Space junk or moneymaker? Here’s just how lucrative the satellite data market could be

Tech

Tech

It’s not a big market on the ASX, but all indicators point to satellite-powered data-as-a-service taking off in the next few years.

Most people are familiar with services like Google Earth, which allows users to see cities, roads and even houses in 3D from various angles using satellite imagery.

But now satellites are being used for things like detecting illegal fishing, smuggling and trafficking, spotting cracks in a tailings dam and even predicting ebola and malaria outbreaks.

Predictions are that the global commercial satellite imaging market will climb more than 86 per cent from 2017 to $US6.8 billion ($9.6 billion) by 2025.

Researcher MarketsandMarkets forecasts that the small satellite services market in particular is projected to more than triple to around $US53.2 billion by 2022.

That is an estimated compound annual growth rate of 29.03 per cent between 2017 and 2022.

The hefty growth is due to factors like satellite miniaturisation and increasing demand for Earth observation and satellite broadband services.

There are just two ASX-listed small caps that have their own satellites — Sky and Space Global (ASX:SAS) and Kleos Space (ASX:KSS).

While SAS is focused on setting up a nano-satellite communications network and providing data coverage to traditionally underserviced parts of the world, Kleos is focusing on launching satellites to sell data-as-a-service.

The company is launching its first four nanosatellites — about the size of a shoebox — in a few months.

These satellites will provide reconnaissance data to defence, security, regulatory and commercial business and governments.

“Rather than observing the Earth in the visible domain as you would with cameras, we are observing it in the ‘radio frequency’ part of the spectrum using antennas,” chief Andrew Bowyer told Stockhead.

“And by flying a few satellites kitted out with antennas together in a formation we are able to locate where radio transmissions are coming from — a sort of reverse GPS.

“If those radio transmissions are coming from an area of the ocean that isn’t showing any legitimate activity (shown with active AIS trackers), then we know we have identified some activity that wasn’t previously known about.

“Thus locating dark, unseen, unlocatable, obscured, obfuscated, covert maritime activity which may indicate activities such as illegal fishing, smuggling and trafficking.”

Mr Bowyer said there is definitely a growing need for more data, whether it is for business intelligence or security intelligence, which is contributing to an increase in the number of entrants to the market.

“This growth is enabled by the increasing capability of small satellites, but also the fantastic achievements of new launch companies such as Rocket Lab,” he said.

Rocket Lab is a private American company that makes and launches small satellites. So far it has launched 24 satellites, some from one of its launch pads in New Zealand.

Even American e-commerce giant Amazon is getting in on the action.

Amazon announced late last year that it is partnering with defence industry heavyweight Lockheed Martin to make accessing satellite data easier and less expensive.

Lockheed said there are currently thousands of satellites orbiting the Earth and collecting data, including Low Earth Orbit (LEO) satellites that account for about 63 per cent of the active satellites in orbit.

“This partnership is designed to be disruptive and lower the barrier of the cost of entry,” Rick Ambrose, executive vice president of Lockheed Martin Space, told SpaceNews in late November.

“Startups don’t have to buy computing power or parabolic dishes. You buy what you need, services on demand.”

One private Australian company was looking to list on the ASX but got a better deal to stay private.

Perth-based Takor Group launched an $8m IPO in early 2017.

“When we were going to list the company, the EV [enterprise value] of the company was actually quite small in comparative terms and we got pretty much an offer we couldn’t refuse from private investors at five times EV,” CEO Amir Farhand told Stockhead.

“So basically, it was a pretty easy decision for us to make.”

EV is a measure of a company’s total value. It is calculated by adding market capitalisation and outstanding debt together, then subtracting the cash and cash equivalents.

Takor got its break when it landed a major contract with the US Department of Defense.

The company created a software product called Mappt that US soldiers use to help map coordinates and keep them away from enemy lines, among other things.

There is also a civilian version of the app that is being used by around 20,000 people globally in the agriculture, logistics, real estate, mining and environmental sectors.

Instead of just providing satellite, aerial and drone imagery and data, the company created its own platform that allows users to collect, view and share their own data.

“Think of it as an eBay or Amazon for all types of maps,” Mr Farhand said.

“We’ve got 5000 drone operators across the world that could get their drone content, map any part of the world and they can upload it to our system and share it, disseminate it to anyone they want. It just brings up a marketplace effectively.”

Takor’s Mappt product has been used for everything from predicting ebola outbreaks to mapping cheetahs in Oran and leopards in Zambia, as well as monitoring acacia plantations in places like Sumatra.

It is also used by big miners like BHP (ASX:BHP).

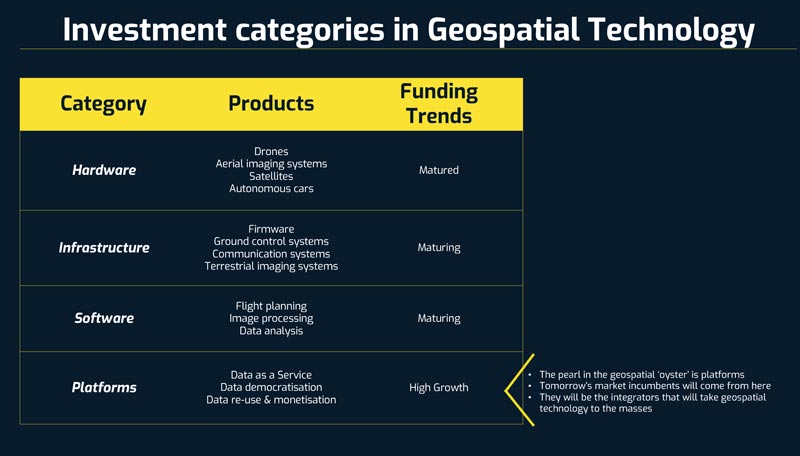

Mr Farhand believes the more lucrative prospect is the “platform-as-a-service” market.

“Out of that fallback of our program of working with the US military for pretty much three years, we hatched a product called Soar and that is effectively a platform-as-a-service,” he explained.

Soar is essentially a “decentralised super-map” using blockchain.

The platform can integrate multiple resolution imagery feeds from satellite, aerial sensors as well as crowd-sourced drone content.

“All your drone imagery, all your satellite imagery, all your aerial imagery from any source — so from Nearmap, Spookfish, Planet Labs, NASA, JAXA — everything could just zoom into the platform,” Mr Farhand said.

“So rather than fighting for the data-as-a-service, because data-as-a-service in our view has now matured in the geospatial world, now we’ve gone onto the platform-as-a-service.”

Soar was released as public beta in October 2018 with a target commercial launch date of April 2019.

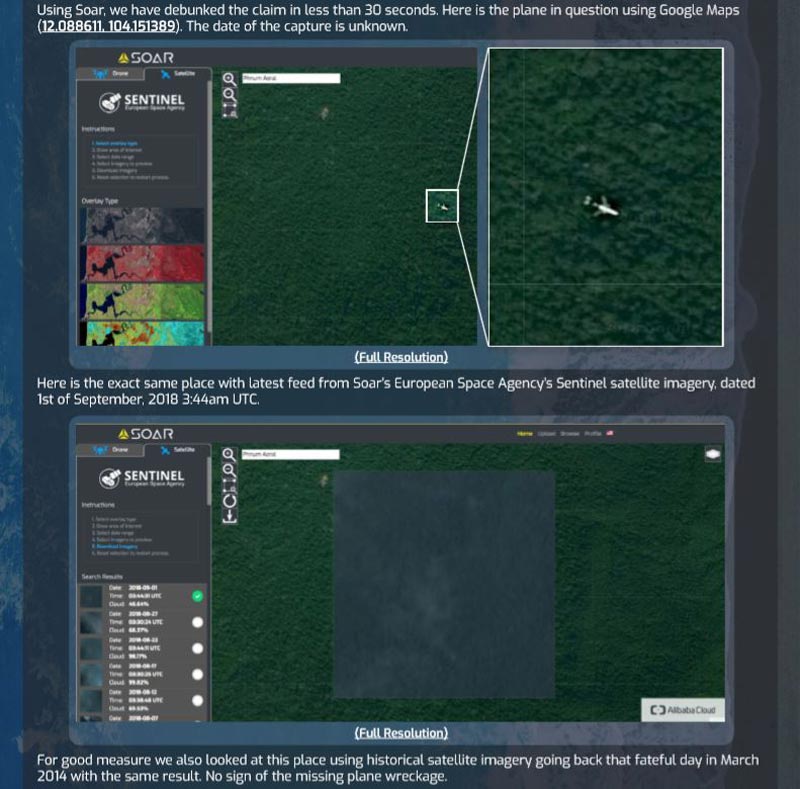

The platform even proved useful in debunking the theory that missing Malaysian plane MH370 was in Cambodia. It took just 30 seconds.

But the big money is not in Australia.

“You could have the best idea in the world but unfortunately the traction is limited here,” Mr Farhand said.

“In terms of our products and revenue, when we started focusing on the market outside of Australia, our revenues probably went up at least three times from that focus.”

Another potential future ASX debutante is Sydney-based start-up Arlula.

Arlula has access to 17 satellites and 34 unique data collection sensors, such as cameras and radars, and can provide a “library of data” that is regularly updated.

The company is currently providing its data to clients in the agriculture, real estate and environmental consulting spaces, but wants to tap the mining sector as well.

Arlula is soon starting a trial to see if it can use its data to predict malaria outbreaks.

The trial involves taking satellite data that looks for variables in things like weather, humidity, temperature, water stillness and quality and then pairs that to ideal environments in which mosquitoes that might be carrying malaria would breed.

Arlula is looking at setting up a text message alert service and has partnered with telco Mobimedia, which has various locations in the Pacific, and Melbourne-based data analytics firm Northraine.

The company is “revenue positive” right now and is about to close to some big deals in the land management space.