Apex predators: Here’s how the ASX’s gamers are trying to get a slice of the $US130bn esports pie

Tech

Tech

By now, even a partial observer of the global esports market knows gaming is big business.

But in case you’re still a non-believer, here’s an eye-opening quote from Animoca Brands’ Chairman Yat Siu:

“How do you get that three per cent to four or five, because a one per cent increase is a $20 billion market.”

We italicised that one per cent bit in case you missed it. We’ll revisit that later, but first, let’s look at the latest reports.

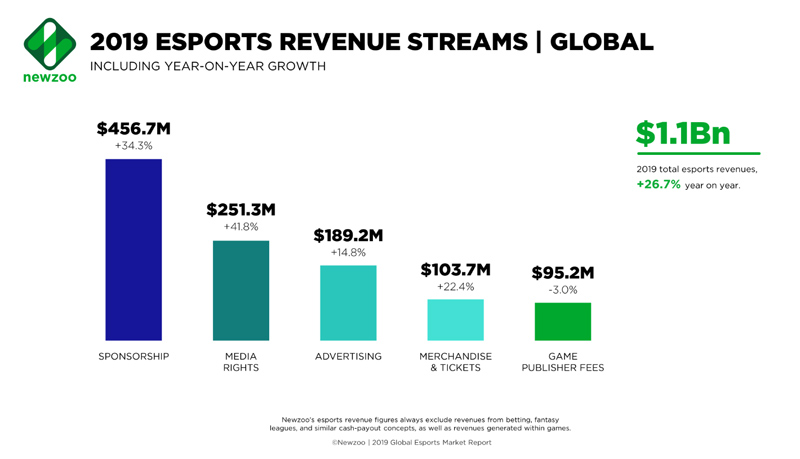

Global esports revenues are expected to climb above $US1 billion for the first time this year, according to esports analytics firm Newzoo.

Most of that will come from advertisers, who now see esports events such as gaming tournaments as an important avenue for sponsorships and marketing.

For the video games market more broadly, it’s a whole different set of numbers; a $US130 billion industry which is largely being driven by growth in gaming products for mobile and tablets.

For investors looking to gain exposure to that growth via ASX-listed stocks, it’s still pretty slim pickings in the local market.

But revenue and monetisation models are yet to be nailed down — a reality reflected in the share prices of the six gaming stocks tracked by Stockhead.

Only two stocks, Animoca Brands (ASX: AB1) and eSports Mogul (ASX: ESH), have gained ground over the last 12 months.

And only two of the six made money in the December quarter. Here’s a summary of their performance:

| ASX code | Name | Price ($) | 1yr total return | Q4 Revenue | Market Cap |

|---|---|---|---|---|---|

| AB1 | ANIMOCA BRANDS CORP LTD | 0.09 | 22% | $6.9m | $67,684,848.00 |

| ESH | ESPORTS MOGUL ASIA PACIFIC | 0.016 | 14% | $0 | $21,577,322.00 |

| EM1 | EMERGE GAMING LTD | 0.01 | -54% | $0 | $5,288,342.00 |

| SHO | SPORTSHERO LTD | 0.07 | -62% | $0 | $18,883,858.00 |

| ICI | ICANDY INTERACTIVE LTD | 0.055 | -66% | $285,000 | $17,013,388.00 |

| KNM | KNEOMEDIA LTD | 0.021 | -78% | $0 | $15,055,215.00 |

Despite the cashflow problems, activity in the sector is still ticking away with a couple of capital raisings and new deal announcements so far in February.

Here’s a look at the two companies that have found favour among investors over the last 12 months:

Animoca Brands

Animoca’s product offering is aligned with the broader gaming industry and the booming growth in mobile games.

The stock price shot from 7 cents to 12 cents at the start of last year after the company announced a deal to publish CryptoKitties in China.

It’s struggled to build much momentum since then, but Chairman Yat Siu says the company is positioning to leverage off the booming growth of in-game purchases.

Speaking with Stockhead after a series of local investor meetings, the Hong Kong-based Siu described the potential size of the market.

“The gaming industry is a $138 billion industry, and over $70 billion comes specifically from in-game purchases,” he said.

“And that has only grown since mobile games came out. But only three or less per cent of users are responsible for the $70 billion. So $70 billion comes from a three per cent conversion rate.”

“The industry has obtained growth because the adjacent markets have growth, but the conundrum is how do you get that three per cent to four or five, because a one per cent increase is a $20 billion market.”

Siu said the next step for Animoca is to effectively utilise blockchain to provide an easy and secure way for gamers to store and trade their digital assets obtained via in-game purchases.

eSports Mogul

Adjacent to the market for actual games, ESH is a dedicated esports platform which brings together networks of gamers, game developers and tournament organisers.

The company turned some heads at the start of this year when it added the insanely popular Fortnite game to its $275,000 gaming tournament in February.

In case you missed it – or don’t have kids – Fortnite has been the scourge of parents worldwide for the past year, encrusting more than 200 million players to their couches and beds and helping Epic Games bank an estimated $3 billion profit by the end of 2018.

It finally has what looks to be a genuine challenger, EA’s Apex Legends, which launched at the start of February. Within a week, it had been downloaded 25 million times and was pulling 2 million concurrent players.

With its Fortnite tournament to manage, February has been a busy month for ESH.

It hired more staff said user growth rapidly accelerated by 50 per cent since January 31, with 1.5 million users now on the platform.

But while there’s plenty of activity in the esports market, the company is yet to monetise it into a revenue stream.

It didn’t make money in the three months to December and forecast March quarter outflows of $1.6 million.

To provide some extra capital, the company lodged a 3B form with the ASX where it announced the issue of 13.4 million additional shares.