Tech play Wangle has just signed up Yojee backer Mat Walker

Tech

Tech

Special report: Yojee backer and leading stockmarket advisor Mat Walker has joined Wangle Technologies as corporate director — and plans to triple his shareholding in the data and cyber-security play.

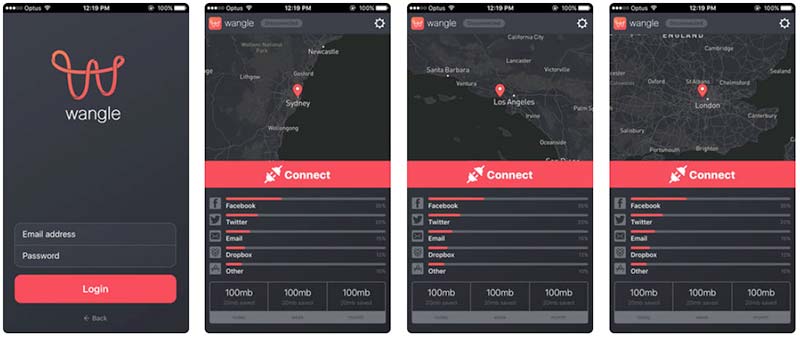

Wangle (ASX:WGL) is known for two key projects: a mobile network acceleration app called Wangle VPN that ups data speed and encrypts user content for security, and a cyber safety app called Wangle Family Insites.

The tech play — which last week signed a deal to put its cyber-safety service in front of hundreds of thousands of Australian parents — said Mr Walker would manage shareholder engagement, capital raising, business development and new opportunities.

Mr Walker is well-known in ASX circles as a successful investor and top-ten shareholder in tech darling Yojee (ASX:YOJ).

He was the chairman of Yojee — which uses artificial intelligence and blockchain technology to improve supply chain management — when it listed in mid-2016 at 2c.

The stock has since increased seven-fold to 14c.

Wangle’s CEO Sean Smith told Stockhead: “It was clear from early discussions that Mat and I share the same vision for the future direction of the business, so I’m delighted we’ve been able to secure his expertise as we turn our attention to delivering commercial outcomes for our shareholders.”

Increased investment

Mr Walker said he would seek shareholder approval to triple his shareholding in Wangle from 50 million to 150 million shares at a cost of $300,000.

“It is imperative as both responsible regulators and parents we get this issue right.

“The compelling attraction of the Wangle solution is the research and education based approach. Our children will overcome a simple blocking approach.

“A holistic approach incorporating the identification of high-risk behaviours and education at both the parent and child level is what is required to achieve the desired outcome.”

“From an investment perspective this ticks all the boxes. The size of the potential market is huge. The global category killer in the space is yet to be determined and the fundamental underlying Wangle technology has no peer in terms of its research and education based solution.”

“Following implementation of the company’s restructure and relocation from Perth to Brisbane, I look forward to working with [Wangle CEO] Sean and his team to expedite the commercialisation process and unlock shareholder value.”

Wangle’s chairman Jon Wild is also planning to buy up to 23 million shares for $69,000.

Wangle also announced today that director James Robinson had resigned.

This special report is brought to you by Wangle Technologies.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.