Vanadium small caps are rocketing. Here’s what you need to know

Mining

Mining

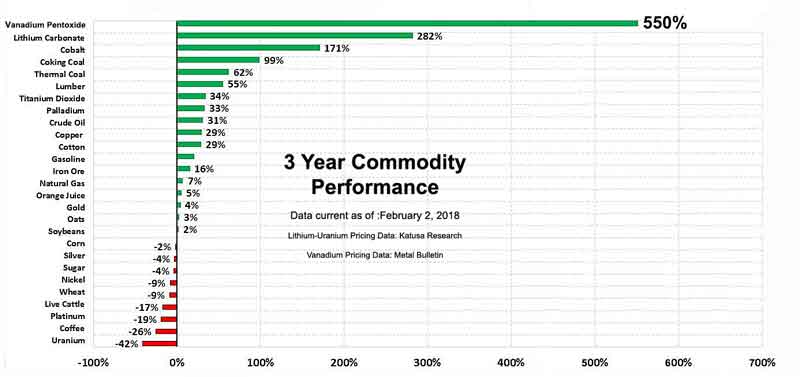

The price of vanadium has rocketed 550 per cent in the past three years, outpacing other commodities, and investors want a piece of the pie.

King River Copper (ASX: KRC), which has a vanadium and titanium landholding in Western Australia, has witnessed its share price rocket 1900 per cent in the past year.

Golden Deeps (ASX:GED) is up 200 per cent and Australian Vanadium (ASX:AVL) has gained 153 per cent.

About 90 per cent of global vanadium production is used to make high-strength steel, but future demand stems from its role in vanadium redox flow batteries (VRBs), which can store more power and discharge it over a much longer period than lithium-ion batteries.

Protean Energy (ASX:POW) chairman Bevan Tarratt told Stockhead that the main drivers of vanadium demand was China’s shift away from polluting, lower-grade steel to a higher-grade product and blue sky” on the battery storage front.

“You’ve got a physical demand at the moment out of China and then a future demand out of that battery side,” he said. “I think the deficit that sits there at the moment is only going to get greater.”

Expert view: vanadium, tungsten and graphene lead second-boom tech metals

Protean Energy is advancing its vanadium project in South Korea and aims to eventually supply the domestic market.

South Korea is one of the largest steel producers globally and the country is also looking to establish itself as a major player in the VRB space, with heavyweights Samsung and LG looking to break into the market.

Technology Metals Australia (ASX:TMT) executive director Ian Prentice told Stockhead that vanadium redox flow batteries would be the big driver of demand over the next two to five years.

“You’ve got a couple of really large batteries being built at the moment in China,” he said.

“Rongke Power in Dalian province is building ultimately what’s going to be a 200MW/800MWh battery, which is going to need something like 7000 tonnes of vanadium pentoxide.

“Largo, which is producing out of Brazil — their nameplate is about 10,000 tonnes per annum. So that one large battery is going to use something like 70 per cent of their annual production.”

The outlook for vanadium has seen investors scramble to gain exposure to the metal.

Eleven of 16 ASX-listed vanadium players tracked by Stockhead (see table below) have made gains in the past 12 months.

(Ed’s note: we updated the following table in September 2018)

| ASX code | Company | 12-month price change | Six-month price change | Price Sep 11 | Market Cap |

|---|---|---|---|---|---|

| TNO | TANDO RESOURCES (listed Nov 2017; adjusted for split) | 2.02325581395 | 0.625 | 0.13 | 22.7M |

| ACP | AUDALIA RESOURCE | -0.1 | -0.307692307692 | 0.009 | 5.3M |

| KRC | KING RIVER COPPE | 5.44444444444 | -0.317647058824 | 0.058 | 70.6M |

| LTR | LIONTOWN RESOURC | 2.22222222222 | -0.236842105263 | 0.029 | 32.3M |

| AVL | AUSTRALIAN VANAD | 2 | -0.0425531914894 | 0.045 | 69.7M |

| TMT | TECHNOLOGY METAL | 1.48837209302 | 0.597014925373 | 0.535 | 31.9M |

| RDS | REDSTONE RESOURC | 0.833333333333 | 0.692307692308 | 0.022 | 7.5M |

| KOR | KORAB RESOURCES | 0.736842105263 | 0.137931034483 | 0.033 | 10.0M |

| VMC | VENUS METALS COR | 0.727272727273 | 0.357142857143 | 0.19 | 14.8M |

| EME | ENERGY METALS LT | 0.609195402299 | 0.12 | 0.14 | 29.4M |

| SBR | SABRE RES | 0.444444444444 | -0.133333333333 | 0.013 | 4.8M |

| IRC | INTERMIN RES | 0.436170212766 | -0.413043478261 | 0.135 | 35.3M |

| POW | PROTEAN ENERGY L | 0.4 | -0.243243243243 | 0.028 | 8.5M |

| RTR | RUMBLE RESOURCES | 0.163636363636 | 0.163636363636 | 0.064 | 22.5M |

| SO4 | SALT LAKE POTASH | 0.0444444444444 | -0.145454545455 | 0.47 | 84.0M |

| NMT | NEOMETALS | 0.0181818181818 | -0.164179104478 | 0.28 | 149.6M |

| TNG | TNG | 0 | -0.129032258065 | 0.135 | 112.3M |

| CZR | COZIRON RESOURCE | -0.0625 | -0.285714285714 | 0.015 | 26.8M |

| CHN | CHALICE GOLD MIN | -0.0666666666667 | -0.2 | 0.14 | 40.0M |

| ARU | ARAFURA RESOURCE | -0.123595505618 | -0.297297297297 | 0.078 | 54.1M |

| MZN | MARINDI METALS L | -0.125 | -0.222222222222 | 0.007 | 10.7M |

| GED | GOLDEN DEEPS | -0.16 | -0.125 | 0.042 | 7.0M |

| AEE | AURA ENERGY | -0.192307692308 | 0.05 | 0.021 | 22.5M |

| AUR | AURIS MINERALS L | -0.289156626506 | 0.18 | 0.059 | 24.1M |

| AVZ | AVZ MINERALS | -0.331034482759 | -0.612 | 0.097 | 181.3M |

| SXX | SOUTHERN CROSS | -0.333333333333 | -0.333333333333 | 0.006 | 6.5M |

| SYR | SYRAH RESOURCES | -0.359267734554 | -0.333333333333 | 2.24 | 764.1M |

| MTB | MOUNT BURGESS | -0.375 | -0.285714285714 | 0.005 | 2.5M |

| PNN | PEPINNINI LITHIU | -0.384615384615 | -0.733333333333 | 0.008 | 4.7M |

| SRN | SUREFIRE RESOURC | -0.411764705882 | -0.411764705882 | 0.01 | 4.2M |

| SI6 | SIX SIGMA METALS | -0.416666666667 | -0.5 | 0.007 | 3.7M |

| TON | TRITON MINERALS | -0.520833333333 | -0.494505494505 | 0.046 | 38.9M |

| LML | LINCOLN MINERALS | -0.577777777778 | -0.40625 | 0.019 | 12.1M |

| BAT | BATTERY MINERALS | -0.597014925373 | -0.625 | 0.027 | 31.2M |

| PUR | PURSUIT MINERALS | -0.783673469388 | -0.518181818182 | 0.053 | 4.2M |

| MUS | MUSTANG RESOURCE | -0.898876404494 | -0.625 | 0.009 | 10.3M |

“We’ve had a number of funds phone us and say they want exposure to the vanadium market, but there’s just a complete lack of ASX-listed companies with vanadium,” Mr Tarratt said.

“So that’s partly why there’s been a run in things like Technology Metals Australia and King River Copper.”

Rumble Resources (ASX:RTR) has climbed 108 per cent, while Technology Metals Australia is up 52 per cent.

Technology Metals, which is focused on its Gabanintha vanadium project in Western Australia, recently received firm commitments to raise $3 million via a placement that was oversubscribed.

“We listed in December 2016 and into a market where there wasn’t a very high level of awareness of what vanadium was at all,” Mr Prentice said.

“There was a bit of a trickle of interest coming in about middle of last year and then I guess the wave has come along since Christmas into this early part of the new year.

“I think it’s just an increased awareness and understanding that this is most likely going to be the next battery metal that has a significant run – the price has already gone up more than 400 per cent since we listed.”

Although Mount Burgess Mining (ASX:MTB) is down 22 per cent over the year, the company’s share price doubled on Friday after it told investors it had uncovered shallow vanadium at its Kihabe deposit in Botswana, where it has been looking for zinc, lead and silver.

“What they’re looking at right now for instance is combining [VRBs] with solar,” chairman and managing director Nigel Forrester told Stockhead.

“There hasn’t really been any good way of storing that solar power. So you can generate that power during the daylight hours, but at night time there’s nothing you can do with it.

“So the whole association of solar, these batteries and just the fact they can store huge amounts of power for huge periods of time, which is something that is going to impact ultimately on controlling carbon emissions so we’ve got to look at it.”