You might be interested in

News

Closing Bell: ASX selloff softens… then pummels again last minute; Rinehart ups stake in Lynas

Mining

REE Survival Guide Part 3 – these ASX juniors are pouring into Brazil’s rare earths scene

Mining

Mining

Last year Roskill expected cobalt to grab its “fair share of headlines” in 2019 – and they weren’t wrong.

It’s all happening.

Last week, Glencore told investors that a wave of supply from its subsidiary Katanga would be deferred until at least 2020 after the Democratic Republic of Congo (DRC) Government wasn’t convinced by the miner’s plan to remove radioactivity from the cobalt.

Glencore then reportedly slashed workforce numbers at the 27,000 tonnes a year Mutanda mine, also in the DRC, amid rising production costs and an “uncertain political climate”.

And now there’s speculation that Zambian copper-cobalt refiner Chambishi Metals, which sources most of its feedstock from the DRC, has suspended operations.

Last year, Mutanda and Katanga together were expected to contribute around 50,000 tonnes of mined supply in 2019, CRU senior analyst George Heppel says.

That’s about 30 per cent of global cobalt supply, and more than 40 per cent of DRC production.

“Given the expected reduction in output from Mutanda (as well as the halting of shipments from Katanga), we expect to see about 15,000 tonnes less output from the DRC in the first half of 2019,” Mr Heppel told Stockhead.

Scroll down for the performance of ASX listed smallcaps with exposure to cobalt>>>

Prices haven’t recovered because high cobalt prices, which peaked at about $98,000 a tonne, sparked an explosion in cobalt intermediate production in the DRC last year.

Cobalt hydroxide stockpiles are still very high.

While these have declined in the wake of lower prices, “there remain significantly large inventories of intermediate material in Africa at the moment”, Mr Heppel says.

“So we expect Glencore’s production curtailments can largely be absorbed by the market,” he says.

“This idea is supported by the fact that payables have barely nudged since the Katanga news last year, and remain at a market bottom of around 60 per cent for clean hydroxide, and in the 40s and 50s for concentrates and off-spec material.”

Plus, any disruption to Chambishi’s output – just 2300 tonnes in 2018 — is largely expected to be temporary.

Unless the refinery shuts down entirely, the market is unlikely to be severely impacted by the news of layoffs at the smelter, Mr Heppel says.

Are battery makers and auto companies concerned enough about these issues plaguing the DRC to source their cobalt elsewhere?

It doesn’t seem that way, Mr Heppel says – if anything, auto makers have become “more accepting” of DRC volumes over the past 18 months.

In some cases, they are working on schemes which would allow them to work directly with artisanal (or small scale) miners, like this blockchain project between carmaker Ford and IBM.

So, while some new supply of cobalt could come from other jurisdictions, the DRC will continue to be the major source of cobalt for battery applications in the long-term, Mr Heppel says – “barring any ‘black swan event’ like a civil war, that is”.

Spoiler: it’s not civil war.

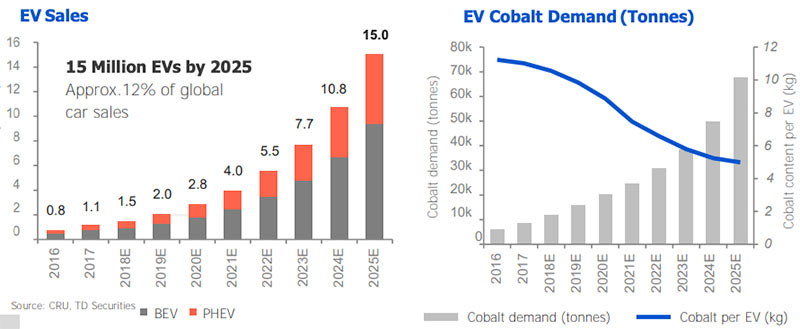

It’s generally accepted that we have enough cobalt until about 2022/2023; then things get hairy for battery makers and EV manufacturers.

This is when oversupply will turn into a supply deficit.

Last year Wood Mackenzie even said that despite the coming wave of supply (which is wavering, obviously) the cobalt market will enter a deficit “as soon as 2023”.

Benchmark Minerals Intelligence has predicted demand for EVs could spark a cobalt deficit as soon as 2022. Roskill has similar forecasts.

The good news is that there’s plenty of Australian cobalt juniors who are currently gearing up for first production as this deficit hits.

Australian Mines (ASX:AUZ) wants to kick off construction in 2019, with the first nickel-cobalt exports to Korean offtake partner SK Innovations’ European electric vehicle (EV) battery plant slated for 2022.

Clean TeQ (ASX:CLQ) is aiming for first production in 2021 at its advanced Sunrise nickel-cobalt project.

And then there are plenty of other promising juniors who are ignoring current negative sentiment and keeping their eyes fixed on the longer-term prize.

Australian Mines boss Benjamin Bell told Stockhead that no one is looking at today’s pricing when it comes to mine financing.

“Every bank that you talk to have their own forward forecasts for nickel pricing, cobalt pricing, EV demand, the AU-US dollar exchange rate – all these things.”

These numbers are not dissimilar when you talk amongst the different lenders, Mr Bell says.

“If you look at where the cobalt price was last year, it was probably 50 per cent higher than it is currently,” he says.

“Just like these lenders didn’t rely on that price, they aren’t relying on the price right now.”

Here’s a list of ASX stocks with exposure to cobalt.

Swipe or scroll to reveal the full table. Click headings to sort:

| Ticker | Name | Share Price [Mon Feb 11] | 1 Week Price Change % | 1 Year Price Change % | Market Cap |

|---|---|---|---|---|---|

| AUR | AURIS MINERALS | 0.04 | 33.3333 | -6.9767 | $16,347,254.00 |

| ASN | ANSON RESOURCES | 0.088 | 28.7879 | -59.5238 | $40,124,348.00 |

| BSX | BLACKSTONE MINERALS | 0.1 | 27.7778 | -74.4444 | $8,007,152.50 |

| CZN | CORAZON MINING | 0.0045 | 25 | -66.6667 | $6,326,416.50 |

| BUX | BUXTON RESOURCES | 0.12 | 20 | 0 | $15,646,375.00 |

| LML | LINCOLN MINERALS | 0.006 | 20 | -81.8182 | $3,449,902.00 |

| AUT | AUTECO MINERALS | 0.006 | 20 | 0 | $5,400,000.00 |

| VXR | VENTUREX RESOURCES | 0.22 | 19.4444 | -4.4444 | $51,652,112.00 |

| TRT | TODD RIVER RESOURCES | 0.074 | 19.3548 | -41.9385 | $11,510,067.00 |

| MZZ | MATADOR MINING | 0.19 | 18.75 | -40.625 | $10,237,833.00 |

| TAR | TARUGA MINERALS | 0.06 | 17.6471 | -25 | $8,470,034.00 |

| ADN | ANDROMEDA METALS | 0.007 | 16.6667 | 0 | $7,590,956.00 |

| JMS | JUPITER MINES | 0.29 | 14.5833 | 290.9465 | $519,132,608.00 |

| LPI | LITHIUM POWER INTERNATIONAL | 0.275 | 14.5833 | -33.7349 | $72,191,320.00 |

| INF | INFINITY LITHIUM | 0.071 | 14.5161 | -40.8333 | $13,882,491.00 |

| MXR | MAXIMUS RESOURCES | 0.071 | 13.2353 | -55.3623 | $2,149,384.25 |

| ENT | ENTERPRISE METALS | 0.009 | 12.5 | -40 | $3,492,564.75 |

| GPX | GRAPHEX MINING | 0.19 | 11.7647 | -36.6667 | $17,760,528.00 |

| RNU | RENASCOR RESOURCES | 0.02 | 11.7647 | -47.2222 | $20,761,638.00 |

| ZNC | ZENITH MINERALS | 0.067 | 11.2903 | -59.4118 | $14,255,063.00 |

| FEL | FE | 0.018 | 11.1111 | -60 | $7,472,559.50 |

| KDR | KIDMAN RESOURCES | 1.425 | 10.8 | -25.1351 | $560,644,416.00 |

| INR | IONEER | 0.15 | 10.7143 | -51.5625 | $228,622,448.00 |

| NZC | NZURI COPPER | 0.21 | 10.5263 | -30 | $54,742,516.00 |

| CZR | COZIRON RESOURCES | 0.011 | 10 | -42.1053 | $21,426,616.00 |

| BKT | BLACK ROCK MINING | 0.073 | 9.5238 | 23.2143 | $38,772,340.00 |

| SYA | SAYONA MINING | 0.023 | 9.5238 | -63.4921 | $43,031,500.00 |

| MIN | MINERAL RESOURCES | 17 | 9.2857 | -9.4294 | $3,195,461,376.00 |

| AMD | ARROW MINERALS | 0.014 | 7.6923 | -56.25 | $4,403,568.50 |

| BAU | BAUXITE RESOURCES | 0.08 | 6.6667 | 33.3333 | $17,153,786.00 |

| RTR | RUMBLE RESOURCES | 0.045 | 6.6667 | 0 | $16,780,330.00 |

| TLG | TALGA RESOURCES | 0.36 | 5.8824 | -47.8261 | $81,822,240.00 |

| OMH | OM HOLDINGS | 1.41 | 5.6818 | 27.3596 | $1,026,686,464.00 |

| KSN | KINGSTON RESOURCES | 0.019 | 5.5556 | -9.5238 | $22,017,570.00 |

| GED | GOLDEN DEEPS | 0.039 | 5.1282 | 17.1429 | $7,026,612.50 |

| POS | POSEIDON NICKEL | 0.042 | 5.1282 | -4.6512 | $108,350,776.00 |

| ARM | AURORA MINERALS | 0.021 | 5 | -38.2353 | $2,459,799.00 |

| WKT | WALKABOUT RESOURCES | 0.11 | 4.7619 | 12.2449 | $33,467,472.00 |

| HMX | HAMMER METALS | 0.023 | 4.5455 | -54 | $6,122,536.00 |

| ARU | ARAFURA RESOURCES | 0.048 | 4.4444 | -51.2927 | $34,627,348.00 |

| BAT | BATTERY MINERALS | 0.023 | 4.3478 | -72.4138 | $25,614,446.00 |

| CAZ | CAZALY RESOURCES | 0.024 | 4.3478 | -40 | $5,587,657.50 |

| S32 | SOUTH32 | 3.71 | 4 | 4.7126 | $18,690,437,120.00 |

| ORE | OROCOBRE | 3.315 | 3.7383 | -47.4763 | $899,673,536.00 |

| RIO | RIO TINTO | 92.1 | 3.4258 | 26.7252 | $133,327,994,880.00 |

| CRL | COMET RESOURCES | 0.032 | 3.2258 | -68 | $7,374,400.00 |

| E25 | ELEMENT 25 | 0.165 | 3.125 | -34 | $13,854,118.00 |

| COB | COBALT BLUE HOLDINGS | 0.17 | 3.0303 | -71.9008 | $20,557,934.00 |

| FCC | FIRST COBALT CORP | 0.19 | 2.7027 | -81.1881 | $59,381,320.00 |

| A4N | COLLERINA COBALT | 0.088 | 2.33 | -17.5 | $49,900,000.00 |

| SO4 | SALT LAKE POTASH | 0.455 | 2.2472 | 3.4091 | $92,821,760.00 |

| EMH | EUROPEAN METALS | 0.35 | 1.4493 | -28.5714 | $46,925,512.00 |

| BEM | BLACKEARTH MINERALS | 0.081 | 1.25 | -59.5 | $4,923,625.50 |

| PAN | PANORAMIC RESOURCES | 0.4875 | 1.0417 | 16.8675 | $239,846,064.00 |

| AML | AEON METALS | 0.29 | 0 | 14 | $173,303,568.00 |

| AYR | ALLOY RESOURCES | 0.003 | 0 | -50 | $4,731,233.00 |

| AZI | ALTA ZINC | 0.006 | 0 | -40 | $8,213,794.00 |

| ADV | ARDIDEN | 0.004 | 0 | -80 | $6,707,521.00 |

| ARE | ARGONAUT RESOURCES | 0.026 | 0 | 13.0435 | $40,413,896.00 |

| AGY | ARGOSY MINERALS | 0.135 | 0 | -60.2941 | $124,672,040.00 |

| ACP | AUDALIA RESOURCES | 0.009 | 0 | -28.3 | $10,700,000.00 |

| ANW | AUS TIN MINING | 0.015 | 0 | -30.4348 | $29,822,562.00 |

| BAR | BARRA RESOURCES | 0.036 | 0 | -18.1818 | $17,783,394.00 |

| BDI | BLINA MINERALS | 0.001 | 0 | -50 | $4,363,882.50 |

| BOA | BOADICEA RESOURCES | 0.155 | 0 | -29.5455 | $8,191,001.50 |

| BYH | BRYAH RESOURCES | 0.08 | 0 | -38.4615 | $4,868,009.50 |

| CAD | CAENEUS MINERALS | 0.001 | 0 | -66.6667 | $14,063,075.00 |

| CFE | CAPE LAMBERT RESOURCES | 0.016 | 0 | -69.2308 | $16,214,425.00 |

| CZI | CASSINI RESOURCES | 0.083 | 0 | 13.6986 | $27,295,060.00 |

| CDT | CASTLE MINERALS | 0.008 | 0 | -60 | $1,790,367.75 |

| CMC | CHINA MAGNESIUM CORP | 0.02 | 0 | -23.0769 | $7,048,771.00 |

| CNJ | CONICO | 0.016 | 0 | -52.9412 | $5,628,132.00 |

| CGM | COUGAR METALS | 0.002 | 0 | -75 | $1,955,605.38 |

| DHR | DARK HORSE RESOURCES | 0.004 | 0 | -80 | $8,892,390.00 |

| DTM | DART MINING | 0.005 | 0 | -43.0199 | $4,640,214.00 |

| DEV | DEVEX RESOURCES | 0.047 | 0 | -49.3535 | $4,321,187.00 |

| DGR | DGR GLOBAL | 0.12 | 0 | 36.3636 | $73,581,824.00 |

| EUC | EUROPEAN COBALT | 0.027 | 0 | -70.6522 | $19,804,130.00 |

| EUR | EUROPEAN LITHIUM | 0.09 | 0 | -55 | $49,492,940.00 |

| 4CE | FORCE COMMODITIES | 0.011 | 0 | -86.4865 | $4,239,158.50 |

| GLN | GALAN LITHIUM | 0.315 | 0 | 125 | $36,307,852.00 |

| GPP | GREENPOWER ENERGY | 0.003 | 0 | -76.9231 | $4,696,111.00 |

| GWR | GWR GROUP | 0.1 | 0 | 35.1351 | $22,816,570.00 |

| HGM | HIGH GRADE METALS | 0.009 | 0 | -86.3636 | $4,076,440.75 |

| IDA | INDIANA RESOURCES | 0.054 | 0 | -11.8501 | $5,167,087.50 |

| KTA | KRAKATOA RESOURCES | 0.025 | 0 | -44.4444 | $2,937,500.00 |

| LPD | LEPIDICO | 0.017 | 0 | -66.6667 | $53,698,804.00 |

| LTR | LIONTOWN RESOURCES | 0.024 | 0 | -27.2727 | $28,349,686.00 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | 0.335 | 0 | -14.6341 | $207,786,240.00 |

| MZN | MARINDI METALS | 0.005 | 0 | -54.5455 | $9,923,794.00 |

| MLS | METALS AUSTRALIA | 0.003 | 0 | -50 | $7,025,393.50 |

| MEI | METEORIC RESOURCES | 0.009 | 0 | -79.0698 | $5,170,102.00 |

| MTB | MOUNT BURGESS MINING | 0.005 | 0 | -44.4444 | $2,210,397.00 |

| OAR | OAKDALERESOURCES | 0.023 | 0 | -34.2857 | $1,502,766.75 |

| OKR | OKAPI RESOURCES | 0.225 | 0 | -43.75 | $7,727,145.00 |

| ORN | ORION MINERALS | 0.033 | 0 | -35.5556 | $56,212,004.00 |

| PMY | PACIFICO MINERALS | 0.004 | 0 | -42.8571 | $6,585,751.50 |

| PSM | PENINSULA MINES | 0.004 | 0 | -69.2308 | $3,451,488.25 |

| PLL | PIEDMONT LITHIUM | 0.1 | 0 | -39.3939 | $67,038,036.00 |

| PSC | PROSPECT RESOURCES | 0.022 | 0 | -61.5385 | $45,014,528.00 |

| RMX | RED MOUNTAIN MINING | 0.006 | 0 | -45.4545 | $4,668,220.50 |

| RDS | REDSTONE RESOURCES | 0.016 | 0 | 38.5281 | $7,535,429.00 |

| RLC | REEDY LAGOON CORP | 0.006 | 0 | -84.6154 | $2,413,630.25 |

| SBR | SABRE RESOURCES | 0.005 | 0 | -73.6842 | $2,034,868.00 |

| SVD | SCANDIVANADIUM | 0.014 | 0 | -44.7368 | $4,926,125.50 |

| SUH | SOUTHERN HEMISPHERE MINING | 0.031 | 0 | -65.5556 | $2,742,553.50 |

| SRK | STRIKE RESOURCES | 0.046 | 0 | -34.2857 | $6,685,376.50 |

| TNO | TANDO RESOURCES | 0.115 | 0 | 105.3333 | $23,230,450.00 |

| TKL | TRAKA RESOURCES | 0.016 | 0 | -72.8814 | $5,301,136.50 |

| VML | VITAL METALS | 0.008 | 0 | -11.1111 | $13,940,890.00 |

| VRC | VOLT RESOURCES | 0.02 | 0 | -40.625 | $27,654,086.00 |

| ZEU | ZEUS RESOURCES | 0.013 | 0 | 0 | $2,500,000.00 |

| GXY | GALAXY RESOURCES | 1.965 | -0.2525 | -35.0329 | $823,198,528.00 |

| SYR | SYRAH RESOURCES | 1.435 | -0.3472 | -56.383 | $506,851,552.00 |

| CLA | CELSIUS RESOURCES | 0.057 | -1.7857 | -45 | $42,404,212.00 |

| LIT | LITHIUM AUSTRALIA | 0.084 | -2.2727 | -50.8571 | $39,897,076.00 |

| AUZ | AUSTRALIAN MINES | 0.042 | -2.3256 | -53.8462 | $118,605,224.00 |

| HIG | HIGHLANDS PACIFIC | 0.1025 | -2.381 | 31.4103 | $112,005,216.00 |

| AXE | ARCHER EXPLORATION | 0.075 | -2.7027 | -26.5306 | $14,356,735.00 |

| ARL | ARDEA RESOURCES | 0.51 | -2.8571 | -59.5238 | $53,545,112.00 |

| HAV | HAVILAH RESOURCES | 0.17 | -2.8571 | -37.037 | $37,102,340.00 |

| CXO | CORE LITHIUM | 0.058 | -3.3898 | -12.3077 | $39,584,600.00 |

| KOR | KORAB RESOURCES | 0.027 | -3.5714 | 0 | $8,647,967.00 |

| HXG | HEXAGON RESOURCES | 0.13 | -3.7037 | -38.0952 | $37,931,840.00 |

| AVL | AUSTRALIAN VANADIUM | 0.024 | -3.8462 | -34.2105 | $49,346,096.00 |

| CHN | CHALICE GOLD MINES | 0.13 | -3.8462 | -4.7619 | $33,321,016.00 |

| K | KIBARAN RESOURCES | 0.105 | -4.1667 | -14.8148 | $35,838,524.00 |

| SEI | SPECIALITY METALS INTERNATIONAL | 0.023 | -4.1667 | -11.5385 | $12,762,158.00 |

| DEG | DE GREY MINING | 0.11 | -4.3478 | -8.3333 | $48,662,916.00 |

| TNG | TNG | 0.105 | -4.5455 | -30 | $101,164,080.00 |

| TMT | TECHNOLOGY METALS AUSTRALIA | 0.315 | -4.6154 | 24 | $22,413,866.00 |

| NMT | NEOMETALS | 0.2 | -4.6512 | -45.1397 | $114,234,600.00 |

| MQR | MARQUEE RESOURCES | 0.057 | -5 | -86.0976 | $2,436,424.25 |

| MRR | MINREX RESOURCES | 0.019 | -5 | -78.6517 | $1,821,676.88 |

| SVM | SOVEREIGN METALS | 0.073 | -5.1948 | -41.6 | $20,213,414.00 |

| NVA | NOVA MINERALS | 0.019 | -5.2632 | -55 | $14,746,549.00 |

| KRR | KING RIVER RESOURCES | 0.035 | -5.41 | -5.41 | $43,400,000.00 |

| CUL | CULLEN RESOURCES | 0.016 | -5.5555 | -18.1818 | $2,880,902.00 |

| HWK | HAWKSTONE MINING | 0.017 | -5.5555 | -29.1667 | $9,695,406.00 |

| PIO | PIONEER RESOURCES | 0.017 | -5.5555 | -37.037 | $25,569,906.00 |

| GME | GME RESOURCES | 0.087 | -5.5556 | -41.0304 | $40,981,920.00 |

| WCN | WHITE CLIFF MINERALS | 0.01 | -5.8824 | -87.1323 | $3,695,604.75 |

| BGS | BIRIMIAN | 0.145 | -6.0606 | -67.3684 | $42,033,620.00 |

| ESR | ESTRELLA RESOURCES | 0.015 | -6.25 | -25 | $6,886,366.00 |

| FGR | FIRST GRAPHENE | 0.15 | -6.25 | 30.4348 | $57,915,060.00 |

| BMT | BERKUT MINERALS | 0.072 | -6.4935 | -52 | $4,073,750.00 |

| GBE | GLOBE METALS AND MINING | 0.016 | -6.6667 | -12.5 | $6,988,835.50 |

| IEC | INTRA ENERGY | 0.014 | -6.6667 | 16.6667 | $5,428,136.50 |

| MLM | METALLICA MINERALS | 0.028 | -6.6667 | -45.098 | $10,673,764.00 |

| MCT | METALICITY | 0.013 | -7.1429 | -65.7895 | $7,229,565.00 |

| VMC | VENUS METALS | 0.14 | -7.1429 | 18.1818 | $11,766,910.00 |

| PLS | PILBARA MINERALS | 0.645 | -7.2464 | -21.4724 | $1,142,656,256.00 |

| SGQ | ST GEORGE MINING | 0.1275 | -7.4074 | -44.4444 | $38,755,108.00 |

| ERX | NOVO LITIO | 0.06 | -7.69 | 17.65 | $27,900,000.00 |

| BPL | BROKEN HILL PROSPECTING | 0.024 | -7.6923 | -61.2903 | $3,549,201.50 |

| CGN | CRATER GOLD MINING | 0.012 | -7.6923 | -33.3333 | $19,981,732.00 |

| IRC | INTERMIN RESOURCES | 0.135 | -7.6923 | -33.3333 | $28,246,616.00 |

| SCI | SILVER CITY MINERALS | 0.013 | -7.6923 | -76 | $3,818,233.25 |

| THX | THUNDELARRA | 0.013 | -7.6923 | -50 | $7,753,150.50 |

| EME | ENERGY METALS | 0.105 | -8.6957 | 5 | $22,016,748.00 |

| AEE | AURA ENERGY | 0.0155 | -8.8235 | -26.1905 | $16,367,769.00 |

| KAI | KAIROS MINERALS | 0.02 | -9.0909 | -42.8571 | $17,897,730.00 |

| LI3 | LITHIUM CONSOLIDATED | 0.064 | -9.8592 | -46.6667 | $6,357,548.50 |

| LKE | LAKE RESOURCES | 0.051 | -10 | -61.4286 | $20,137,798.00 |

| PNN | PEPINNINI LITHIUM | 0.0045 | -10 | -87.1429 | $3,243,035.00 |

| TON | TRITON MINERALS | 0.044 | -10 | -49.4382 | $41,721,208.00 |

| AJM | ALTURA MINING | 0.135 | -10.3448 | -61.7647 | $245,749,472.00 |

| HNR | HANNANS | 0.008 | -11.1111 | -63.6364 | $15,903,636.00 |

| LCD | LATITUDE CONSOLIDATED | 0.016 | -11.1111 | -27.2727 | $4,402,864.00 |

| PM1 | PURE MINERALS | 0.015 | -11.7647 | -11.7647 | $4,715,686.00 |

| WML | WOOMERA MINING | 0.052 | -11.7647 | -94 | $6,762,266.00 |

| THR | THOR MINING | 0.021 | -12 | -69.0141 | $15,771,812.00 |

| BSM | BASS METALS | 0.014 | -12.5 | -33.3333 | $38,660,244.00 |

| CHK | COHIBA MINERALS | 0.013 | -13.3333 | 30 | $8,639,985.00 |

| MTC | METALSTECH | 0.03 | -14.2857 | -81.25 | $3,508,616.50 |

| N27 | NORTHERN COBALT | 0.06 | -14.2857 | -85.3659 | $3,181,431.25 |

| TKM | TREK METALS | 0.006 | -14.2857 | -79.3103 | $1,873,821.63 |

| VMS | VENTURE MINERALS | 0.018 | -14.2857 | -47.0588 | $9,371,016.00 |

| JRV | JERVOIS MINING | 0.21 | -15.6863 | -57.8431 | $50,234,172.00 |

| MTH | MITHRIL RESOURCES | 0.005 | -16.6667 | -86.4754 | $2,111,946.00 |

| SXX | SOUTHERN CROSS EXPLORATION | 0.005 | -16.6667 | -37.5 | $5,384,216.00 |

| SRN | SUREFIRE RESOURCES | 0.006 | -16.6667 | -70.8333 | $2,203,268.25 |

| AOU | AUROCH MINERALS | 0.062 | -17.3333 | -34.7368 | $6,231,219.50 |

| PGM | PLATINA RESOURCES | 0.061 | -17.5676 | -49.1667 | $15,847,574.00 |

| NWC | NEW WORLD COBALT | 0.016 | -17.6471 | -84.9462 | $7,721,247.00 |

| LRS | LATIN RESOURCES | 0.002 | -20 | -81.8182 | $5,818,230.00 |

| SI6 | SIX SIGMA METALS | 0.004 | -20 | -66.6667 | $1,830,012.63 |

| AVZ | AVZ MINERALS | 0.039 | -22.449 | -85.098 | $79,315,384.00 |

| RIE | RIEDEL RESOURCES | 0.012 | -25 | -84.4156 | $5,016,836.50 |

| PUR | PURSUIT MINERALS | 0.041 | -25.9259 | -60 | $5,855,696.50 |

| NXE | MUSTANG RESOURCES | 0.035 | -30 | -84.65 | $5,300,000.00 |

| KLH | KALIA | 0.002 | -33.3333 | -77.7778 | $5,028,695.00 |