There is no stopping iron ore right now

Mining

Iron ore keeps on surging with both spot and futures markets closing at multi-year highs on Wednesday.

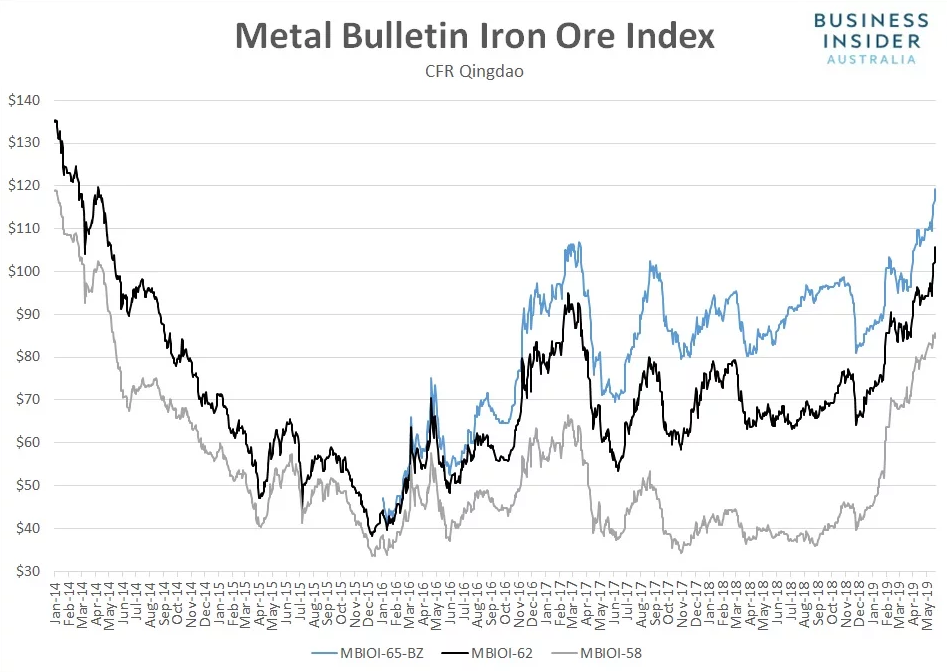

According to Metal Bulletin, the spot price for benchmark 62% fines surged 3.4% to $105.78, leaving it at the highest level since May 7, 2014.

The benchmark has now rallied in each of the past five sessions, gaining 12.1% in the process. From late November last year, it’s surged 65%.

Like the benchmark price, large gains were also seen in lower and higher grade ore on Wednesday.

58% fines jumped 1.6% to $85.70 a tonne while 65% added 2.2% to settle at $119.20 a tonne. Both grades also sit at multi-year highs, having jumped 116% and 47% respectively since the end of November.

Supply disruptions in Brazil and soaring steel production in China, both the largest consumer of iron ore and largest producer of steel globally, have helped to fuel price gains over recent months, resulting in a steep decline in Chinese iron ore port inventories.

Improved steel mill profit margins in China, encouraging output to ramp up at a time when demand is strong, has been another factor.

“Investors expect steel mills to accept even higher iron ore prices as mills are keen to ramp up more output to cash in on fat profit margins,” a Beijing-based trader told Reuters.

According to Morgan Stanley’s global metals and mining team, gross profit margins for mills operating in Tangshan, China’s largest steel production hub, currently sit at around 400 yuan a tonne for hot-rolled coil product and an even larger 600 yuan a tonne for rebar.

“On average, post financing costs, overheads and tax, profit margins are around 300 yuan a tonne,” analysts at the bank said in a note released this week.

Mirroring the move in spot markets, Dalian iron ore futures staged another crazy rally on Wednesday, surging as high as 733 yuan, the highest level on record.

The September 2019 contract eventually finished the session at 728 yuan, up from 717.5 yuan on Tuesday evening.

Rebar and hot-rolled coil futures in Shanghai also pushed higher, lifting to 3,910 and 3,757 yuan respectively.

In contrast, coking coal and coke futures eased after surging on Tuesday, finishing the session at 1,387.5 and 2,296.5 yuan respectively.

There was little movement on those levels in overnight trade on Wednesday, especially in rebar and iron ore contracts which were near-unmoved from the day session close.

SHFE Hot Rolled Coil ¥3,741 , -0.45%

SHFE Rebar ¥3,911 , 0.15%

DCE Iron Ore ¥729.00 , 0.97%

DCE Coking Coal ¥1,386.50 , -1.28%

DCE Coke ¥2,274.00 , -1.22%

The mixed price performance provides few clues as to whether the rally in iron ore spot markets will continue on Thursday.

Trade in Chinese commodity futures will resume at 11am AEST.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.