Six Sigma picks up vanadium project in pro-business Zimbabwe

Mining

Mining

Special Report: Six Sigma Metals could soon have its hands on the first vanadium mine in a new-look Zimbabwe.

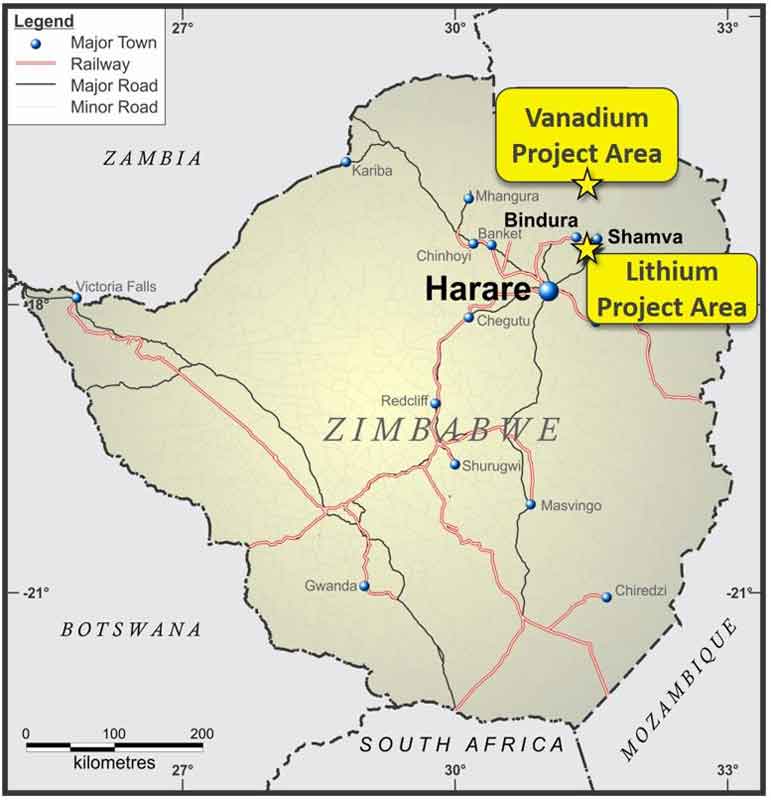

The company has executed an option agreement with Zimbabwe-based miner Mirrorplex to acquire up to an 80 per cent interest in its vanadium-titanium and lithium projects in the country.

It follows Six Sigma’s (ASX:SI6) remit to focus on what it calls the “new world” or battery metals – and commodities that have captured the attention of many juniors in the past six months.

But the company isn’t putting all their eggs in one basket – the new play gives them exposure to the sectors across two commodities and in a country experiencing material investor interest.

Vanadium prospect

The Chuatsa vanadium project is located 140km northeast of the country’s capital, and is land that has not been explored since Anglo America Prospecting in the 1960s.

But all signs point to significant mineralisation.

Historical trenching assays of the Chuatsa site have reported vanadium pentoxide grades up to 0.8 per cent and titanium dioxide grades of up to 7.81 per cent.

Back then, the explorer quit the project due to the lack of processing facilities nearby but almost 60 years later the site has a very different outlook.

The prospect now lies approximately 20km north of the town of Mount Darwin, a significant regional centre with sealed roads, grid power and amenities like an airport, hospitals and banks.

Mineralisation has been interpreted to be geologically similar to that of other juniors Australian Vanadium (ASX:AVL) and King River Copper (ASX:KRC) – and higher grade.

Its comes against the backdrop of a bull market for the battery metal – the commodity now fetching as much as five times that of its price three years ago.

Lithium prospect

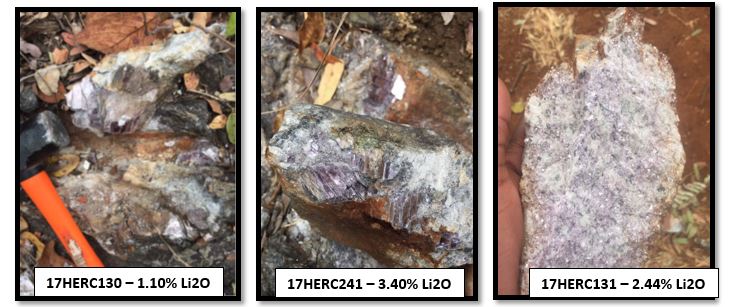

On the lithium side, the Shamva project contains at least five large pegmatite bodies with evidence of historic small-scale tin/beryl mining and records of ‘substantial outcrops of spodumene and lepidolite’.

Spodumene is the main lithium-bearing mineral mined from most hard rock lithium mines around the world. Lepidolite is also a lithium-bearing mineral.

Recent exploration, although minimal, has been highly encouraging – showing results of as much as 3.4 per cent lithium oxide in rock sampling.

Of the samples taken, 15 per cent were greater than 1 per cent lithium oxide and numerous results were above 2 per cent.

There has been no exploration drilling done on the site to date, which will be the focus of Six Sigma Metals’ phase one program.

Time is right

Since the fall of long-time leader Robert Mugabe in November, the new president Emmerson Mnangagwa has been making it known to the world that his country is finally ‘open for business’.

And there’s plenty of business to be done.

Earlier this year, the country signed a landmark $4.2 billion deal with a Cypriot investor to develop a platinum mine and refinery – output of which is expected to reach 1.4 million ounces annually within three years from the start of mining in 2020.

“Zimbabwe is open for business and whoever stands in the way, hurting business in this country, will fall. It is not business as usual anymore, things have to change,” President Mnangagwa said at the signing ceremony.

Add to that the potential of the region for battery metals, just like its neighbours Mozambique and South Africa – and the Democratic Republic of Congo to the North.

In the latter years of Mugabe’s reign foreign investment stalled – leaving a country rich in resources largely underexplored.

This special report is brought to you by Six Sigma Metals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.