Finder’s acquisition of Timor-Leste oil fields delivers value uplift: MST Access

Energy

Energy

Special Report: MST Access believes Finder Energy’s acquisition of the Kuda Tasi and Jahal fields offshore Timor-Leste is transformational and places it on the path towards becoming an oil producer by Q4 2027.

The low US$2m cost of entry, existing best estimate (2C) contingent resource of 22 million barrels (MMboe) of oil in the two fields that could deliver significant cash flows and the potential to serve as a hub for exploring and developing other discoveries and prospects nearby, all combine to add value to the company.

Using the discounted cash flow model for the Kuda Tasi and Jahal risked at 50%, MST Access has valued Finder Energy (ASX:FDR) at 39c per share, significantly higher than its current price of 5.5c.

“Secondary valuation measures for production companies, specifically EV/BOE (enterprise value/barrels of oil equivalent) provide context to the potential scale of re-rating that could occur once FDR is an established producer,” MST Access Senior Analyst Stuart Baker said.

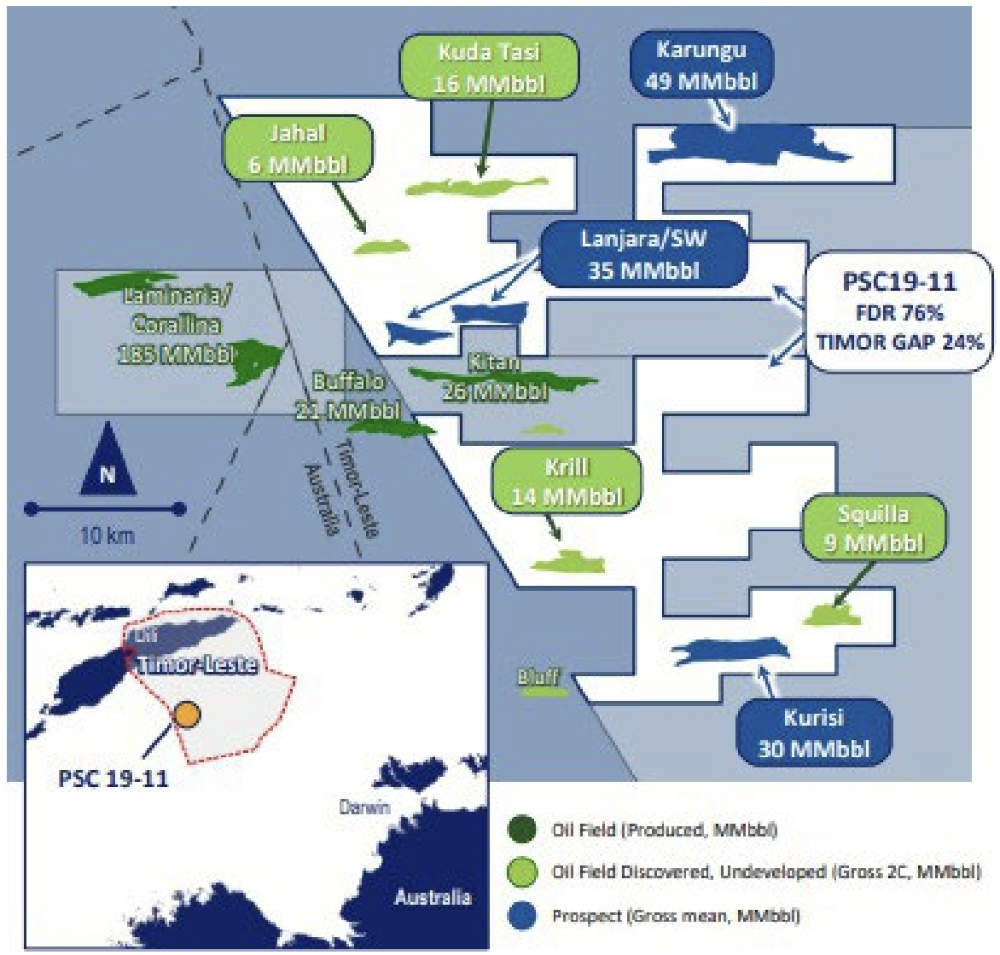

The company had acquired the 76% stake in PSC 19-11, which includes other discoveries that take gross 2C resources up to 34MMboe, in August from Eni and Inpex.

Kuda Tasi and Jahal are discovered oil fields which are development ready and only require further geological work to de-risk the sub-surface reservoir models to inform well location and production expectations.

Krill and Squilla require more work and likely 3D seismic to improve the sub-surface understanding.

The latter two were located on dated 2D or very early 3D seismic and evaluated with wireline tools less sophisticated than what is available today and appear to have updip potential.

PSC 19-11 also hosts low-risk, near-field exploration potential for up to 116MMbbl of mean prospective resources.

Contingent resources are already proven to host hydrocarbons though still at a stage where their economic viability is unknown, while prospective resources require drilling to prove up the presence of oil (or gas).

MST Access notes that the Timor-Leste assets were acquired at low cost from larger companies that viewed these as immaterial.

They were discovered when oil prices were <$20 per barrel and thus not high enough to trigger development.

However, current oil prices have created favourable development economics, making it highly attractive for a smaller company like FDR.

Development planning is currently underway with the company evaluating the option of using a floating, production, storage and offloading (FPSO) system that is typical for this region and can be readily leased to reduce capex.

The company’s offshore WA and UK North Sea assets, which have a prospect inventory of hundreds of millions of barrels of oil equivalent – mostly oil, are described as “sleeper assets” that provide options for future activity.

MST Access flagged that FDR will need to bring in partners with capital and operational experience for the Timor-Leste assets as their capex requirements will be significant for a company of its size.

Capex heavy drilling activity required for its other assets will also require partners to proceed.

MST Access said that based on its understanding of the reservoirs, and the style of development that may be applied, it believes that a case could be made for the exploitation of 16 million barrels of oil over 5-6 years.

Field production rates will be determined by the size and processing capacity of the FPSO, with higher flow rates offset by the higher costs associated with leasing a larger vessel.

“Our production forecasts recovers 16 MMbbls of oil (gross) from the five wells. This is lower than the 2C figure and assumes an economic cut-off rate of 2,000 bopd (barrels of oil per day) in 2032,” MST Access added.

“This cut-off rate is the rate at which production revenue is insufficient to cover field costs. Higher oil prices, or initiatives to reduce costs in late field life may extend operational life and ultimate recovery. Day-rates from what is likely to be a leased FPSO, are to be determined.”

MST Access estimates an initial production rate of 40,000bopd when Kuda Tasi enters production in 4Q 2027 with Jahal entering production in 4Q 2031 at 4,000 bopd.

Development capex is expected to be ~US$270m ($409.8m) while the cost of leasing an FPSO is estimated at US$250,000 per day.

Based on these numbers and a 10% discount on net cash flows, FDR’s share of cashflows after cost and profit oil, and carry of TIMOR GAP’s E&A expenditure, is calculated to be US$258m.

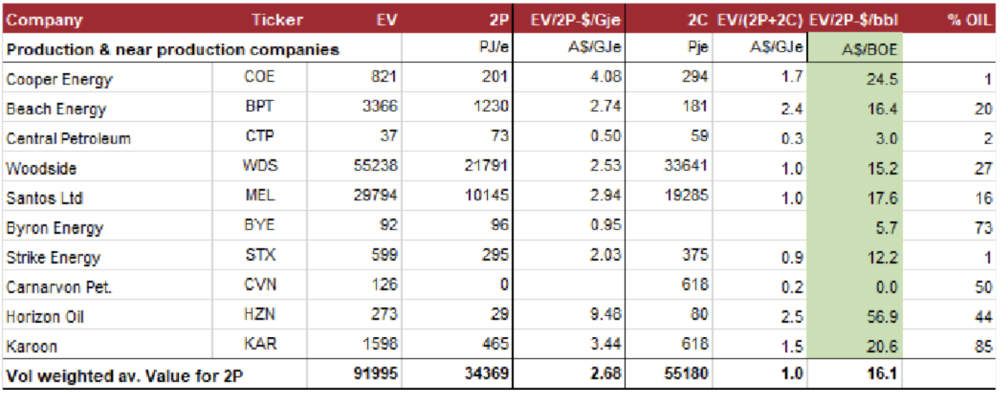

MST Access adds that a significant range of EV per barrel of 2P reserves can be seen in ASX-listed companies that it deems to have sustainable production.

This dispersion – ranging from $3/boe to $56.9/boe – is due to factors such as the gas-oil split, with the former being generally less valuable, the location and fiscal terms, other factors such as underlying financial strength and market expectations for growth.

It notes that companies with more oil trade at higher values for reserves, due to the generally higher, and more profitable value in oil production compared to gas.

“These figures point to how FDR may be valued in the equity market once it reaches FID, enters production and is valued on an EV-per-barrel basis,” it added.

The research firm said that growth catalysts for the company include milestones in engineering for the two oil fields, reserve booking and securing partnerships.

FDR could also see further value from farm-out or transaction activity for its non Timor-Leste assets.

This article was developed in collaboration with Finder Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.