Invest to invest: SelfWealth says it has made investors 39pc richer

Tech

Tech

When it comes to the diversified financials section of the ASX small cap market, things can get a little bit meta.

Take SelfWealth (ASX:SWF), the online broker well-known for its $9.50 per trade flat-fee platform. So by you investing in it, SelfWealth gets more funding, which in turn allows it to continue investing in its platform, which allows more people to… invest in shares on the ASX.

And it appears to be working: its most popular portfolio model, the SelfWealth Top 10, has outperformed the ASX200 by 39 per cent in the last two years, and by 10 per cent over the past four years.

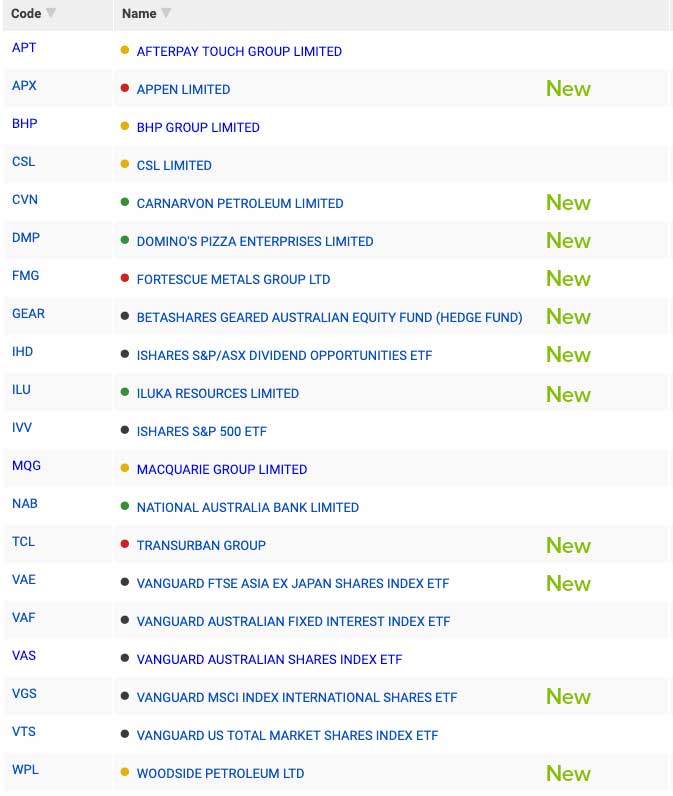

The portfolio, used by over 50 per cent of SelfWealth’s 60,000-strong community, takes the top 20 stocks from the top 10 investors and gives them equal weighting — it is then rebalanced at the start of every quarter.

So essentially it allows investors to copy the trading of top-performing investors, who are identified via SelfWealth’s proprietary ranking tool called WealthCheck Score.

Founded by Andrew Ward, who was a frustrated investor himself sick of paying fees across a range of platforms, SelfWealth listed in November 2017, though it struggled in its early days. He says it has grown since to become a self-sufficient community.

“There is a belief that to access outperformance, such as our community consistently delivers, you need to pay someone else a lot of money to do it for you,” he says.

“SelfWealth allows you to take full control of your portfolio, unlock outperformance, own shares directly and do so on Australia’s cheapest and only flat-fee share brokering platform. I take great personal satisfaction in seeing individuals and families using our tools to improve their wealth.”

The company is slowly moving towards profitability, with its half-year loss a 9 per cent improvement on the prior half-year, thanks to a mammoth 294 per cent jump in sales revenue.