This Sultan Resources director’s approach is all about value for shareholders

Mining

Mining

Special report: With Eddie King on its team, Sultan Resources is very much focused on building shareholder value.

Mr King has a methodical approach to turning unloved, low enterprise value companies into success stories and that is what he is setting out to do with newly minted Sultan (ASX:SLZ) in his role as a non-executive director.

“My background in engineering has set me up for a methodical approach to the way we approach these businesses and companies – ticking the boxes, de-risking as much as possible, getting the right team together, applying those engineering basics that I learnt through my establishment,” he told Stockhead.

“That’s the way I like to approach it so that it gives every opportunity for shareholders and these companies to succeed.”

Described as “pretty modest”, Mr King is held in high regard by the people in his team.

Mr King holds a Bachelor of Commerce and Bachelor of Engineering (Mining Systems) from the University of Western Australia.

His experience includes managing a boutique investment banking firm, where he specialised in the technical and financial analysis of global resource projects for equity research and mergers and acquisitions.

He also represented a stockbroking and corporate advisory firm where he specialised in providing corporate advisory services for micro-cap ASX-listed companies.

Mr King is a director of ASX-listed companies European Cobalt (ASX: EUC), Eastern Iron (ASX: EFE), Drake Resources (ASX: DRK), Axxis Technology Group (ASX: AYG), Six Sigma Metals (ASX: SI6), Bowen Coking Coal (ASX: BCB) and Pure Minerals (ASX: PM1).

Keys to good investment

The top three things investors should look for in a good resources company are valuation, people and grade, according to Mr King.

“When you’re investing in a microcap company you’re usually drawn in by the people or quality of the projects but sometimes valuation is forgotten. You’ve got to look at the valuation also because you have to be comfortable with what you pay as an entry price,” Mr King explained.

Sultan has an enterprise value of just $1.4 million and market cap of just $4.6 million at a share price of 18c currently.

The company has assembled an exploration project portfolio in Western Australia highly prospective for gold, copper, nickel and cobalt.

Sultan made its ASX debut in mid-August.

Mr King believes one of the most important things in building a successful company is to ensure hard-earned shareholder funds go into exploration and building value.

“The worst thing you can do as a micro-cap is raise $4 million and spend much of it in administration and legacy issues rather than put those dollars into the ground,” he said.

“My business model is based on helping shells or low-enterprise-value companies and really going through the motions of cleaning them up, making sure the right people are in place and just making sure that everyone is aligned in the goals of what it is we’re going to do to add shareholder value.”

‘Looking for elephants in elephant country’

And what better way to give a company the best possible chance of success than by securing projects right near other big existing mines and recent new discoveries.

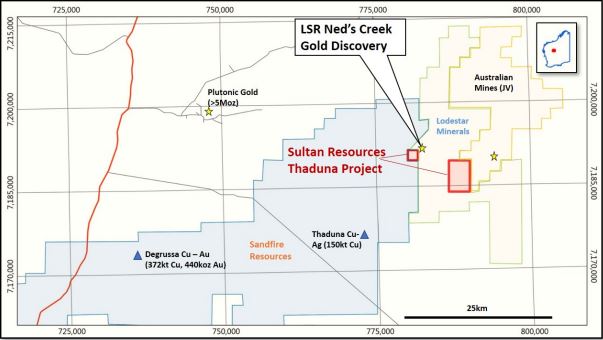

Sultan’s Thaduna project is located 190km northeast of Meekatharra and adjacent to Lodestar Minerals’(ASX: LSR) Ned Creek gold discovery.

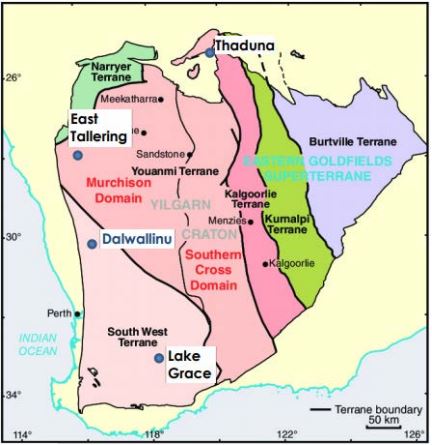

Over the past year, Lodestar has uncovered what appears to a be a major intrusion-related gold system with similar characteristics to a number of 1-million-ounce-plus gold deposits elsewhere in the Yilgarn Craton.

Sultan believes Lodestar’s discovery continues into its Thaduna landholding.

“Our current expectations are that that geological structure continues into our territory and we’re hoping that if they’ve got the tip then we’ve got the bigger part of the iceberg flowing into our boundary, and that’s what we’re hoping to discover with drilling,” Mr King said.

“The best place to find new gold mines is near or under existing ones.

“We’re looking for elephants in elephant country and if you want to go looking for a new gold mine, go to where there’s lots of gold mines.”

One example is Bellevue Gold (ASX:BGL), which has found another million ounces under the old Bellevue mine that was one of Australia’s highest grade gold mines producing around 800,000 ounces at 15 grams per tonne (g/t).

Anything over 5g/t is considered high-grade.

Grade is also a priority for Sultan.

“What I’d like to see first is grade,” Mr King said. “If we can get some good grade showings on surface samples and then some drill hits, then that’s really half the job done.”

The company is working towards the start of drilling at the Thaduna project.

This special report is brought to you by Sultan Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.