positions.

Rounding out Elementos’s multi-project strategy is a memorandum of understanding for the company to enter a joint venture on the historic Temengor tin project, 250km north of Kuala Lumpur in Malaysia.

Originally operated as a hydraulic elluvial mining operation between 1926 and 1931, the joint venture is interested in the project as a hard-rock operation, potentially at an annual rate of 2,200t of tin from 2024.