Here are the winning – and losing – ASX cleantech stocks for 2018

Tech

Tech

Australian “cleantech” stocks have outperformed the ASX200 for the fifth year in a row — though they haven’t matched the overall performance of ASX small caps.

Advisory Australian CleanTech maintains an index of 90 ASX “cleantech” stocks that derive more than half their revenue from output that “positively enhances the communities and ecologies in which they reside”.

The index returned 13.9 per cent in the year to June, compared to 13.1 per cent last year. That’s slightly down on 2015 and 2016 when it did 16.6 per cent and 21.3 per cent respectively.

By comparison the ASX Small Ords index — a measure of small and midcap stocks — returned a strong 20.5 per cent, the first time since 2016 that the volatile index cracked positive double figures.

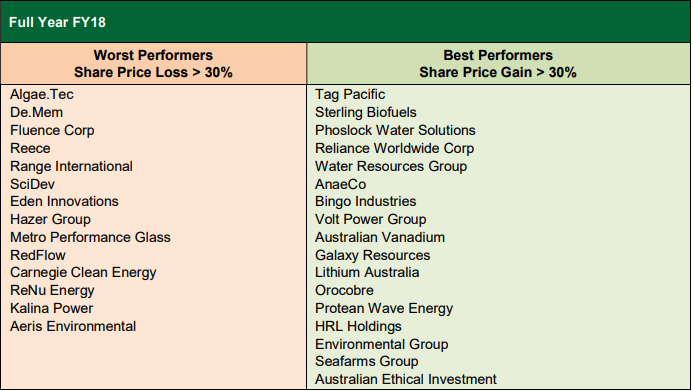

This year’s CleanTech Index performance was driven by 17 companies which saw gains of over 30 per cent, according to Cleantech’s annual report out today.

The top performers were environmental services company HRL Holdings (ASX:HRL), waterways cleaner Phoslock Water Solutions (ASX:PHK) and miner Australian Vanadium (ASX:AVL).

The Index includes companies from energy through to water and low emission vehicle technologies — hence the inclusion of Australian Vanadium.

The Index includes five sub-indices on water, waste, sustainable miners, energy storage, and renewable energy.

The gains were partially offset by 14 companies that lost more than 30 per cent.

The worst performers were pallet maker Range International (ASX:RAN), green concreter Eden Innovations (ASX:EDE) and heat energy generator Kalina Power (ASX:KPO).

Interestingly, of the five the water index was the best performer, rising 45.9 per cent in 2018.

While Phoslock gained 105 per cent over the year, notable water stocks Fluence Corp (ASX:FLC) lost 54 per cent and De.Mem (ASX:DEM) lost 59 per cent.

Blue Sky Alternative, a listed water investor, lost 81 per cent after a US short seller pointed out flaws in the way it valued its investments.