TopTung has just doubled its Nickel-Copper Sulphide landholding in Canada

Mining

Mining

Special Report: The acquisition of three advanced nickel-copper sulphide projects is putting explorer TopTung on the fast track to production.

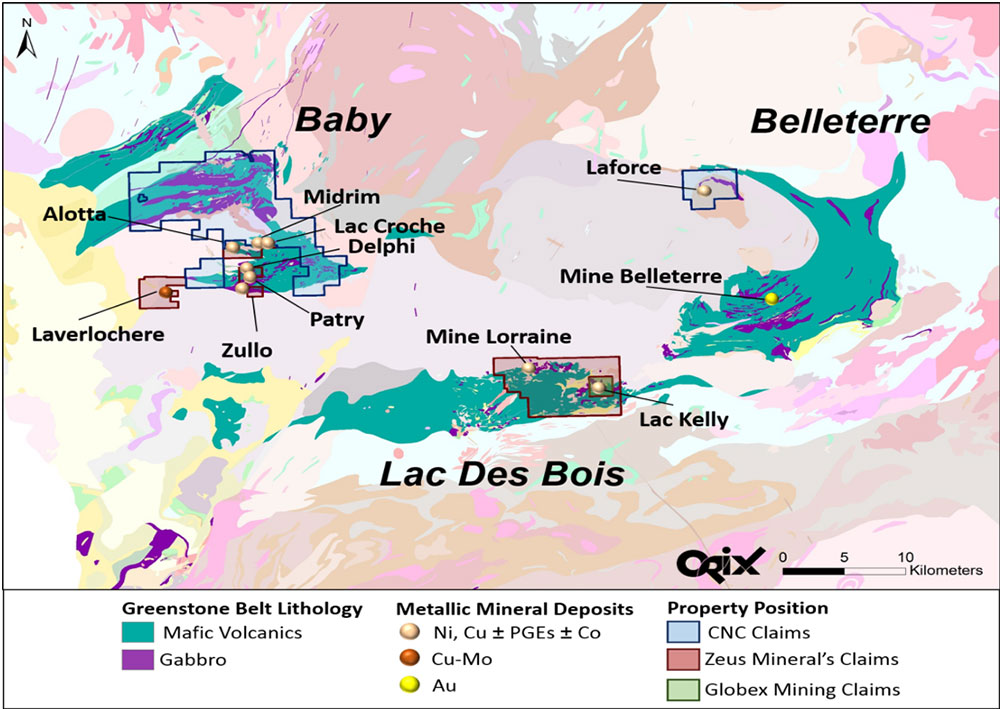

TopTung (ASX:TTW) has entered a conditional agreement to acquire Canadian Nickel Corporation (CNC) and its three advanced nickel-copper sulphide projects — Midrim, Lac Kelly and Laforce – in Quebec, Canada.

This will more than double TopTung’s landholding in the area and represents the first time these project areas have been consolidated since 2005.

These projects sit in the same mineral belt as TopTung’s Alotta project, where recent drilling showed the deposit was well suited to near term, low-cost mining and toll milling.

This drilling included significant high-grade, near surface massive sulphide mineralised zones up to 3.04 per cent nickel and 4.81 per cent copper.

>> Follow TopTung on Twitter for the latest updates @ToptungLtd

Midrim complements Alotta very well – they are just 1.5km apart, with high grade and shallow mineralisation containing high value by-products, including platinum group elements (PGE) and cobalt.

Previous high-grade world class intercepts at Midrim include:

Anything above 3 per nickel is considered high grade.

Sulphide is superior

Nickel is usually found in two main ore types – sulphide or laterite.

Sulphides are much cheaper to turn into battery grade nickel sulphate than nickel laterites and fetch a higher price.

And it’s important to note that nickel sulphides are usually found at least 100m underground — but this region hosts a lot of high-grade “pods” close to surface.

Usually, the closer a deposit is to the surface, the cheaper is to mine and these deposits look like they are amenable to simple open pit mining.

A bulk sample scoping study commissioned by CNC to assess the viability and profitability of a simple mining, trucking and toll milling operation at Midrim is almost complete.

Miners undertake up to four different types of studies when examining whether or not a resource can be mined economically.

These are — in order of importance — scoping, preliminary feasibility (PFS), definitive feasibility (DFS) and bankable feasibility (BFS).

The results of this study are important – because they allow TopTung to determine what scale of operation and grade of mineralisation is required for its mining and toll treating business model to be successful.

Toll treating means processing its ore at local, established third party smelters and refineries.

Toll treating allows TopTung to start producing and making money without having to build expensive infrastructure first.

The company can simply truck mined rock about 200km (3-hour drive) to nearby Sudbury, the biggest Nickel processing hub in the world where established smelters and refineries are built to process ores typically found in the area.

“So our focus and what we need to achieve is very simple – we just need to locate and define a few of these high-grade pods, whether that be through acquisition or exploration, and we’re off to the races,” TopTung chairman Dr Leon Pretorius told Stockhead.

“We don’t need to build a refinery. It’s going to be a very low-cost simple process.”

In order to better reflect this new direction, the company has proposed a name change to Chase Mining Corporation Limited.

This special report is brought to you by TopTung.