You might be interested in

Mining

Reporting Rodeo: Here's how analysts think the ASX's big miners will shape up in March quarter reporting season

Mining

Want a chart that shows good things could be on the cards for copper? OFC you do

News

Mining

Ambitious $3m market cap Alloy Resources (ASX:AYR) is prepping for a hectic but potentially company-changing year.

This includes working towards near-term gold production (and cash flow) at the Horse Well project, and finally punching some holes into six untouched copper-gold targets in JV with Rio Tinto in the red-hot Paterson Province.

But Alloy also plans to hit the ground running at a couple of new projects neighbouring DeGrussa and Nebo-Babel – Australia’s most significant recent copper-gold discoveries.

Alloy has just announced plans to acquire unlisted company Dingo Resources, which has options over these two projects.

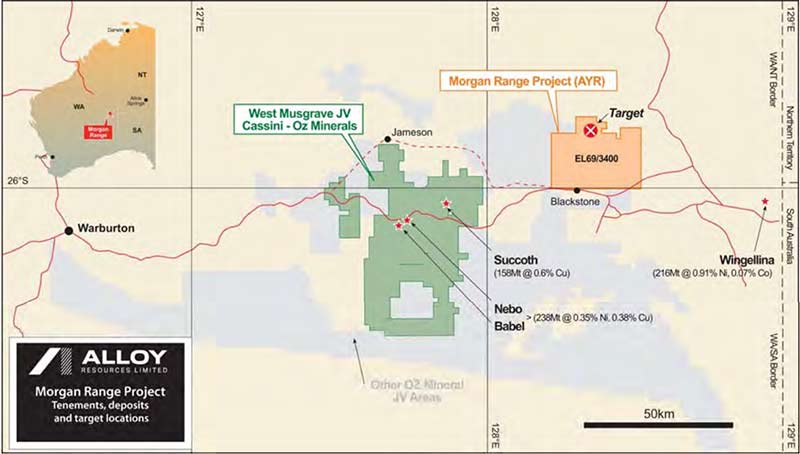

The first is Morgan Range in the West Musgrave belt of WA, home to Australia’s largest undeveloped nickel-copper deposit Nebo-Babel, owned by Cassini Resources (ASX:CZI) and OZ Minerals (ASX:OZL).

The main target at Morgan Range — a large electromagnetic anomaly — was defined by previous exploration but never drilled.

In 2015, Rio Tinto Exploration (RTX) recognised this anomaly as a priority during a regional technical review and made an application for the area, which has now been optioned to Dingo.

Under the deal, RTX will have the right to re-acquire a 60 per cent JV interest in Morgan Range if Alloy defines a resource with an ‘in the ground’ value of +$1bn.

If Rio decide to kick on with the JV, they must reimburse Alloy’s exploration spend to date and sole fund the first $40m of joint venture expenditure.

Alloy chief exec Andy Viner calls this the perfect low-cost, high-reward type opportunity all explorers are looking for.

“The reason it’s low cost is that we don’t have to do the work to generate the target; its already been found,” he says.

“These opportunities are very hard to find. I think when you have a big brother like Rio Tinto saying: ‘all our guys are really excited about it – it could be the next Nebo-Babel’ it gives you a lot of confidence.

Alloy wants to complete a first-ever 2,000m drill program to test this conductor at depth, “maybe as soon as the middle of the year”.

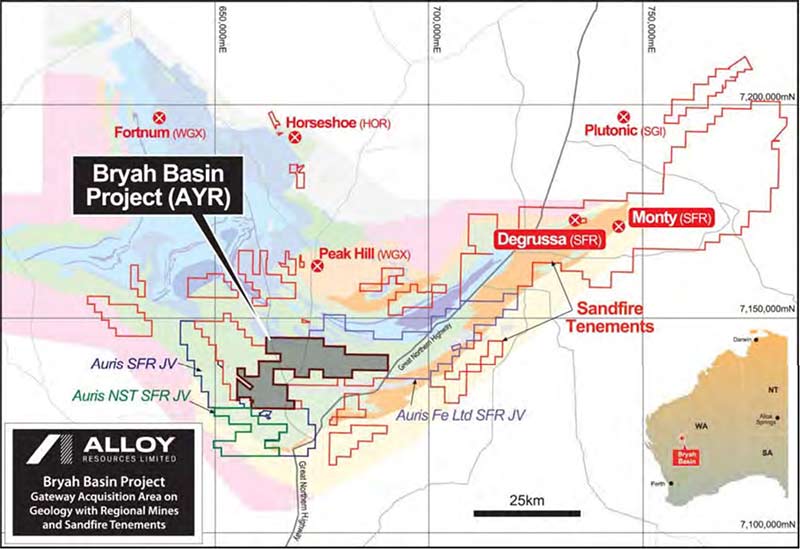

Dingo’s second project is in the Gascoyne district of WA, home to Sandfire Resources’ (ASX:SFR) world-class DeGrussa and Monty VMS deposits. Another great neighbourhood.

In fact, Sandfire, looking for the next big deposit, is actively exploring in the area and holds tenements and JVs that completely surround Dingo’s 260sqkm Bryah Basin project.

READ: Zero to Hero — this is how copper play Sandfire went from 4c to over $8 in 18 crazy months

And yet historical exploration at Byrah Basin has been quite limited — most drilling is less than 60m deep — mainly due to the extensive ‘cover’ that extends through the project area.

Still, this historic drilling managed to highlight several copper and gold targets beneath cover that have not been followed up since the development of DeGrussa in 2009. This mineralisation remains poorly understood due to the lack of deep drilling, Viner says.

“It’s one of the reasons I like this project,” he says.

“With very little rock outcrop [to guide geologists], hardly anything has been done on this block of land over the past ~12 years since DeGrussa was discovered.

“It’s just incredible.”

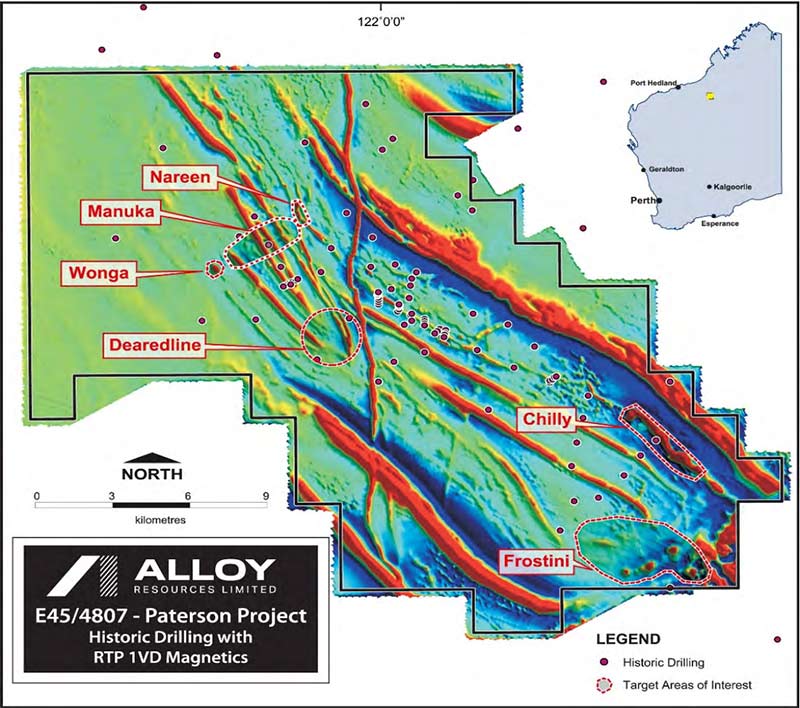

In 2018, Alloy entered into a JV deal with RTX over a 423sqkm landholding in the Paterson Province of WA, just 25km from the 32 million-ounce Telfer gold deposit.

RTX can earn an initial 70 per cent by spending $500,000 within three years.

An eight-hole drilling program across six very interesting copper-gold target areas is now expected to be undertaken in April-May 2020. Early success here could be another game changer for Alloy.

Viner is confident this program, delayed a couple of times, will kick off as scheduled.

“Late last year RTX had graders and dozers in there to clear the drill pads,” he says.

“I was just talking to one of their guys yesterday — he’s pretty sure they will be on the ground in April.”

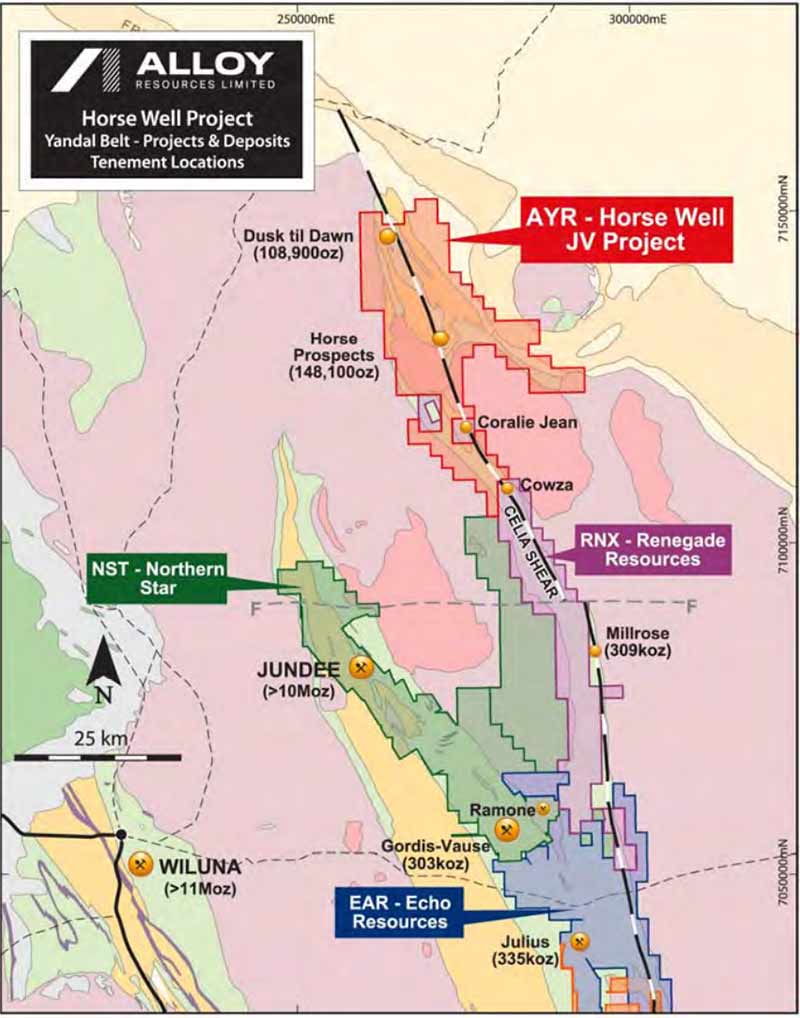

Over at the Horse Well JV with gold producer Silver Lake Resources (ASX:SLR), Alloy is aiming to define some shallow high-grade resources that at current gold prices would support trucking and toll milling for some quick cash.

“We will do scoping studies and work out the economics, talk to [neighbouring miners] Blackham Resources and Northern Star to try line up a milling option,” Viner says.

“Blackham is more likely, because they are running out of free milling ore.

“I’ve already talked to them, and I know they are looking. They would love 500,000t a year.”

Viner says a partial sale could also be on the cards. The ultimate aim would be to use Horse Well to fund exploration at these other projects.

That’s four-potential dial-moving projects for this $3m market cap tiddler.

“It’s a good story,” Viner says.

“Alloy is a revitalised company that has really good projects. There’s going to be a lot of action, and we are looking forward to cranking it up.”