IPH not ready to give up on acquisition of QANTM, but QANTM and Xenith don’t care

Tech

Tech

All is not fair in love and war when it comes to the intellectual property tech sector.

$1.2 billion IP giant IPH is refusing to give up on acquiring QANTM Intellectual Property.

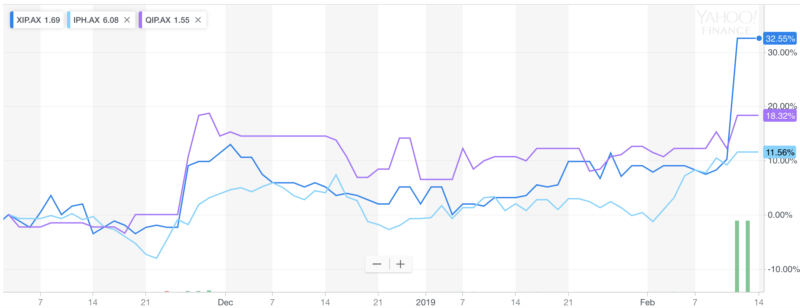

It told shareholders on Wednesday that it now had a 19.9 per cent stake Xenith IP (ASX:XIP) in an attempt to block an already-announced merger between Xenith and QANTM (ASX:QIP).

It all appeared over in November, with QANTM shareholders to own 55 per cent of the new company and XIP shareholders 45 per cent.

But IPH believes it is far more attractive.

“On the basis of the information released to date, IPH does not support the current Xenith scheme to be acquired by QANTM and does not intend to vote in favour of it,” it said.

“IPH believes an alternative transaction involving a strategic combination of one of these businesses with IPH has the potential to create significant value.”

It said it would seek further discussions with Xenith and QANTM on the subject, but late on Wednesday Xenith and QANTM returned serve, saying neither had heard a peep from IPH.

“QANTM has not received any communication from IPH with respect to an alternative transaction to the current scheme of arrangement proposed by Xenith and QANTM and so intends to proceed with the proposed merger,” QANTM said.

Xenith parroted QANTM, telling shareholders to ignore talk from IPH.

The scheme is expected to be put to a shareholder vote in March next year.