You might be interested in

News

ASX Small Caps Lunch Wrap: Inflation a little higher than expected, but then so is the ASX

Mining

FMG Results: Fortescue stunned by 'mind-blowing' China renewables rollout, says steel demand is diversifying

Mining

Mining

Major miner Fortescue Metals (ASX:FMG) will form a $4m exploration JV with Tasman Resources (ASX:TAS), right next door to BHPs massive Olympic Dam mine in South Australia.

Olympic Dam – which is aiming to produce 215,000 tonnes of copper for FY19 — is the third largest copper equivalent deposit, the largest uranium deposit, and third largest gold deposit in the world.

Tasman investors loved the news, sending the stock up 25 per cent to 3.5c in early trade.

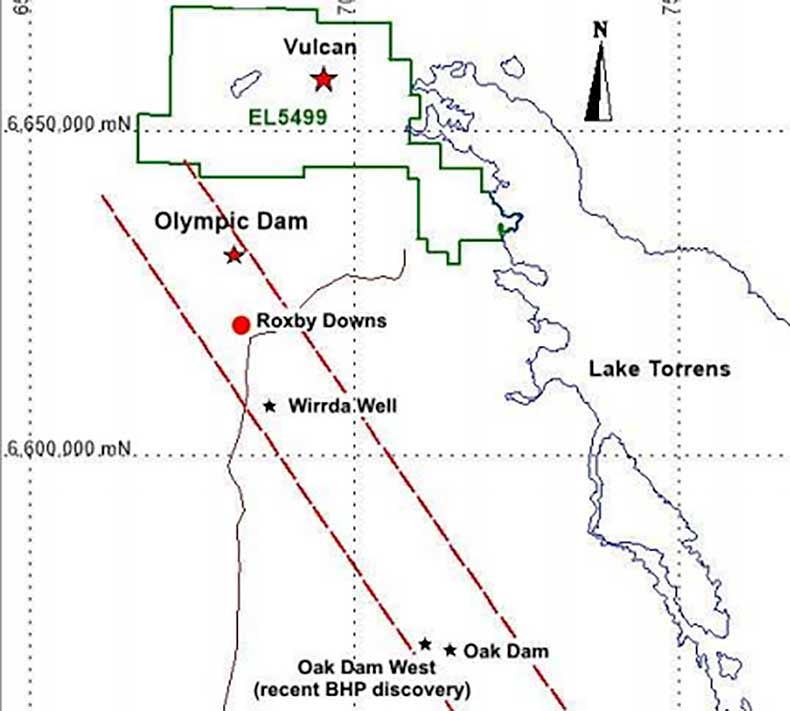

Tasman’s project, which hosts the Vulcan iron oxide-copper-gold-uranium (“IOCGU”) prospect, is only 30km north of Olympic Dam.

Fortescue, which will be project manager, can earn a 51 per cent interest by sole funding $4m on exploration expenditure within three years.

The miner can increase its stake to 80 per cent by sole funding a further $7 million, five-year exploration program.

Tasman has been chipping away at this project for over a decade.

The explorer’s first drill hole at Vulcan in November 2009 intersecting a new mineralised and altered IOCGU system — at 870m depth.

Those deep holes are expensive, especially for a junior explorer.

In 2011, Tasman entered a farm-in agreement with cashed-up major Rio Tinto.

Another bunch of deep diamond drill holes were completed, again all intersecting significant thicknesses of IOCGU style mineralisation and alteration, Tasman said.

The two-stage farm-in agreement could’ve seen Rio earn 80 per cent of the project by spending up to $75m in exploration plus $17m in cash payments to Tasman.

In 2014, Rio pulled out after spending just $10 million on the project, leaving Tasman with 100 per cent ownership.