“Not my issue”: Splitit chief says credit risk is the banks’ problem as dazzling debut continues

Tech

Tech

Gil Don, chief of newly-listed payments provider Splitit, says it’s the banks who take on the credit risk if consumers can’t afford repayments incurred by using Splitit, not the company, as its dazzling debut continued on Wednesday morning.

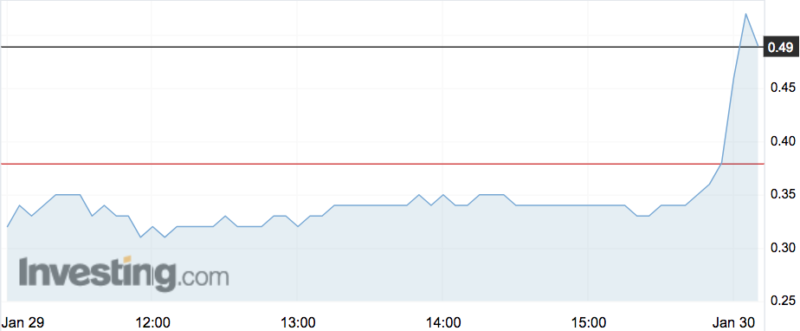

Splitit (ASX:SPT) shares were hitting highs of 52c within half an hour of the market opening, up 37 per cent on yesterday’s close of 38c and up 160 per cent on the offer price.

“Not my issue”

Company chief Gil Don told Stockhead the business model appealed to both merchants and consumers, with banks taking the risk if a customer was unable to make repayments.

“We are a tech company, we don’t take the risk on, the bank takes the risk on,” he said.

“Whether you are using Splitit or your credit card, you need to pay your bills, it is not my issue, it is the issue of the issuing bank.

“It is not us taking on the risk nor is it the merchant taking on the risk.

“Our technology allows people to manage their cash flow responsibly and smartly use their credit instead of paying for additional loans or accruing additional debt.

“And for merchants it is a win-win as it adds another option to their checkout.”

According to the company’s prospectus it does not conduct further credit checks on new users, relying on the checks already conducted by the bank which issued the credit card:

“The company was established on the premise that customers prefer to “buy now and pay later” however do not want to apply for additional lines of credit, fill out lengthy application forms or undertake further credit checks in order to do so,” the IPO document reads.

Buy now pay later (BNPL) lenders have recently been the subject of a senate inquiry to address concerns their platforms are putting customers at increased risk of financial hardship.

Investor love-in

Being the first successful initial public offering of the year to reach listing, Splitit is garnering plenty of attention.

It falls into the buy-now-pay-later crew, but differs from tech darling Afterpay because it uses a consumer’s credit card credit to pay off a large transaction in instalments, with no fees or interest when their monthly bill is due.

The company sold 60 million shares at 20c a pop in its $12 million IPO.

Mr Don said the early support would lead the way to the company become the next eight-figure tech stock on the ASX.

“I am very happy to have gotten the attention of investors and we are looking forward to potentially becoming a $1 billion company,” he said. “We will invest this money smartly and in the coming years look to become a billion dollar company.”

He said Splitit had spent very little on marketing thus far, and its prospectus outlined 39 per cent, or $5.8 million, of the IPO funding would go towards sales and marketing.

“Imagine what will happen when we do start to spend money on marketing. This is what we are planning to do, this is what we want to bring to our investors and now it is a matter of execution.”